Norrporten-2012-UK

Norrporten-2012-UK

Norrporten-2012-UK

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

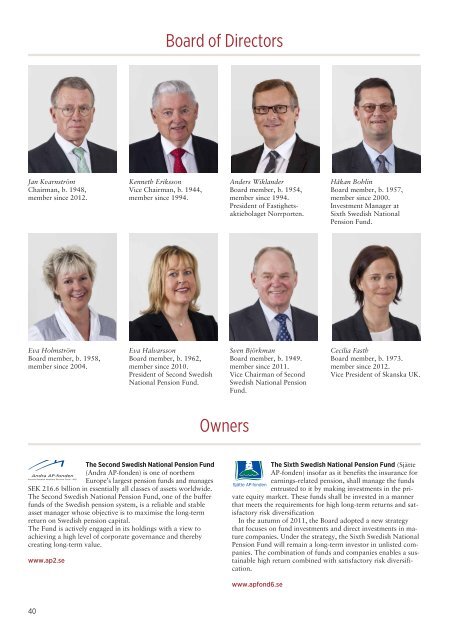

Jan Kvarnström<br />

Chairman, b. 1948,<br />

member since <strong>2012</strong>.<br />

Eva Holmström<br />

Board member, b. 1958,<br />

member since 2004.<br />

The Second Swedish National Pension Fund<br />

(Andra AP-fonden) is one of northern<br />

Europe’s largest pension funds and manages<br />

SEK 216.6 billion in essentially all classes of assets worldwide.<br />

The Second Swedish National Pension Fund, one of the buffer<br />

funds of the Swedish pension system, is a reliable and stable<br />

asset manager whose objective is to maximise the long-term<br />

return on Swedish pension capital.<br />

The Fund is actively engaged in its holdings with a view to<br />

achieving a high level of corporate governance and thereby<br />

creating long-term value.<br />

www.ap2.se<br />

40<br />

Kenneth Eriksson<br />

Vice Chairman, b. 1944,<br />

member since 1994.<br />

Board of directors<br />

Eva Halvarsson<br />

Board member, b. 1962,<br />

member since 2010.<br />

President of Second Swedish<br />

National Pension Fund.<br />

owners<br />

Anders Wiklander<br />

Board member, b. 1954,<br />

member since 1994.<br />

President of Fastighetsaktiebolaget<br />

<strong>Norrporten</strong>.<br />

Sven Björkman<br />

Board member, b. 1949.<br />

member since 2011.<br />

Vice Chairman of Second<br />

Swedish National Pension<br />

Fund.<br />

The Sixth Swedish National Pension Fund (Sjätte<br />

AP-fonden) insofar as it benefits the insurance for<br />

earnings-related pension, shall manage the funds<br />

entrusted to it by making investments in the private<br />

equity market. These funds shall be invested in a manner<br />

that meets the requirements for high long-term returns and satisfactory<br />

risk diversification<br />

In the autumn of 2011, the Board adopted a new strategy<br />

that focuses on fund investments and direct investments in mature<br />

companies. Under the strategy, the Sixth Swedish National<br />

Pension Fund will remain a long-term investor in unlisted companies.<br />

The combination of funds and companies enables a sustainable<br />

high return combined with satisfactory risk diversification.<br />

www.apfond6.se<br />

Håkan Bohlin<br />

Board member, b. 1957,<br />

member since 2000.<br />

Investment Manager at<br />

Sixth Swedish National<br />

Pension Fund.<br />

Cecilia Fasth<br />

Board member, b. 1973.<br />

member since <strong>2012</strong>.<br />

Vice President of Skanska <strong>UK</strong>.