PINC POWERPICKS - Myiris.com

PINC POWERPICKS - Myiris.com

PINC POWERPICKS - Myiris.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>PINC</strong> <strong>POWERPICKS</strong> RESEARCH<br />

RESEARCH<br />

BAJAJ AUTO: BUY, TP-Rs1,665 (14% upside)<br />

What’s the theme?<br />

With the success of Pulsar135 and Discover twins (100cc and 150cc), Bajaj Auto's brand-centric strategy has<br />

been validated. In its attempt to leverage these brands, Bajai Auto recently launched Discover125cc and is all<br />

set to launch Pulsar250cc in Sep'11. The high-margin brands, Pulsar and Discover, now account for 70% of<br />

the <strong>com</strong>pany's motorcycle sales. In addition, continued demand for 3-wheelers and robust exports would help<br />

Bajaj Auto achieve volume growth of 16.2% in FY12 and 11.9% in FY13.<br />

What will move the stock?<br />

1) Despite rising macro headwinds, we expect Bajaj Auto to be less sensitive to such concerns. Given a slew of<br />

product launches in the near future, Bajaj Auto would be able to maintain market share with domestic volume<br />

growth of 16%, in line with industry growth. 2) Export outlook continues to be stable with total exports expected<br />

to touch 1.4mn in FY12. 3) Management expects to improve market share with growth of 22% to 4.8mn units<br />

during FY12 as against our volume estimate of 4.5mn units. 4) Increased proportion of high-margin motorcycles<br />

and continued contribution of three-wheelers would enable the <strong>com</strong>pany to tide over the input cost pressures<br />

and restrict the contraction in margins to 70bps 5) Opening up of new permits for three wheelers in Karnataka<br />

would be a further boost to domestic sales 6) The <strong>com</strong>pany is in the process of reviving the Boxer brand with<br />

a 150cc motorcycle especially targeted at the rural segment wherein Hero MotoCorp is the dominant player.<br />

Where are we stacked versus consensus?<br />

Our FY12 and FY13 earnings estimates are Rs107.5 and Rs123.3 respectively. We have a 'BUY'<br />

re<strong>com</strong>mendation on the stock with a target price of Rs1,665, discounting FY13E earnings at 13.5x. Our<br />

FY12 earnings estimate is 6.1% higher than consensus estimate of Rs101.3.<br />

What will challenge our target price?<br />

1) Significant increase in prices of <strong>com</strong>modities such as steel and rubber are likely to pressurise margins.<br />

2) The <strong>com</strong>pany draws significant benefits from the DEPB scheme and withdrawal of the same would<br />

impact profitability. In case the incentive is entirely withdrawn, our earnings estimate would reduce ~10%.<br />

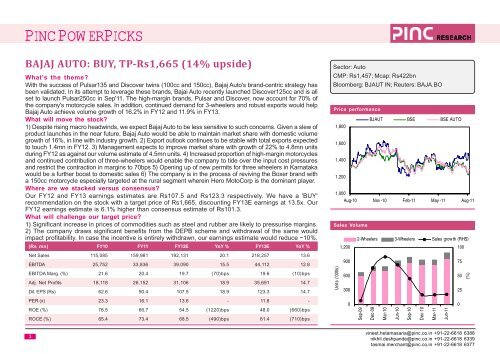

(Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 115,085 159,981 192,131 20.1 218,257 13.6<br />

EBITDA 25,752 33,836 39,090 15.5 44,112 12.8<br />

EBITDA Marg. (%) 21.6 20.4 19.7 (70)bps 19.6 (10)bps<br />

Adj. Net Profits 18,118 26,152 31,106 18.9 35,691 14.7<br />

Dil. EPS (Rs) 62.6 90.4 107.5 18.9 123.3 14.7<br />

PER (x) 23.3 16.1 13.6 - 11.8 -<br />

ROE (%) 78.5 66.7 54.5 (1220)bps 48.0 (660)bps<br />

ROCE (%) 65.4 73.4 68.5 (490)bps 61.4 (710)bps<br />

3<br />

Sector: Auto<br />

CMP: Rs1,457; Mcap: Rs422bn<br />

Bloomberg: BJAUT IN; Reuters: BAJA.BO<br />

Price performance<br />

1,800<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

Aug-10 Nov -10 Feb-11 May -11 Aug-11<br />

Sales Volume<br />

Units ('000s)<br />

1,200<br />

900<br />

600<br />

300<br />

0<br />

Sep-09<br />

BJAUT BSE BSE AUTO<br />

2-Wheelers 3-Wheelers Sales grow th (RHS)<br />

Dec-09<br />

Mar-10<br />

Jun-10<br />

Sep-10<br />

Dec-10<br />

Mar-11<br />

Jun-11<br />

100<br />

vineet.hetamasaria@pinc.co.in +91-22-6618 6388<br />

nikhil.deshpande@pinc.co.in +91-22-6618 6339<br />

tasmai.merchant@pinc.co.in +91-22-6618 6377<br />

75<br />

50<br />

25<br />

0<br />

(%)