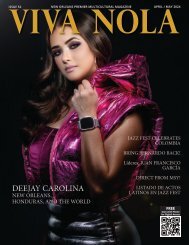

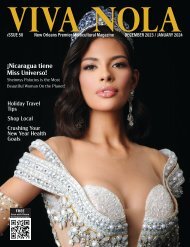

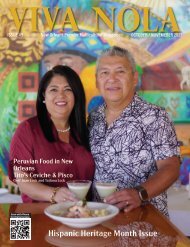

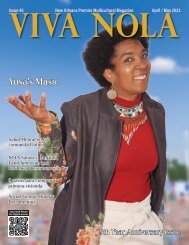

VIVA NOLA August/September 2022

Bilingual Magazine. Variety. Based in New Orleans, LA.

Bilingual Magazine. Variety. Based in New Orleans, LA.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

College-Bound Hispanics and<br />

Their Financial Stability<br />

By AnaGarcía<br />

@anag1928<br />

There is a lack of basic financial<br />

information in the Hispanic community,<br />

which makes it even more challenging<br />

for youth in this community to achieve their<br />

goals. College-bound students are often<br />

unaware of financial aid resources and don’t<br />

know how to manage their money, so we<br />

contacted experts in our community to offer<br />

some information to students, regardless of<br />

their immigration status.<br />

Ingrid Bustos founded ECCO Centro<br />

Comunitario, a non-profit organization and<br />

resource center that prepares students for<br />

college. Bustos saw the need to provide<br />

resources for students that want to pursue a<br />

college or university degree.<br />

An average community college tuition<br />

is almost $8,000 per year and a 4-year<br />

university costs around $30,000 per year.<br />

“For an immigrant family, it’s hard to afford<br />

that. So, students will rely on scholarships to<br />

attend college,” said Bustos.<br />

Obtaining scholarships isn’t easy. Students<br />

must work hard. An ACT score of 26 points<br />

or above will help the student’s chances of<br />

receiving financial aid from some private<br />

colleges. However, for immigrant students<br />

still mastering English, achieving high scores<br />

in standardized testing is harder.<br />

Bustos mentions private universities<br />

usually have a variety of scholarships<br />

available. They offer scholarships for sports<br />

and arts, for community leadership, and<br />

from foundations. But in Louisiana, “most<br />

scholarships are based on high ACT scores,”<br />

says Bustos.<br />

To find opportunities, students must<br />

take charge of their search. New Orleans<br />

schools offer a 2-year program called<br />

College Track that prepares them and helps<br />

them find scholarships. In other schools,<br />

students must rely on their counselors. “I<br />

always tell students to ask for help from<br />

their school counselor. Also, you can ask<br />

the university counselor when you visit the<br />

10 ~ <strong>VIVA</strong> <strong>NOLA</strong> <strong>August</strong>/<strong>September</strong> <strong>2022</strong><br />

university. Then, ask what scholarships are<br />

available. They should give you a list of the<br />

scholarships they offer,” says Bustos about<br />

finding available scholarships.<br />

Bustos founded ECCO to help Latinx<br />

students in Louisiana. With a bilingual staff,<br />

they can guide Spanish-speaking parents<br />

and students in navigating the application<br />

process. In addition, the organization offers<br />

“Camino a la Universidad,” a 12-week<br />

workshop to prepare students to apply for<br />

scholarships. “Thanks to the sponsors that<br />

support our mission, we can provide two<br />

hours with a professional to help them in the<br />

process,” says Bustos. The requirements for<br />

applying depend on the kind of scholarship<br />

pursued. “If it is an athletic scholarship, the<br />

student must submit a highlight reel of his<br />

plays. For an art scholarship, you can send<br />

photos of your art. As for academic studies,<br />

universities always consider the GPA (grade<br />

point average),” she adds.<br />

Another challenge for students is<br />

financial literacy. Many Hispanic students<br />

don’t know how to open a bank account.<br />

Undocumented students are afraid of being<br />

flagged when getting into the system.<br />

Veronica Reyes, Louisiana Programming<br />

Officer at TruFund Financial Services, Inc.<br />

shares valuable information on this topic.<br />

“Opening a bank account is not as scary as it<br />

seems. You don’t have to be afraid of being<br />

deported just for opening an account,” says<br />

Reyes, adding that doing some research is<br />

essential. “What is important to you may be<br />

different than what is important to someone<br />

else.”<br />

Reyes says some things to consider<br />

when choosing the right bank are the size<br />

of the bank, personal service, locations in<br />

the community or out of state, ATMs, etc.<br />

These are important to consider as well<br />

as the features, benefits, perks, and types<br />

of accounts offered by the bank and any<br />

monthly service fees and other fees that may<br />

apply before opening your bank account,”<br />

advises Reyes.<br />

Large chain banks usually have more<br />

branches in your city and other states, which<br />

means you’ll get the same service no matter<br />

where you go. This wide coverage can<br />

help you avoid fees for using other banks’<br />

services (like ATM fees, etc.) Large banks<br />

also offer services like 24-hour helplines for<br />

their customers. In addition, these banks<br />

usually can assist in different languages and<br />

have the best technology. Smaller banks,<br />

also known as community banks, tend to<br />

be friendlier than big banks. They provide<br />

one-on-one attention and offer a variety of<br />

accounts and loans that help benefit the<br />

community. Community banks are locally<br />

owned and operated, and usually offer better<br />

rates and lower fees. Credit unions are<br />

not-for-profit financial institutions, often with<br />

a mission to be “community-oriented” and<br />

exist to serve their members. Credit unions<br />

have made their services more accessible<br />

by offering lower fees and partnering with<br />

other credit unions to provide shared branch<br />

banking and ATMs.<br />

To open an account, you must meet the<br />

requirements established by each institution.<br />

“First, confirm the bank or credit union’s<br />

eligibility and age requirements for opening<br />

a savings or checking account. If you are<br />

under 18, some banks may require that you<br />

open the account with a parent or guardian,”<br />

says Reyes.<br />

Choose the correct account for you.<br />

Different types of bank accounts meet<br />

different needs. For example, when<br />

someone opens their first bank account, it is<br />

either a regular checking or savings account<br />

(or both). “It’s important to deposit money<br />

into the type of account that suits your<br />

financial goals, so you have access to the<br />

right spending and saving tools,” says Reyes.<br />

Regardless of race or nationality, the<br />

youth are our future, and we will continue to<br />

provide resources and information for their<br />

success.