Jeweller: The Great Diamond Debate - Round II

Facts Vs Marketing: In 2019, both natural and man-made diamonds battled for the hearts and minds of consumers – and the gloves came off. While the dust is far from settled, the question remains: can consumers really make an informed choice in the midst of a marketing barrage and an increasingly confused industry?

Facts Vs Marketing: In 2019, both natural and man-made diamonds battled for the hearts and minds of consumers – and the gloves came off. While the dust is far from settled, the question remains: can consumers really make an informed choice in the midst of a marketing barrage and an increasingly confused industry?

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DIAMOND AUTHORITY<br />

Don’t blame synthetic diamonds<br />

for the natural industry’s woes<br />

GARRY HOLLOWAY’S KEY POINTS:<br />

Market changes in India and China have had significant impacts on the natural diamond market<br />

From a technical perspective, both CVD and HPHT synthetic diamonds have qualities that make them attractive<br />

Synthetic diamonds offer benefits to cutters and retailers – but consumers prefer natural diamonds for engagements and anniversaries<br />

<strong>The</strong>re is a popular theory that synthetic<br />

diamonds are killing the natural, mined<br />

diamond business. That’s fake news! <strong>The</strong><br />

natural diamond industry is doing a better<br />

job at harming itself than the manufactured<br />

diamond industry could ever hope to do.<br />

20.0%<br />

10.0%<br />

0.0%<br />

0.30 CT<br />

0.50 CT<br />

1.00 CT<br />

3.00 CT<br />

It’s economics 101: liquidity crisis.<br />

Most diamond cutters (they liked to be called<br />

manufacturers, but now ‘manufacturers’ refers to<br />

growers of synthetics) require bank finance for their<br />

rough diamond buying.<br />

For far too long, Indian companies have been<br />

hooked on government-subsidised interest rates to<br />

promote skilled export-oriented employment.<br />

-10.0%<br />

-20.0%<br />

Oct 18 Nov Dec Jan 19 Feb Mar Apr May Jun Jul Aug Sep Oct<br />

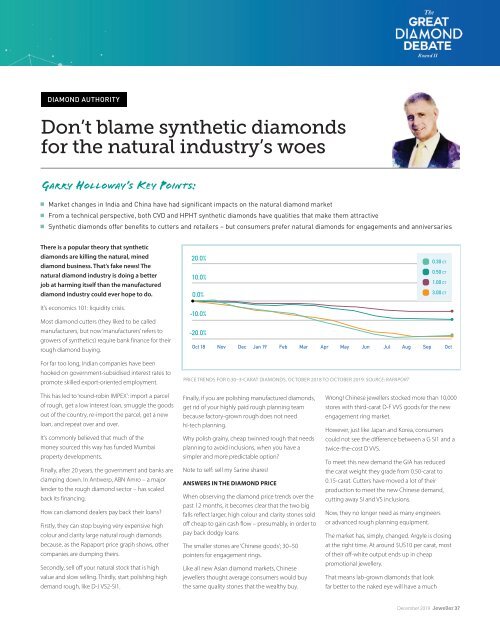

PRICE TRENDS FOR 0.30–3-CARAT DIAMONDS, OCTOBER 2018 TO OCTOBER 2019. SOURCE: RAPAPORT<br />

This has led to ‘round-robin IMPEX’: import a parcel<br />

of rough, get a low interest loan, smuggle the goods<br />

out of the country, re-import the parcel, get a new<br />

loan, and repeat over and over.<br />

It’s commonly believed that much of the<br />

money sourced this way has funded Mumbai<br />

property developments.<br />

Finally, after 20 years, the government and banks are<br />

clamping down. In Antwerp, ABN Amro – a major<br />

lender to the rough diamond sector – has scaled<br />

back its financing.<br />

How can diamond dealers pay back their loans?<br />

Firstly, they can stop buying very expensive high<br />

colour and clarity large natural rough diamonds<br />

because, as the Rapaport price graph shows, other<br />

companies are dumping theirs.<br />

Secondly, sell off your natural stock that is high<br />

value and slow selling. Thirdly, start polishing high<br />

demand rough, like D-J VS2-SI1.<br />

Finally, if you are polishing manufactured diamonds,<br />

get rid of your highly paid rough planning team<br />

because factory-grown rough does not need<br />

hi-tech planning.<br />

Why polish grainy, cheap twinned rough that needs<br />

planning to avoid inclusions, when you have a<br />

simpler and more predictable option?<br />

Note to self: sell my Sarine shares!<br />

ANSWERS IN THE DIAMOND PRICE<br />

When observing the diamond price trends over the<br />

past 12 months, it becomes clear that the two big<br />

falls reflect larger, high colour and clarity stones sold<br />

off cheap to gain cash flow – presumably, in order to<br />

pay back dodgy loans.<br />

<strong>The</strong> smaller stones are ‘Chinese goods’; 30–50<br />

pointers for engagement rings.<br />

Like all new Asian diamond markets, Chinese<br />

jewellers thought average consumers would buy<br />

the same quality stones that the wealthy buy.<br />

Wrong! Chinese jewellers stocked more than 10,000<br />

stores with third-carat D-F VVS goods for the new<br />

engagement ring market.<br />

However, just like Japan and Korea, consumers<br />

could not see the difference between a G SI1 and a<br />

twice-the-cost D VVS.<br />

To meet this new demand the GIA has reduced<br />

the carat weight they grade from 0.50-carat to<br />

0.15-carat. Cutters have moved a lot of their<br />

production to meet the new Chinese demand,<br />

cutting away SI and VS inclusions.<br />

Now, they no longer need as many engineers<br />

or advanced rough planning equipment.<br />

<strong>The</strong> market has, simply, changed. Argyle is closing<br />

at the right time. At around $US10 per carat, most<br />

of their off-white output ends up in cheap<br />

promotional jewellery.<br />

That means lab-grown diamonds that look<br />

far better to the naked eye will have a much<br />

December 2019 <strong>Jeweller</strong> 37