CM December DECEMBER 2018

THE CICM MAGAZINE FOR CONSUMER AND COMMERCIAL CREDIT PROFESSIONALS

THE CICM MAGAZINE FOR CONSUMER AND COMMERCIAL CREDIT PROFESSIONALS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EXCLUSIVE REPORT<br />

AUTHOR – Nalanda Matia<br />

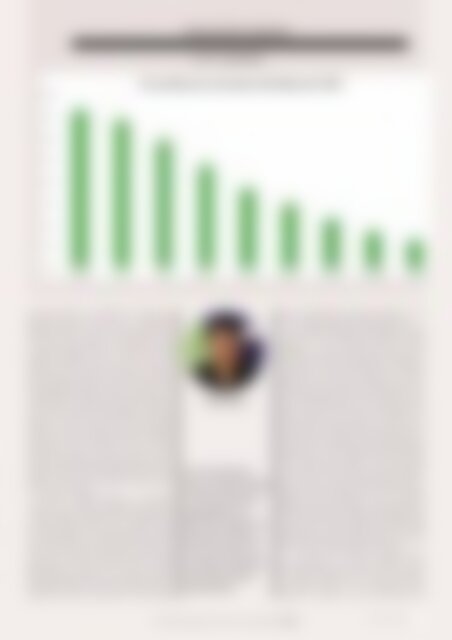

recession (2010-11) era while for sectors like<br />

Personal Services, Construction or Machinery<br />

Manufacturing have not seen any significant<br />

reduction in the number of liquidations since<br />

the post-recession period. These latter group<br />

of industry segments may be suffering on the<br />

stability perspective and it needs to be seen<br />

whether or not policies could be put in place to<br />

help businesses continue on the path of stable<br />

and sustainable growth. Overall, the number of<br />

businesses that closed their doors in the past year<br />

has declined by a little over 20 percent. However,<br />

on the whole, the volatility in change of business<br />

failures has declined considerably, businesses<br />

within the UK economy have slowly gained<br />

stability over time, attaining maximum stability<br />

around late 2015 through mid 2017. Business<br />

liquidations seemed to take an upturn on the<br />

annual basis again in the second half of 2017,<br />

but have been steadily declining, achieving the<br />

highest decline since Q1 2016 during the current<br />

quarter – but there are pockets of concern that<br />

need further attention.<br />

A potent leading indicator of business<br />

stability is a business’ payment performance<br />

– how promptly a business has been paying its<br />

creditors and/or suppliers. The 12-month view<br />

of the percentage of prompt payments made<br />

by UK businesses on an average shows that the<br />

metric has been quite stable over this period of<br />

time. For the past year, the percentage of prompt<br />

payments for these businesses have hovered<br />

approximately around the 30 percent mark,<br />

with small improvements around early <strong>2018</strong> and<br />

stabilising around 31 percent currently after a<br />

slight drop earlier in the quarter. This number<br />

Nalanda Matia<br />

In conclusion,<br />

the overall health<br />

of the business<br />

population in<br />

the UK seems to<br />

be fairly robust,<br />

with pockets of<br />

concern present<br />

in some major<br />

industries.<br />

varies considerably for business segments – and<br />

have a strong correlation with business size.<br />

The smallest businesses (by employee counts)<br />

seem to make the highest percentage of prompt<br />

payments – over 35 percent of their account<br />

payables are paid promptly within terms. This<br />

percentage declines systematically, dropping to<br />

14 percent of prompt payments for mid-sized<br />

businesses with 101-250 employees on their<br />

payroll. The percentage of prompt payments for<br />

the largest businesses in the country with more<br />

than 1,000 people under their employ pay only<br />

about six percent of their accounts payable in a<br />

prompt manner. This trend is not only true for<br />

the current recording period, but holds true for<br />

all historical periods as well and clearly points to<br />

the position of confidence that large businesses<br />

enjoy by virtue of their market power and possibly<br />

brand name in the industry. This also brings<br />

to the forefront the plight of small businesses,<br />

that in spite of their incessant cash-constrained<br />

state, they do not have the bargaining power to<br />

attain more favourable terms for their accounts<br />

payable and are obligated to pay a relatively<br />

higher percentage of these in a prompt manner.<br />

This trend can best be addressed by regional and<br />

local authorities by providing special financing<br />

programs for small businesses in need to help<br />

them maintain better payment terms as well as<br />

gain stability and reduced financial stress.<br />

As for all other metrics reviewed above,<br />

the percentage of prompt payments vary<br />

considerably by industry as well. This variation<br />

is usually attributed to the norms set within<br />

an industry which vary considerably from<br />

industry to industry. As can be seen from the<br />

The Recognised Standard / www.cicm.com / <strong>December</strong> <strong>2018</strong> / PAGE 43<br />

continues on page 44 >