NCSEA Connections Child Support Products & Services Guide 2023

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

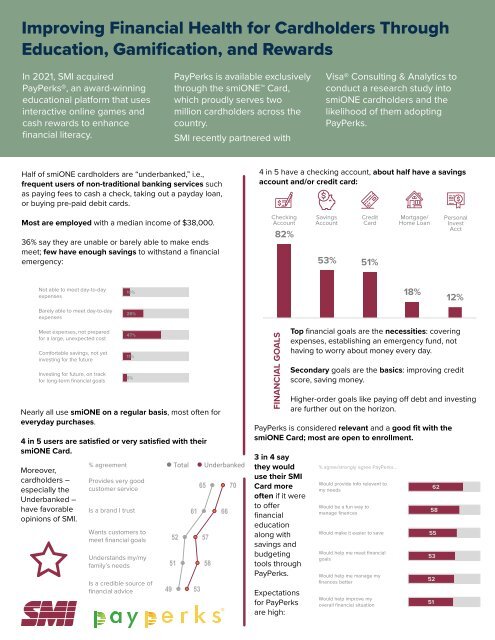

Improving Financial Health for Cardholders Through<br />

Education, Gamification, and Rewards<br />

In 2021, SMI acquired<br />

PayPerks®, an award-winning<br />

educational platform that uses<br />

interactive online games and<br />

cash rewards to enhance<br />

financial literacy.<br />

PayPerks is available exclusively<br />

through the smiONE Card,<br />

which proudly serves two<br />

million cardholders across the<br />

country.<br />

SMI recently partnered with<br />

Visa® Consulting & Analytics to<br />

conduct a research study into<br />

smiONE cardholders and the<br />

likelihood of them adopting<br />

PayPerks.<br />

Half of smiONE cardholders are “underbanked,” i.e.,<br />

frequent users of non-traditional banking services such<br />

as paying fees to cash a check, taking out a payday loan,<br />

or buying pre-paid debit cards.<br />

4 in 5 have a checking account, about half have a savings<br />

account and/or credit card:<br />

Most are employed with a median income of $38,000.<br />

36% say they are unable or barely able to make ends<br />

meet; few have enough savings to withstand a financial<br />

emergency:<br />

Checking<br />

Account<br />

82%<br />

Savings<br />

Account<br />

Credit<br />

Card<br />

53% 51%<br />

Mortgage/<br />

Home Loan<br />

Personal<br />

Invest<br />

Acct<br />

Not able to meet day-to-day<br />

expenses<br />

10% 10%<br />

18%<br />

12%<br />

Barely able to meet day-to-day<br />

expenses<br />

26% 26%<br />

Meet expenses, not prepared<br />

for a large, unexpected cost<br />

Comfortable savings, not yet<br />

investing for the future<br />

Investing for future, on track<br />

for long-term financial goals<br />

47% 47%<br />

11% 11%<br />

6% 6%<br />

Nearly all use smiONE on a regular basis, most often for<br />

everyday purchases.<br />

4 in 5 users are satisfied or very satisfied with their<br />

smiONE Card.<br />

Moreover,<br />

cardholders –<br />

especially the<br />

Underbanked –<br />

have favorable<br />

opinions of SMI.<br />

% agreement<br />

Provides very good<br />

customer service<br />

Is a brand I trust<br />

Wants customers to<br />

meet financial goals<br />

Understands my/my<br />

family’s needs<br />

Is a credible source of<br />

financial advice<br />

• Total<br />

49<br />

52<br />

51<br />

61<br />

53<br />

• Underbanked<br />

65<br />

57<br />

58<br />

66<br />

70<br />

FINANCIAL GOALS<br />

Top financial goals are the necessities: covering<br />

expenses, establishing an emergency fund, not<br />

having to worry about money every day.<br />

Secondary goals are the basics: improving credit<br />

score, saving money.<br />

Higher-order goals like paying off debt and investing<br />

are further out on the horizon.<br />

PayPerks is considered relevant and a good fit with the<br />

smiONE Card; most are open to enrollment.<br />

3 in 4 say<br />

they would<br />

use their SMI<br />

Card more<br />

often if it were<br />

to offer<br />

financial<br />

education<br />

along with<br />

savings and<br />

budgeting<br />

tools through<br />

PayPerks.<br />

Expectations<br />

for PayPerks<br />

are high:<br />

% agree/strongly agree PayPerks…<br />

Would provide info relevant to<br />

my needs<br />

Would be a fun way to<br />

manage finances<br />

Would make it easier to save<br />

Would help me meet financial<br />

goals<br />

Would help me manage my<br />

finances better<br />

Would help improve my<br />

overall financial situation<br />

62<br />

58<br />

55<br />

53<br />

52<br />

51