TLA37_AllPages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

While it may be difficult to find the<br />

bad news in predicted growth, the<br />

growth in another area is contributing<br />

to the problem. Sales of new<br />

Class 8 trucks are growing at a rate<br />

25.1% higher than last year, which<br />

was a very good year for truck sales.<br />

America’s capacity to haul freight is<br />

increasing by about 10,000 trucks<br />

per month. There are enough orders<br />

already on the books to keep the<br />

build going for another seven to eight<br />

months.<br />

The law of supply and demand<br />

applies to trucking. For the past few<br />

years, there haven’t been enough<br />

trucks to haul all the freight made<br />

available through the growing economy,<br />

sending freight rates skyward<br />

and providing record profits for<br />

many carriers. Today, as more trucks<br />

hit the road, the balance is shifting.<br />

Spot rates are already stagnant and headed downward<br />

in some regions, with longer-term contract rates soon to<br />

follow. “If you are operating in the spot market, things<br />

will be softer,” Vise stated. “Those that keep costs down<br />

will be ok, while those that spent the extra earnings realized<br />

during the rate spikes will have a more difficult<br />

time.”<br />

Contract rates are far less volatile. “We’re expecting<br />

this year to be almost flat,” Vise said. “For the remainder<br />

of this year, we’re expecting softer contract rates to offset<br />

higher rates from earlier in the year.”<br />

While freight rates are expected to decline gradually,<br />

there are a few factors that could accelerate the process,<br />

the proverbial monkey wrench in the economic system.<br />

One factor that looms large is the prospect of tariffs, those<br />

imposed by the Trump administration and even those that<br />

are threatened.<br />

“We’ve seen a sharp decline in imports in quarter one,<br />

partly due to the threat of tariffs,” Vise said. “That pushes<br />

the GDP (Gross Domestic Product) upward. But remember<br />

that imports create business for the trucking industry,<br />

too.”<br />

Vise said threatened tariffs on goods from Mexico<br />

would have had far greater impact on the U.S. market and<br />

on transportation than tariff issues with China.<br />

“The risk of upsetting the economic apple cart is much<br />

greater with Mexico than with China,” he said. “Mexico is<br />

the world’s second-largest exporter of goods, more than<br />

twice the size of China.”<br />

Still, carriers that haul a lot of imported freight from<br />

West Coast ports will see a reduction in Chinese trade.<br />

Some of that reduction will be picked up by other Asian<br />

countries, such as Taiwan and South Korea.<br />

“Asian trade, excluding China, is growing well,” Vise<br />

said. “But what does happen is there will be winners and<br />

losers.” He pointed out that imports from Europe are growing,<br />

particularly from France and Italy. Overall, he said,<br />

carriers hauling imports from ports west of the Mississippi<br />

will see a reduction of import freight while carriers hauling<br />

from eastern ports will see an increase.<br />

Recent demonstrations in Hong Kong, if they have an<br />

impact at all, will have a greater impact on financial and<br />

service industries than on goods produced, which take up<br />

a much smaller share of the market.<br />

Fuel price fluctuations can have a devastating impact.<br />

“We’re looking at fuel being moderately higher,” Vise said,<br />

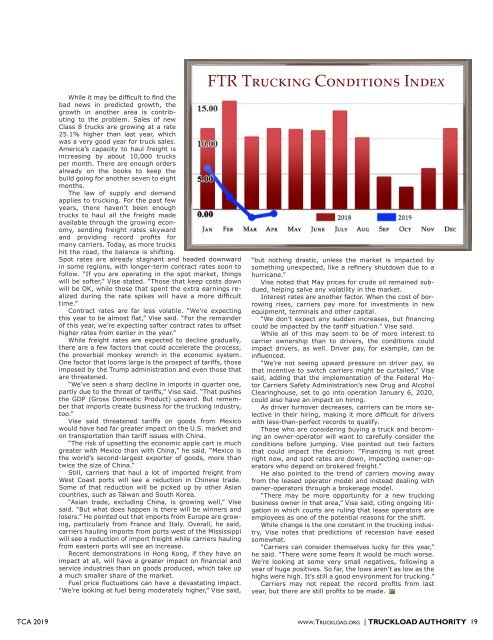

FTR Trucking Conditions Index<br />

“but nothing drastic, unless the market is impacted by<br />

something unexpected, like a refinery shutdown due to a<br />

hurricane.”<br />

Vise noted that May prices for crude oil remained subdued,<br />

helping salve any volatility in the market.<br />

Interest rates are another factor. When the cost of borrowing<br />

rises, carriers pay more for investments in new<br />

equipment, terminals and other capital.<br />

“We don’t expect any sudden increases, but financing<br />

could be impacted by the tariff situation.” Vise said.<br />

While all of this may seem to be of more interest to<br />

carrier ownership than to drivers, the conditions could<br />

impact drivers, as well. Driver pay, for example, can be<br />

influenced.<br />

“We’re not seeing upward pressure on driver pay, so<br />

that incentive to switch carriers might be curtailed,” Vise<br />

said, adding that the implementation of the Federal Motor<br />

Carriers Safety Administration’s new Drug and Alcohol<br />

Clearinghouse, set to go into operation January 6, 2020,<br />

could also have an impact on hiring.<br />

As driver turnover decreases, carriers can be more selective<br />

in their hiring, making it more difficult for drivers<br />

with less-than-perfect records to qualify.<br />

Those who are considering buying a truck and becoming<br />

an owner-operator will want to carefully consider the<br />

conditions before jumping. Vise pointed out two factors<br />

that could impact the decision: “Financing is not great<br />

right now, and spot rates are down, impacting owner-operators<br />

who depend on brokered freight.”<br />

He also pointed to the trend of carriers moving away<br />

from the leased operator model and instead dealing with<br />

owner-operators through a brokerage model.<br />

“There may be more opportunity for a new trucking<br />

business owner in that area,” Vise said, citing ongoing litigation<br />

in which courts are ruling that lease operators are<br />

employees as one of the potential reasons for the shift.<br />

While change is the one constant in the trucking industry,<br />

Vise notes that predictions of recession have eased<br />

somewhat.<br />

“Carriers can consider themselves lucky for this year,”<br />

he said. “There were some fears it would be much worse.<br />

We’re looking at some very small negatives, following a<br />

year of huge positives. So far, the lows aren’t as low as the<br />

highs were high. It’s still a good environment for trucking.”<br />

Carriers may not repeat the record profits from last<br />

year, but there are still profits to be made.<br />

TCA 2019 www.Truckload.org | Truckload Authority 19