2023-05 SUSTAINABLE BUS

The new issue of Sustainable Bus magazine is here!

The new issue of Sustainable Bus magazine is here!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

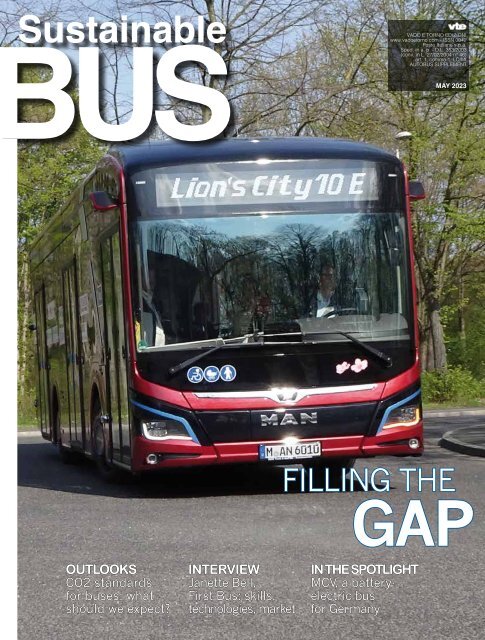

Sustainable<br />

US<br />

VADO E TORNO EDIZIONI<br />

www.vadoetorno.com - ISSN 0042<br />

Poste Italiane s.p.a.<br />

Sped. in a. p. - D.L. 353/2003<br />

(conv. in L. 27/02/2004 n° 46)<br />

art. 1, comma 1, LO/MI<br />

AUTO<strong>BUS</strong> SUPPLEMENT<br />

MAY <strong>2023</strong><br />

FILLING THE<br />

GAP<br />

OUTLOOKS<br />

CO2 standards<br />

for buses: what<br />

should we expect?<br />

INTERVIEW<br />

Janette Bell,<br />

First Bus: skills,<br />

technologies, market<br />

IN THE SPOTLIGHT<br />

MCV, a battery-<br />

electric bus<br />

for Germany

The future. Today.<br />

Sustainable<br />

<strong>BUS</strong><br />

CONTENTS<br />

4<br />

5<br />

<strong>SUSTAINABLE</strong>-<strong>BUS</strong>.COM MAY <strong>2023</strong><br />

POST-IT<br />

Iveco Bus brings back<br />

bus production in Italy<br />

Volvo - MCV deal for e-bus<br />

manufacturing in Europe<br />

26<br />

4<br />

6<br />

8<br />

TECHNO<br />

ZF to launch new generation AxTrax.<br />

Series production from late 2024<br />

Upgrade of e-buses.<br />

A project by Equipmake in York<br />

10<br />

INTERVIEW<br />

Janette Bell on First Bus’<br />

strategies for today’s challenges<br />

Our new A range.<br />

12 - 24 m<br />

100% zero-emission<br />

14<br />

18<br />

22<br />

26<br />

OUTLOOKS<br />

UK: decarbonization is a good thing,<br />

but increasing passengers come first<br />

A picture of EU e-bus market 2022.<br />

Yutong leading the registrations’ rank<br />

Main EU bus&coach markets from<br />

2019 to 2022. An analysis<br />

EU should allow only ZE bus sales from<br />

2027, Transport&Environment says<br />

battery-electric<br />

hydrogen<br />

10<br />

30<br />

EXPO<br />

VDV-powered ElekBu: the German<br />

bet on zero emission buses<br />

trolley<br />

LEADING THE WAY.<br />

36<br />

42<br />

46<br />

IN THE SPOTLIGHT<br />

MAN Lion’s City 10E.<br />

Latest add in the Lion’s e-bus family<br />

MCV C127 EV.<br />

Made in Egypt, headed to Germany<br />

Setra MultiClass 500 LE.<br />

EvoBus’ new strategies in Class II<br />

Bernard Van Hoolstraat 58 • 2500 Lier (Koningshooikt) • BELGIUM +32 3 420 20 20 info@vanhool.com vanhool.com<br />

vanhooloffi cial<br />

vanhooloffi cial<br />

vanhool<br />

42<br />

50<br />

PORTFOLIO<br />

All the electric buses<br />

on the European market<br />

3

POST-IT<br />

POST-IT<br />

IVECO <strong>BUS</strong> OPENED A PLANT IN FOGGIA<br />

Made in Italy<br />

GOAL: FINALIZING 1,000 <strong>BUS</strong>ES PER YEAR<br />

In mid-April Iveco Bus has opened<br />

a new plant in Foggia, South<br />

Italy, for the final assembly of electric<br />

and low-emission buses. The<br />

first part of the production process<br />

will be carried out in other Iveco<br />

plants in France, the Czech Republic,<br />

and Turkey. The Foggia plant<br />

will add finishing components, including<br />

seats and surveillance systems,<br />

and rely on alternative propulsion<br />

from Torino and hydrogen<br />

fuel cells. The plant has been largely<br />

financed with Next Generation EU<br />

funds and will complete and supply<br />

low and zero-emission buses to the<br />

Italian market. The plant covers an<br />

area of around 30,000 square meters<br />

and is powered by more than 1,000<br />

photovoltaic panels, with an annual<br />

production of 640 MWh. It has 4.0<br />

industrial solutions, intelligent LED<br />

lighting systems, and water-saving<br />

features. The plant is expected to assemble<br />

1,000 buses annually, with a<br />

potential capacity of over 4,000, as stated by Iveco Group representatives.<br />

The company aims to reduce its environmental impact and promote a circular<br />

economy by implementing measures such as recycling waste and using<br />

renewable energy sources.<br />

Among the “features” of the Foggia plant we find a team of engineers dedicated<br />

to customizing the product, a virtual reality room for technical training<br />

and augmented reality tools for quality control. There are three customization<br />

stations, one finishing and quality control station, one electrification line, one<br />

battery warehouse, and one customer center with a delivery area.<br />

The plant covers an area of around<br />

30,000 square meters and is powered<br />

by more than 1,000 photovoltaic<br />

panels. It is expected to assemble<br />

1,000 buses annually, with a potential<br />

capacity of over 4,000, as stated by<br />

Iveco Group representatives.<br />

MCV WILL BUILD VOLVO E-<strong>BUS</strong>ES<br />

In mid-March Volvo Buses announced the forthcoming<br />

closure of its Wroclaw factory in Poland and its intention<br />

to concentrate its European operations solely on<br />

chassis production, leaving the task of building bodies to<br />

other companies. The announcement was made in a press<br />

release of disruptive frankness (we will only quote the<br />

opening, credited to president Anna Westerberg: “Our<br />

business in Europe has been loss-making for years”).<br />

Well, in late April the group announced that it has signed<br />

a letter of intent with the well-known Egyptian manufacturer<br />

MCV (an acronym for Manufacturing Commercial<br />

Vehicles), which will be entrusted with the production<br />

under license of bodies for Volvo electric buses headed<br />

to the European markets. Series production is scheduled<br />

to start in the summer of 2024 and delivery of the<br />

first e-buses is planned for early 2025. For the intercity<br />

segment, it is stated, “Volvo Buses and MCV will work<br />

together to develop an electric offer”. Chassis production<br />

will remain at the Volvo Buses plants in Boras and<br />

Uddevalla, Sweden. MCV already produces Mercedes-<br />

Benz-based bodies. Production volume? Something like<br />

10,000 buses per year. Sixty per cent of which is for<br />

export in some sixty countries. It is already one of the<br />

main partners of Volvo Buses. It has delivered in the<br />

UK, to the Metroline fleet in London, vehicles based on<br />

the BZL electric chassis, launched by the Swedish group<br />

in September 2021 and destined, it was then stated, for<br />

global markets outside Europe (only today it is possible<br />

to read, with hindsight, the first step in the reorganisation<br />

of the business...). Concerning coaches, Volvo Buses has<br />

signed a deal with Spanish Sunsundegui.<br />

COMMITTED TO ZERO EMISSION<br />

2035 E-MOBILITY TAIWAN<br />

The exhibition 2035 E-Mobility Taiwan joined forces<br />

with Taipei AMPA and AutoTronics Taipei to showcase<br />

the Taiwanese automotive<br />

industry<br />

ecosystem to the<br />

world of electric<br />

mobility. We have<br />

been joining the<br />

Tapei-based expo<br />

in mid-April. This<br />

marks the first<br />

time that the three<br />

exhibitions have<br />

been held concurrently<br />

and in the<br />

same location, attracting<br />

830 exhibitors from both domestic and foreign<br />

markets with a total of 2,200 booths. The ‘2035’ in the<br />

trade show’s name signifies that the future of transportation<br />

is anticipated to be dominated by electric and autonomous<br />

vehicles by 2035. Taiwan’s automotive electronics<br />

industry has experienced rapid growth over the<br />

years, thanks to the country’s strong foundation in semiconductor,<br />

ICT, and advanced manufacturing. Taiwanese<br />

companies have become major suppliers of parts and<br />

components to some of the world’s top EV makers, including<br />

Tesla. Master Bus has showcased their first fully<br />

electric intercity bus. The 12-metre, 45-seater vehicle is<br />

equipped with LTO (Lithium-Titanete Oxide) batteries,<br />

chosen for their stability and long lifespan. Among other<br />

key exhibitors we found Gus Technology, battery cell producer<br />

with focus on LTO chemicals, the traction components<br />

provider Shihlin Electric & Engineering, the power<br />

components giant Delta Electronics and the smart technology<br />

company Advantech. Last but not least, Taiwan<br />

Telematics Industry Association.<br />

Hydrogen bus<br />

Full maintenance<br />

Hydrogen retrofit<br />

& training<br />

WWW.SAFRA.FR<br />

Fleet & TCO<br />

management<br />

4

TECHNO<br />

ZF UNVEILED 2ND GENERATION E-AXLE AXTRAX 2<br />

AxTrax 2 The Revenge<br />

SERIES PRODUCTION TO BEGIN IN EUROPE IN LATE 2024<br />

At the Advanced Clean Transportation<br />

(ACT) Expo in early<br />

May, ZF premiered its new Ax-<br />

Trax 2 electric axle platform.<br />

Series production of the e-axle is<br />

planned to begin in Europe in late<br />

2024 and in the U.S. in 2025, ZF<br />

states. What is very interesting, it<br />

will be offered in two variants:<br />

with one e-drive and with two integrated<br />

e-drives (AxTrax 2 dual),<br />

being the latter a real news in ZF<br />

offer (and a rarity in the e-bus segment,<br />

with just Volvo Buses so far<br />

mounting on the 7900 Electric a<br />

2-speed transmission).<br />

It is worth mentioning that the Ax-<br />

Trax has its roots in 2015, when it<br />

was launched for the first time as<br />

AVE130. It has so far established<br />

itself as one of the leading solution<br />

for e-buses (adopted by Solaris,<br />

Daimler Buses, VDL, Ebusco<br />

and many others…).<br />

The integrated and modular e-<br />

powertrain system is addressed to light, medium and heavy-duty commercial<br />

vehicles.<br />

The group points out that AxTrax 2 “features a compact design to help<br />

maximize the available space for batteries and enhance manufacturer’s<br />

design flexibility for future vehicle concepts. AxTrax 2 can be fully<br />

synchronized with key vehicle functions, including braking, ADAS and<br />

automated driving systems, to help enhance vehicle safety and efficiency.<br />

It also enables advanced digital and telematics systems via CAN bus to<br />

communicate and share e-axle system information”.<br />

The ZF AxTrax has its roots in 2015,<br />

when it was launched for the first<br />

time as AVE130. It has so far established<br />

itself as one of the leading<br />

solution for e-buses (adopted by Solaris,<br />

Daimler Buses, VDL, Ebusco<br />

and many others…).<br />

ACCELERA!<br />

Launched in March <strong>2023</strong>, Accelera is the new brand<br />

of Cummins New Power business unit. It is led by<br />

Amy Davis, who<br />

has been at the<br />

helm of the New<br />

Power business<br />

unit since 2020:<br />

she will serve as<br />

President of Accelera.<br />

Together with<br />

unveiling the<br />

new brand identity,<br />

Cummins<br />

has announced<br />

that Accelera<br />

and Blue Bird have entered a deal to power a new<br />

fleet of 1,000 electric school buses across the United<br />

States over the next 12-18 months. “Production<br />

of the electric school buses will be significantly accelerated,<br />

more than doubling the zero-emissions<br />

school buses that the pair have put into operation<br />

since the start of production. With 1,000 new electric<br />

school buses on the road, 10,600 metric tons<br />

of harmful carbon emissions will be prevented annually”,<br />

Accelera says.<br />

Duties and commitments of Accelera by Cummins<br />

include powering 52 fuel cell city buses in Lingang,<br />

Shanghai as well as the world’s first fleets of hydrogen<br />

fuel cell passenger trains in Germany. Recently<br />

acquired Meritor and Siemens Commercial<br />

Vehicle business will be “embedded” in Accelera.<br />

Cummins states it has invested more than $1.5<br />

billion million in research and technology, capital<br />

and acquisitions to build Accelera’s leadership and<br />

technological capabilities.<br />

6

TECHNO<br />

EARLY GEN E-<strong>BUS</strong>ES GET IMPROVEMENTS<br />

After complete upgrade of the vehicle’s electric<br />

power system, the first Optare Versa is back on service<br />

around the city of York. It belong to an early generation<br />

electric bus: a batch of 12 vehicles is to be converted in<br />

a contract awarded by operator First Bus to Equipmake.<br />

The bus now features a pioneering electric drivetrain<br />

and is expected to have a range of 150 miles in all UK<br />

weather conditions, thanks to a larger battery and Equipmake’s<br />

patented HVAC system.<br />

The Optare Versa trial lasted for 4 weeks. This will enable<br />

engineering teams at First York and Equipmake to<br />

evaluate its performance and make any final adjustments.<br />

A total of 12 converted vehicles will be delivered over<br />

the coming months, according to the roadmap agreed<br />

by the partners.<br />

Equipmake has developed dedicated skills on repowering<br />

of buses, most recently completing an all-electric repower<br />

of the New Routemaster (showcased at Euro Bus<br />

Expo 2022 in November 2022), as well as partnering<br />

with First Bus to upgrade its fleet improving the capabilities<br />

of some early generation e-buses. The company<br />

is also working on coach repowering: they have indeed<br />

been showcasing a repowered Van Hool at ITT Hub.<br />

Tom Bridge, Operations Director of First Bus in North<br />

& West Yorkshire, said: “It’s great to see the bus back<br />

in service and we’re confident customers will enjoy the<br />

experience of an ultra-smooth, quiet ride and the benefit<br />

of zero-emission travel. This retrofit technology is<br />

another important step in our transition to achieving a<br />

fully electric fleet in York, continuing to help improve<br />

air quality in the city and supporting the goal of First<br />

Bus nationally to have a zero-emission fleet by 2035”.<br />

ALL ABOUT <strong>BUS</strong>, COACH AND PEOPLE<br />

On-demand<br />

transport<br />

that actually<br />

works.<br />

EUROPE BRUSSELS<br />

7-12 OCT <strong>2023</strong><br />

WWW.<strong>BUS</strong>WORLDEUROPE.ORG<br />

8<br />

THE OTHER<br />

<strong>BUS</strong>WORLD<br />

EXHIBITIONS<br />

CENTRAL ASIA ASTANA | 18-20 MAY <strong>2023</strong><br />

SOUTHEAST ASIA JAKARTA | 15-17 MAY 2024<br />

TÜRKIYE ISTANBUL | 29-31 MAY 2024

INTERVIEW<br />

JANETTE BELL, MANAGING DIRECTOR, FIRST <strong>BUS</strong><br />

CHALLENGE ACCEPTED<br />

First Bus, one of the five main operators in the UK, is expected to have<br />

over 600 zero-emission buses in operation by early 2024. How is the<br />

company organizing itself to keep pace with this change? What does the<br />

future hold for autonomous driving? Business case?<br />

First Bus is one of the<br />

top five bus companies<br />

in the United Kingdom,<br />

with operations from<br />

Aberdeen in the very north of<br />

Scotland down to Cornwall,<br />

thanks to about 4,500 buses and<br />

14,000 employees. We interviewed<br />

the managing director<br />

Janette Bell.<br />

First Bus recently reported<br />

that at the conclusion of the<br />

ZEBRA projects, the company<br />

is expected to have over<br />

600 zero-emission buses in its<br />

fleet. Could you sum up the<br />

deliveries to date, how many<br />

vehicles you do have on order<br />

today and which timeline you<br />

expect for further orders and<br />

deliveries?<br />

«We have a very clear statement<br />

that we wish to fully decarbonize<br />

our fleet by 2035, and we’ve<br />

been making progress towards<br />

that goal. As of today, we actually<br />

have 229 zero-emission<br />

vehicles in operation, with the<br />

biggest area of operation being<br />

our Caledonia depot in Glasgow.<br />

We have 412 buses currently<br />

on order, and those are<br />

being delivered as we speak. We<br />

expect to take deliveries every<br />

month now through until March<br />

next year, and we will have a<br />

total of 622 zero-emission vehicles<br />

by then».<br />

Many believe that innovative<br />

financing schemes are necessary<br />

to make the large-scale<br />

deployment of e-buses from an<br />

economic perspective. What is<br />

your opinion on this? Do you<br />

think the financing schemes<br />

currently in place in the UK<br />

are enough to kickstart the<br />

transition of public transport<br />

fleets?<br />

«There are significant differences<br />

between the upfront costs of<br />

electric and diesel vehicles and<br />

their infrastructure. However,<br />

the government’s funding and<br />

support for partnerships with<br />

local authorities have enabled<br />

us to obtain the initial funding<br />

for these vehicles and infrastructure.<br />

I believe we are at<br />

the forefront of zero-emission<br />

vehicles, and there are various<br />

funding options available for<br />

companies to explore. The<br />

strength of a company’s balance<br />

sheet may determine which<br />

financing option they choose.<br />

Still, I expect more innovation<br />

in vehicles, infrastructure, and<br />

financing options, and I believe<br />

many are exploring these options<br />

now».<br />

The pandemic has changed<br />

mobility patterns globally.<br />

From First Bus’s perspective,<br />

have the changes generated<br />

by Covid-19 led to long-term<br />

changes in passengers’ behavior?<br />

How is your group addressing<br />

these changes?<br />

«Absolutely. Covid-19 has<br />

accelerated trends that were<br />

already prevalent in the United<br />

Kingdom. Digital payments<br />

have been accelerated, and we<br />

have invested heavily in using<br />

the data from geolocation and<br />

other sources to improve the<br />

performance and punctuality<br />

of our services. We have also<br />

adjusted our fares and product<br />

structures to suit the changing<br />

habits of our customers, such as<br />

introducing three-day tickets in<br />

addition to weekly ones. We are<br />

looking at where we are relative<br />

to what people are doing now<br />

and what they may be doing in<br />

the future, rather than comparing<br />

our business to 2019. It is<br />

about adaptation, adjusting our<br />

services to what is happening<br />

now and in the future».<br />

Can you tell us about your involvement<br />

in demand responsive<br />

transport in the UK?<br />

«We’ve been involved in a few<br />

projects. It’s a potentially useful<br />

solution which could run<br />

alongside core services, providing<br />

support and potentially<br />

feeding into the main network.<br />

I think it’s an area that probably<br />

could be further developed; however,<br />

I think one of the challenges<br />

that many operators face is<br />

making those services economically<br />

sustainable».<br />

«We consider engineering to be a key competence, and we do not<br />

outsource our maintenance activities. Instead, we focus on upskilling<br />

and reskilling our engineers to adapt to the changes brought by<br />

electrification. While we recognize a change in the competencies<br />

required, we believe we can handle them internally»<br />

«As of today, we have 229 zero-emission vehicles in operation,<br />

with the biggest area of operation being our Caledonia depot in<br />

Glasgow. We have 412 buses currently on order, and those are being<br />

delivered. We expect to take deliveries every month now through until<br />

March 2024. We’ll have a total of 622 zero-emission buses by then»<br />

One of the most debated topic<br />

is TCO: which is the comparison<br />

between e-buses and diesel<br />

buses today, according to the<br />

data you have collected so far?<br />

«One of the challenges we face<br />

is that we do not have a zeroemission<br />

vehicle that has gone<br />

through an entire cycle of ownership,<br />

including battery replacements.<br />

Therefore, there are<br />

many theoretical pieces to consider.<br />

As we move forward, TCO<br />

for e-buses and diesel buses will<br />

mature and become more clear<br />

over time, and everyone in the<br />

industry will learn from these<br />

experiences».<br />

Dealing with e-buses and<br />

energy transition implies<br />

changes in the structure of<br />

public transport companies.<br />

How is First Bus changing,<br />

in terms of organization<br />

and skills, to get ready for<br />

the challenge?<br />

«To prepare for this challenge,<br />

we’ve appointed a sustainability<br />

executive to oversee our<br />

decarbonization efforts. We’re<br />

also rethinking our operational<br />

processes, from upskilling<br />

our workforce to changing the<br />

way we handle buses in depots.<br />

This transformation touches<br />

every aspect of our business, so<br />

we’re building a blueprint model<br />

to guide us as we continue<br />

to deploy more EVs and learn<br />

from our experiences. Additionally,<br />

we’ve established an internal<br />

center of excellence and<br />

are providing training for our<br />

drivers, engineers, and support<br />

teams. These efforts are part<br />

of our comprehensive plan to<br />

transform our entire business».<br />

With electrification, what is<br />

happening is that maintenance<br />

activities are quite often<br />

outsourced to manufacturers<br />

and service providers within<br />

full service contracts…<br />

«No, that’s not the case at First<br />

Bus. We consider engineering to<br />

be a key competence, and we do<br />

not outsource our maintenance<br />

staff. Instead, we focus on<br />

upskilling and reskilling our engineers<br />

to adapt to the changes<br />

brought by electrification. While<br />

we recognize a change in the<br />

competencies required, we believe<br />

we can handle them internally<br />

while maintaining strong<br />

relationships with our suppliers<br />

and manufacturers».<br />

With the transition to e-buses,<br />

public transport companies<br />

are often more looking for<br />

partners than just for suppliers.<br />

What requests do you<br />

feel to make at industry players<br />

at this stage?<br />

10<br />

11

INTERVIEW<br />

«The market in the UK is made<br />

up of five big operators and<br />

many small and medium-sized<br />

enterprises. As we come through<br />

Covid, we have seen some<br />

small parts of consolidation,<br />

and we’ve also seen some of<br />

our large competitors go into<br />

new ownership structures. How<br />

we make sure being able to decarbonize<br />

our fleet is one thing,<br />

but obviously, what we’re wanting<br />

to do is to play a larger<br />

role in the communities that<br />

we operate in. Certainly, we<br />

are working with third parties,<br />

some of those larger companies,<br />

but also some small SMEs<br />

to make sure that we can share<br />

infrastructure and partner with<br />

businesses in the community».<br />

Charging<br />

forward<br />

to accelerate the world’s<br />

transition to eMobility<br />

We make power<br />

last longer.<br />

Our battery technology<br />

makes cleaner power<br />

safe and scalable.<br />

«We’ve always prided ourselves<br />

at First Bus in how we partner<br />

with our suppliers. We are<br />

now working with more technology<br />

and digital suppliers in the<br />

zero emissions space and continuing<br />

to foster a spirit of innovation<br />

through collaboration.<br />

Our aim is to learn together<br />

with our suppliers and local<br />

authorities, which is essential<br />

as we embark on this journey<br />

towards sustainability».<br />

What about the delivery time<br />

of vehicles? It’s another hot<br />

topic nowadays…<br />

«At the moment, things are more<br />

drawn out. It’s very clear that<br />

with the disruption to the supply<br />

chain that has resulted from Covid<br />

and geopolitical issues, we<br />

have seen supply chains extend<br />

out. What is important is that<br />

we work very closely with our<br />

manufacturers to ensure that<br />

there’s maximum efficiency on<br />

manufacturing lines and that<br />

we’re all as efficient in that supply<br />

chain as possible».<br />

What do you think of Brexit<br />

and its consequences on the<br />

evolution of the zero-emission<br />

bus market?<br />

«It would be very difficult to<br />

isolate any impact of Brexit.<br />

Between Brexit, pandemic, and<br />

the geopolitical situation, there<br />

are multiple issues that have disrupted<br />

the supply chain».<br />

The emergence of macro trends<br />

such as digitalization and<br />

energy transition are already,<br />

according to many, bringing<br />

towards a concentration of<br />

public transport services in<br />

the hands of larger companies.<br />

And Covid put much pressure<br />

on PTOs balance sheets. Do<br />

you think these circumstances<br />

will end up bringing a push<br />

towards large companies getting<br />

a larger share of the market?<br />

To what extent?<br />

«One of the challenges we face is that we don’t have a zero<br />

emission vehicle that has gone through an entire cycle of ownership,<br />

including battery replacements. Therefore, there are many theoretical<br />

pieces to consider. As we move forward, TCO for e-buses and<br />

diesel buses will mature and become more clear over time»<br />

Autonomous driving. What is<br />

First Bus doing to stay ahead<br />

in this area?<br />

«We’ve been involved in a<br />

multi-consortium in Oxford,<br />

which has delivered the UK’s<br />

first autonomous bus. This has<br />

been running around Milton<br />

Park Science and Technology<br />

Park since March. Our reason<br />

for piloting this project is to<br />

better understand the technology<br />

and gather feedbacks<br />

from safety drivers, stakeholders,<br />

and customers».<br />

We haven’t so far mentioned<br />

the topic of hydrogen. First<br />

Bus is also running a pilot on<br />

fuel cell technology. Can you<br />

tell us more about that?<br />

«We recognize that the potential<br />

range opportunities that<br />

hydrogen buses give you are<br />

particularly interesting for rural<br />

areas. However, the hydrogen<br />

infrastructure and vehicles<br />

themselves are currently more<br />

expensive. At First Bus, we<br />

want to make sure that we’re<br />

not just thinking ahead but also<br />

considering cost and sustainability.<br />

We’ve had hydrogen<br />

buses operating for over a year<br />

now, and they’ve been performing<br />

well».<br />

12

OUTLOOKS<br />

INCREASING <strong>BUS</strong> PATRONAGE IN THE UK<br />

PRECONDITIONS FOR TRANSITION<br />

The UK’s journey to establishing a<br />

zero-emission bus fleet is strongly<br />

dependent on bus passenger numbers.<br />

Ensuring bus services that are reliable<br />

long term is crucial to building a<br />

sustainable bus network<br />

In a recent Sustainable Bus article<br />

(February <strong>2023</strong> issue) looking<br />

at how the UK is funding its zero-emission<br />

bus transition, a conclusion<br />

was that to achieve it, increasing<br />

patronage is crucial. Confidence in long<br />

term passenger demand on bus travel is<br />

necessary to give the security in required<br />

ZEB (zero-emission bus) technology in-<br />

Reliable journey time<br />

The Confederation of Passenger Transvestment.<br />

Although passenger numbers<br />

are rising, patronage is yet to return to<br />

pre-covid levels.<br />

The UK government has stated the aim of<br />

increasing patronage, including its March<br />

2021 launched “Bus Back Better: The National<br />

Bus Strategy”, supporting England<br />

outside of London with ad hoc grants, as<br />

well as more established longer-term funding,<br />

while devolved regions manage their<br />

own support. Outside of London, the UK<br />

bus network is mainly privatised, with bus<br />

operators generating around 60 percent of<br />

their income from fare-paying passengers,<br />

with public funding subsidising the remainder,<br />

according to data from National<br />

Audit Office. As a result, services that are<br />

commercially unviable, or unable to be<br />

funded by local authorities, are at risk.<br />

No legal requirement<br />

The Campaign for Better Transport estimates<br />

that operator commercial services<br />

declined by 26 percent between 2012 and<br />

2020 – albeit most significantly in the pandemic’s<br />

first year – and services supported<br />

by local authorities declined by 52 percent<br />

in bus miles over the same period. “There<br />

Outside of London, the UK<br />

bus network is mainly privatised.<br />

Bus operators generate<br />

60 percent of their income<br />

from fare-paying passengers,<br />

with public funding subsidising<br />

the remainder. As a result,<br />

services that are commercially<br />

unviable, or unable to be funded<br />

by local authorities, are at<br />

risk. The Campaign for Better<br />

Transport estimates that operator<br />

commercial services declined<br />

by 26 percent between<br />

2012 and 2020 – albeit most<br />

significantly in the pandemic’s<br />

first year – and services<br />

supported by local authorities<br />

declined by 52 percent in bus<br />

miles over the same period.<br />

is no legal requirement to supply a bus<br />

service and no framework is provided to<br />

guarantee a bus service to those who need<br />

it. For patronage to grow, people need to<br />

feel confident that they can switch to using<br />

buses for most of their journeys, and that<br />

services will still be there in future. This<br />

is not the case in many areas,” says Claire<br />

Walters, chief executive, Bus Users UK,<br />

that champions the rights of passengers.<br />

If bus services aren’t sufficient, the current<br />

system can allow local authorities to take<br />

control, like developments in Manchester.<br />

Later this year, the city will become the<br />

first outside of London to have a regulated<br />

bus system. While the regulation debate<br />

has continued since privatisation in 1985,<br />

the existing framework can be successful<br />

in increasing patronage.<br />

“With close partnership, we can get to a<br />

non-adversarial culture between the private<br />

and public sectors which exists in<br />

places like Oxford and Brighton, where<br />

privatisation has worked relatively well.<br />

Franchising in certain areas can be appropriate,<br />

but many authorities are concluding<br />

that effective partnerships can be a preferred<br />

way forward,” says professor Graham<br />

Parkhurst, director, Centre for Transport<br />

and Society at University of the West<br />

of England, Bristol.<br />

But whichever approach, greater stability<br />

in financial support is necessary to enable<br />

reliable service provision long term.<br />

“There’s a marked contrast with rail,<br />

which has had relatively high levels of security<br />

and funding, despite buses carrying<br />

significantly more people,” says professor<br />

Peter White, expert on public transport<br />

systems, University of Westminster. “The<br />

bus industry has had repeated three-month<br />

budgetary extensions, meaning that management<br />

has had to prepare for sharp service<br />

cutbacks, then to discover that they<br />

can carry on running for another three<br />

months. That’s a highly unsatisfactory way<br />

of proceeding.”<br />

port (CPT) reports that for every 1 percent<br />

bus speeds decrease each year, this<br />

results in over 10 percent fall in passenger<br />

numbers over the course of a decade. The<br />

organisation says congestion is the number<br />

one challenge to a reliable bus service<br />

and is the main reason people do not take<br />

the bus, making journeys too slow with<br />

unpredictable timings.<br />

According to CPT, measures including<br />

priority at junctions and traffic lights,<br />

bus-only roads, bus-only lanes, and park<br />

and ride schemes, have helped increase<br />

patronage, in combination with other<br />

factors, by as much as 50 percent in<br />

Bristol and 24 percent in Milton Keynes.<br />

However, prioritisation at the expense of<br />

the car can still face resistance. Though<br />

Coventry plans to become the UK’s first<br />

all-electric bus city, a proposal to introduce<br />

bus gates on certain city centre<br />

streets, with private cars prohibited between<br />

10am and midnight, has just been<br />

rejected following fears of declining<br />

trade from local shops.<br />

Service reliability decreased by extended<br />

dwell time can also be a challenge. Outside<br />

of London, a single door for entry<br />

and exit, as well as diverse fares and payment<br />

methods, impact process speed. As<br />

well as improvements to reliability, service<br />

frequency is also important.<br />

“In the late ‘80s with high frequency minibuses,<br />

we were able to show that a minibus<br />

every 10 minutes, instead of a double<br />

decker every half hour, produced a large<br />

increase in ridership, purely as a frequency<br />

effect,” says Peter White. “With the<br />

driver recruitment challenge, this isn’t<br />

feasible at the moment, but with driverless<br />

buses, this might change, depending<br />

on the issues connected with automated<br />

vehicle technology.”<br />

Inter-urban and rural networks<br />

Connecting two or more towns or cities,<br />

inter-urban bus services provide a link<br />

with intermediate stops to serve villages<br />

en route, with these services able to provide<br />

connections currently missing from<br />

14<br />

15

OUTLOOKS<br />

the rail network.<br />

“Inter-urban bus services showed they can<br />

be successful in attracting more riders to<br />

buses on a purely commercial basis, and<br />

even those with some government finance<br />

achieve it at a relatively modest cost,”<br />

says Peter White. “In rural Wales, for example,<br />

the Traws Cymru network is very<br />

useful for filling gaps in the rail service,<br />

especially for north-south movement, and<br />

public sector support is modest compared<br />

with the cost of rural rail services.”<br />

Similarly, for rural areas, Graham<br />

Parkhurst argues in favour of a “hub and<br />

spoke” system, including frequent routes<br />

with bus priorities where necessary, fed<br />

by connectors including demand responsive<br />

links. If necessary, car parking can<br />

be used too, which would still minimise<br />

environmental impact and congestion.<br />

“Rural services are unlikely to be commercially<br />

profitable, but we have to accept<br />

that public transport is a good for the<br />

economy and society, and it needs financial<br />

support,” says Graham Parkhurst.<br />

“One important issue is whether you can<br />

integrate the public bus service with the<br />

school transport provision, because authorities<br />

have a statutory obligation to<br />

provide free school travel above certain<br />

distances, whereas they are not obliged<br />

to support buses,” says Peter White. “Inevitably,<br />

rural service frequencies will<br />

be lower, but integrating these functions<br />

could achieve the most efficient use of<br />

public money.”<br />

“Clearly, it’s difficult to provide services<br />

which are free from any form of subsidy<br />

in rural areas because the passenger numbers<br />

are quite low,” says Martin Dean,<br />

managing director, UK regional bus, Go-<br />

Ahead. “But where you’ve got a transport<br />

authority that’s willing to invest, I think<br />

you can have a successful network in a rural<br />

area. Cornwall is a really good example.<br />

I would say the level of bus provision<br />

there is probably the best it’s been for a<br />

long time and we’re happy to contribute<br />

to that.”<br />

Environmental sustainability<br />

To meet net zero climate targets, buses<br />

can more quickly increase modal share<br />

than rail, based on an already available<br />

road network. At the same time, incentivizing<br />

a switch to electric cars could be a<br />

problematic long term strategy.<br />

“Switching to electric power for private<br />

cars presents some efficiency benefits,<br />

but it’s likely to be a long time before we<br />

have a fully decarbonized electric grid.<br />

An electric car still needs as much road<br />

space as a diesel or petrol variant, so they<br />

will still impose congestion on the economy,”<br />

says Graham Parkhurst.<br />

“Zero-emission buses have a role to play<br />

in improving patronage,” says Tim Griffen,<br />

project officer, at Zemo Partnership,<br />

that works to accelerate transport to ZE.<br />

“As well as the incentive of sustainability,<br />

they’re clean, quiet, and the ride is more<br />

pleasurable. But whether it’s a zero-emission<br />

bus or a diesel bus, if it’s stuck in<br />

congestion, it’s not going to increase patronage.<br />

Capital funding to zero-emission<br />

buses is crucial, but if that doesn’t come<br />

alongside a proper bus service improvement<br />

plan with defined routes for bus priority,<br />

the benefits that ZEBs offer might<br />

not be fully realised.”<br />

Fare price<br />

In recent attempt to increase bus use,<br />

the government is subsidising a temporary<br />

flat £2 (€2.27) charge for a single<br />

journey, operating between January to<br />

June <strong>2023</strong>. CPT says the interim results<br />

are mixed, and according to an April report<br />

by Transport Focus , an independent<br />

watchdog, 11% of bus users say the £2<br />

bus fare has increased their bus use, up<br />

from 7 percent in January.<br />

“The £2 flat fare has meant that we’ve<br />

seen some pretty significant patronage<br />

increases on longer distance routes, with<br />

growth in some cases up to 40 percent,”<br />

says Martin Dean. For example, Go<br />

North East’s X10 service between Newcastle<br />

and Middlesborough, a distance of<br />

39 miles (63km) is usually £8 (€9), giving<br />

passengers a significant saving.<br />

The Confederation of<br />

Passenger Transport (CPT)<br />

reports that for every<br />

1 percent bus speeds<br />

decrease each year, this<br />

results in over 10 percent<br />

fall in passenger numbers<br />

over the course of a<br />

decade. The organization<br />

says congestion is the<br />

number one challenge to a<br />

reliable bus service and is<br />

the main reason people do<br />

not take the bus, making<br />

journeys too slow with<br />

unpredictable timings.<br />

SUMMING UP FUNDING<br />

England (outside of London) main ongoing bus fu nding from government<br />

Fund Recipient Amount<br />

Bus Service Operators Grant (BSOG)<br />

Operators – plus local authorities running com-<br />

£0.22 (€0.25) per km<br />

munity transport services<br />

Revenue Support Grant from the Department for Level-<br />

Local authorities - typically used to fund con-<br />

Various per authority, un-ringfenced for discretionary<br />

ling Up, Housing and Communities (DLUHC)<br />

cessionary fare reimbursement to bus operators<br />

investment in bus services*<br />

and ‘supported’ services not commercially<br />

viable for operators<br />

Total ~ £2bn year*<br />

England (outside of London) ad hoc funding from government<br />

Fund Recipient Amount<br />

Covid-19 Bus Services Support Grant (CBSSG), rena-<br />

Operators<br />

med the Bus Recovery Grant (BSG), set up to support<br />

lower revenue throughout the pandemic<br />

£2 Fare Cap subsidy of single fares between January<br />

and June <strong>2023</strong><br />

Operators<br />

Approximately £2bn support to operators during the<br />

pandemic and up to June <strong>2023</strong><br />

Local Bus Service Improvement Plan (BSIP) Local authorities – 79 applied for funding; 31<br />

will be granted funding<br />

£1.153bn<br />

* House Commons, Transport Committee, Bus ser vices in England outside London. Ninth Report of Session 2017–19<br />

Scotland, Wales, and Northern Ireland have similar s chemes funded by their devolved administrations.<br />

Source: Elaboration Sustainable Bus - Alex Byles<br />

While Go-Ahead Regional Bus is now<br />

at just over 90 percent patronage, the<br />

operator notes the UK trend of a slower<br />

return of concessionary passengers<br />

– despite their receipt of free travel on<br />

reaching pension age. Jon Shaw argues<br />

that replacing free concessionary travel<br />

with a 50p flat fare for all could increase<br />

patronage and revenue.<br />

“Instead of providing free travel for older<br />

people, and under 22s in Scotland,<br />

charging a flat fare of 50p still provides<br />

subsidized transport, but the money that<br />

you free up can be returned to the bus<br />

system for the benefit of everybody,<br />

funding the infrastructure needed to<br />

increase patronage.”<br />

Jon Shaw first published this proposal<br />

in 2014 with colleague Iain Docherty in<br />

“The Transport Debate”. Allowing for inflation<br />

from time of writing, the costing<br />

While Go-Ahead Regional<br />

Bus is now at just over<br />

90 percent patronage, the<br />

operator notes the UK<br />

trend of a slower return<br />

of concessionary passengers.<br />

Jon Shaw argues<br />

that the introduction of<br />

a flat fare of 50p (€0.57)<br />

per single journey would<br />

free up more than £500m<br />

(€569m) a year for investment.<br />

This would make it<br />

possible to roll out stateof-the-art,<br />

European style<br />

bus service quality across<br />

the equivalent of up to 20<br />

cities the size of Plymouth<br />

(250,000 inhabitants) within<br />

10 years.<br />

stated that the introduction of a flat fare<br />

of 50p (€0.57) per single journey would<br />

free up more than £500m (€569m) a year<br />

for investment. This would make it possible,<br />

they argue, to roll out state-of-the-art,<br />

European style bus service quality across<br />

the equivalent of up to 20 cities the size<br />

of Plymouth (250,000 inhabitants) within<br />

10 years.<br />

Reliability is king<br />

“We’re not talking about needing to change<br />

everyone’s travel habits straight away,”<br />

says Jon Shaw. “Change 20 or 30 percent<br />

of people’s travel habits and it gets better<br />

for everybody. What’s key is providing a<br />

realistic alternative to enough car journeys<br />

to make a difference, instead of trying to<br />

provide an alternative for everything.”<br />

The key to the habit change is reliability.<br />

“If you’re trying to attract car users, I<br />

think it’s absolutely essential to make<br />

sure you offer reliability as the starting<br />

point, ahead of the more subtle issues<br />

like the appeal of electric vehicles,”<br />

says Peter White.<br />

This is supported by the view of bus users<br />

on the ground, where confidence in<br />

the ability to quickly get from A to B<br />

reigns supreme.<br />

“If public transport is not reliable, quick,<br />

and easy to use, people are going to be<br />

wedded to their cars, even if it costs them<br />

money,” concludes Claire Walters.<br />

Alex Byles<br />

16<br />

17

OUTLOOKS<br />

ELECTRIC <strong>BUS</strong> MARKET 2022. AND THE WINNER IS...<br />

4K AND GROWING<br />

26 percent growth compared to 2021, over 4<br />

thousand vehicles registered, 30 percent of the<br />

city bus market being zero-emission. The leaders?<br />

Yutong, ADL-BYD, Mercedes<br />

Let the numbers speak: the European<br />

electric bus market grew by 26<br />

percent in 2022. Registered buses<br />

are above 4,000, settling at 4,152.<br />

The ranking of market leaders is surprising:<br />

Yutong is first, followed by the joint<br />

venture between Alexander Dennis and<br />

BYD, then Daimler Buses with the eCitaro.<br />

Iveco Bus and VDL are growing, while<br />

Solaris is lagging behind after two years at<br />

the helm of this specific market segment,<br />

which is described once again by the data<br />

provided by Chatrou CME Solutions (covering<br />

27 European countries with the addition<br />

of the United Kingdom, Iceland, Nor-<br />

way and Switzerland). A key takeaway:<br />

today, 30 percent of the city bus market is<br />

zero-emission.<br />

Surprises are not lacking<br />

A focus on manufacturers. As already mentioned<br />

above, Yutong is leading with 479<br />

registrations. A leap forward (or rather: up)<br />

of 58 percent compared to 2021. A figure<br />

which, there’s no denying it, surprised many<br />

insiders and can be attributed to the lack of<br />

communication strategy of a group (let’s remember<br />

it is the largest bus manufacturer in<br />

the world in terms of sales volumes) which<br />

has a rather, so to speak, ‘vague’ organization<br />

on the European market. Most of the<br />

vehicles registered were sold in the United<br />

Kingdom, the Nordic countries and France,<br />

with a share between 60 and 100 electric<br />

buses for each of these countries. In the first<br />

two cases, the manufacturer is represented<br />

by the dealer. Next we find Alexander<br />

Dennis - BYD, with 465 registrations on<br />

the British market. Another confirmation<br />

for the third place: 4<strong>05</strong> eCitaros were delivered<br />

last year, up 21 percent compared to<br />

the previous year. Iveco Bus is fourth (and<br />

growing by 26 percent), with 347 units registered.<br />

We are also witnessing the comeback<br />

of VDL, which after a few ‘out of<br />

tune’ years has doubled its registrations to<br />

344 units, reviving the glories of 2019. The<br />

sixth place of Solaris is surprising, leaving<br />

behind a 3 percent market share. The Polish<br />

brand led the e-bus market in 2020 and<br />

2021. However, the -12 percent in sales volume<br />

compared to 2021 prefigures nothing<br />

more than a realignment with respect to val-<br />

30 percent of the European<br />

city bus market is zeroemission.<br />

Yutong is leading<br />

with 479 registrations.<br />

A leap forward (or rather:<br />

up) of 58 percent compared<br />

to 2021. Most of the<br />

vehicles sold by the Chinese<br />

brand were registered<br />

in UK, Nordic countries<br />

and France. Iveco Bus is<br />

fourth (and growing by 26<br />

percent), with 347 units<br />

registered. We are also<br />

witnessing the comeback<br />

of VDL, which after a few<br />

‘out of tune’ years has<br />

doubled its registrations to<br />

344 units, reviving the<br />

glories of 2019.<br />

WHAT’S UP IN THE FUEL<br />

CELL <strong>BUS</strong> WORLD?<br />

In 2022, registrations of fuel cell<br />

buses in Europe decreased compared<br />

to 2021: 99 against 158.<br />

As of January 1st, <strong>2023</strong>, 370 fuel<br />

cell city buses were in operation in<br />

Europe. Van Hool is still the market<br />

leader with a total of 106 hydrogen<br />

buses and a market share<br />

of 28.6 percent. Then come Solaris<br />

with 104 registrations (54 last<br />

year) and Wrightbus with a total<br />

of 82 buses. It is noteworthy that<br />

the Bolechowo-based company covered<br />

over half of the European fuel<br />

cell market last year. In Germany,<br />

it has even delivered more hydrogen<br />

vehicles than battery vehicles.<br />

Is it a sign of changing times or<br />

pure coincidence?<br />

THE CASE FOR CNG<br />

INTERCITY <strong>BUS</strong>ES...<br />

Looking at the volumes of each alternative<br />

drive technology, 4,152 electric<br />

buses (excluding trolleybuses),<br />

2,018 hybrid buses, 3,274 natural<br />

gas buses and 99 hydrogen buses<br />

were registered in 2022. The total?<br />

9,543 buses. This means that 62.5<br />

percent of registered city buses in<br />

Europe are now powered by alternative<br />

fuels. The share is up compared<br />

to 59 percent in 2021, but the total<br />

volume is down, mainly due to the<br />

lower volume of hybrid bus registrations<br />

(-38.5 percent). The city bus<br />

market decreased drastically last<br />

year (-14 percent on a continental<br />

scale).<br />

Analyzing the gas drive market specifically,<br />

data shows that the volumes<br />

of natural gas buses grew<br />

slightly from 3,088 in 2021 to 3,274<br />

in 2022 (+6.1 percent) and have settled<br />

at an almost stable level since<br />

2020. The interesting aspect is that<br />

the share of natural gas buses in the<br />

intercity segment is still growing,<br />

going from 864 in 2021 to 978 in<br />

2022. Translated as a percentage:<br />

+13 percent.<br />

18<br />

19

OUTLOOKS<br />

ues that literally exploded in the<br />

previous two years (which allow<br />

the group to maintain its leading<br />

position considering the 2012-<br />

2022 period). Especially since<br />

the Poles have done very well<br />

in the (small) hydrogen market,<br />

as we will see. Continuing our<br />

analysis, it is worth mentioning<br />

the leap forward made by Karsan,<br />

which in one year went from<br />

36 to 135 e-bus registrations:<br />

+275 percent. Good performance<br />

also for Chinese Golden Dragon, which<br />

reached 133 registrations.<br />

Irizar, Bluebus and Ebusco, on the other<br />

hand, had more negatives than positives in<br />

2022. The Spanish manufacturer dropped<br />

by 45 percent (but there was a boom in registrations<br />

in 2021...).<br />

Country by country...<br />

Ebusco is down 40 percent. 90 units were<br />

scheduled for delivery in 2022 in Berlin,<br />

but delivery was delayed due to supply<br />

chain constraints (the first units landed in<br />

the German capital in early <strong>2023</strong>). There is<br />

a quite large gap between registration data<br />

and the statements of the Dutch group,<br />

which in February <strong>2023</strong> proclaimed an order<br />

portfolio of 1,474 vehicles (including<br />

UK leads the ranking of<br />

countries with the most<br />

e-bus registrationswith a<br />

total of 685 e- buses. Germany<br />

is second with a total<br />

of 581 electric buses. In five<br />

European countries, over<br />

three-quarters of urban vehicle<br />

registrations are covered<br />

by electric vehicles.<br />

20<br />

WHO GROWS, WHO FALLS...<br />

2022** 2021** 2020** 2019* Trend volumes Market Market Trend market<br />

2022/2021 % share 2022 % share 2021 % share 2022/2021 %<br />

Yutong 479 303 164 1<strong>05</strong> 58.1 11.5 9.2 2.3<br />

BYD - ADL 465 375 190 79 24 11.2 11.4 -0.2<br />

Mercedes 4<strong>05</strong> 333 99 126 21.6 9.8 10.1 -0.4<br />

Iveco Bus / Heuliez Bus 347 274 114 83 26.6 8.4 8.3 0<br />

VDL 344 178 127 386 93.3 8.3 5.4 2.9<br />

Solaris 342 390 416 145 -12.3 8.2 11.9 -3.6<br />

BYD 322 257 424 236 25.3 7.8 7.8 -0.1<br />

Volvo Buses 232 211 217 135 10 5.6 6.4 -0.8<br />

MAN 230 134 25 0 71.6 5.5 4.1 1.5<br />

Karsan 135 36 23 *** 275 3.3 1.1 2.2<br />

Golden Dragon 133 53 *** *** 150.9 3.2 1.6 1.6<br />

Wrightbus 112 *** *** *** - 2.7 - 2.7<br />

Irizar 110 201 24 127 -45.3 2.6 6.1 -3.5<br />

Bluebus 91 1<strong>05</strong> 17 15 -13.3 2.2 3.2 -1<br />

Van Hool 87 *** *** *** - 2.1 - 2.1<br />

Ebusco 78 132 109 102 -40.9 1.9 4 -2.1<br />

SOR *** 60 51 *** - - 1.8 -<br />

Optare *** 52 31 31 - - 1.6 -<br />

Higer *** 36 *** *** - - 1.1 -<br />

Scania *** 15 1 0 - - 0.5 -<br />

Others 240 137 178 115 - - - -<br />

Total 4,152 3,282 2,210 1,685 26.5 100 - 100<br />

* Registrations in Estonia, Latvia, Lithuania, Czech Republic, Slovakia, Hungary, Croatia, Romania and Slovenia are not counted<br />

** Registrations EU27+UK+ICE+NO+CH<br />

*** Figure not available<br />

Based on Chatrou - CME Solutions data on battery-electric bus registrations (excluding trolley buses) above 8 ton.<br />

EUROPEAN LANDSCAPE<br />

2022 2021 2020 Trend e-bus Share of e-buses on<br />

registrations 2021/2020 city<br />

2022/2021 % bus market 2021 %*<br />

UK 685 540 288 26.9 51.7<br />

Germany 581 555 350 4.7 20.6<br />

France 549 512 133 7.2 27.3<br />

Denmark 381 217 1 75.6 100.8<br />

Finland 279 190 25 46.8 93.9<br />

Sweden 256 189 206 35.4 54.2<br />

Norway 216 86 210 151.2 145.9<br />

Poland 149 215 196 -30.7 25.1<br />

Luxembourg 138 29 38 375.9 89.6<br />

Spain 136 127 42 7.1 15.3<br />

Italy 121 178 97 -32 15.5<br />

Netherlands 95 152 445 -37.5 84.8<br />

Switzerland 81 37 7 118.9 32.3<br />

Portugal 52 31 8 67.7 7.5<br />

Belgium 42 19 12 121.1 13.5<br />

* Figure not available<br />

** Including, in addition to the data of the countries not mentioned in the table, also those of Bulgaria, Romania, Hungary<br />

Based on Chatrou - CME Solutions data on battery-electric bus registrations (excluding trolley buses) above 8 ton.<br />

ond with a total of 581 electric buses, followed<br />

by France with 549 units. It is worth<br />

mentioning Denmark, where 381 e-buses<br />

were registered last year. However, beyond<br />

the total volumes, it is particularly interestalso<br />

the options).<br />

As already mentioned, the United Kingdom<br />

leads the ranking of countries with<br />

the most e-bus registrations in 2022 with a<br />

total of 685 electric buses. Germany is sec-<br />

ing to compare electric vehicle registrations<br />

with the total urban registrations.<br />

In five European countries, over three-quarters<br />

of urban vehicle registrations are<br />

covered by electric vehicles. Indeed, the<br />

assumption according to which electric vehicles<br />

can only be Class I has come to an<br />

end: the cases of Denmark and Norway are<br />

proof of this. Here the volume of e-buses<br />

exceeds the total number of urban registrations.<br />

The Netherlands, Luxembourg<br />

and Finland follow the Nordic duo, but<br />

the picture offered by the United Kingdom<br />

and Sweden is also notable, on much more<br />

conspicuous total bus registration volumes:<br />

the share of battery-electric vehicles<br />

is over 50 percent. 27 percent in France<br />

and 20 percent in Germany. Italy and Spain<br />

stop at 15 percent. And Italy is curiously<br />

the only country, together with Poland, in<br />

which the registrations of electric buses<br />

have lost ground in 2022. Actually, there<br />

would be a third country, the Netherlands,<br />

where however the public transport electrification<br />

rate is already very high and a drop<br />

in volumes can be basically attributable to<br />

an already saturated market. P.B.<br />

21

OUTLOOKS<br />

OUTLOOK EUROPEAN MARKETS: TRENDS AND FORECASTS<br />

TOWARDS A NEW<br />

STATUS QUO?<br />

How do we recover from a pandemic? By 2022,<br />

the five main European markets had lost a<br />

quarter of their volumes compared to 2019.<br />

In Germany, 1,000 vehicles have ‘disappeared’<br />

How is the European bus market<br />

doing, three years after the<br />

outbreak of the pandemic? Has<br />

the (copious) public funding<br />

allocated to the chapters of shared mobility<br />

and decarbonisation already started<br />

to translate into growing orders? Has the<br />

great loss of 2020 been recovered? These<br />

are all questions that can be answered by<br />

putting the market data of the last four<br />

years in sequence. Questions to which it<br />

will rarely be possible to answer with a<br />

clear ‘yes’ or ‘no’, most of the<br />

time leaving room for an alternation<br />

of lights, shadows and<br />

grayscales. Yes, it is possible<br />

to identify the trends that informed<br />

the years from 2019 to<br />

2022. And to draw some conclusions.<br />

The data reported in these pages<br />

come from one source:<br />

Chatrou CME Solutions, aka<br />

Wim Chatrou, which has been<br />

for years a continental point<br />

of reference as regards the tracking<br />

of bus registrations in<br />

European countries. We focus<br />

on the main markets: Germany,<br />

France, Italy, United Kingdom,<br />

Spain. Five countries that historically<br />

cover a good 70 percent of registrations<br />

in Western Europe.<br />

France, Germany, Italy, UK, Spain<br />

Speaking of numbers, the EU market in<br />

the last four years is led by France, with<br />

a total of 22,244 registered buses and<br />

coaches. More than Germany, which follows<br />

closely with 21,402. Italy, the UK<br />

and Spain are far away. And it is precisely<br />

Financed markets are<br />

holding up (and there is<br />

no shortage of funds),<br />

for the coach market<br />

it is a real collapse: 54<br />

percent less vehicles<br />

registered last year<br />

compared to the last year<br />

before the pandemic.<br />

with our ‘cousins’ from across the Alps<br />

that we begin our four-year journey of<br />

market ups and downs. Over 5,800 pieces<br />

in 2019, the French market suffered a 9<br />

percent drop in 2020. It should be borne<br />

in mind, however, that the 2019 figure<br />

was the highest since 2010, except for<br />

over 6,000 recorded in 2015.<br />

The French market, as known, is a market<br />

in which school buses traditionally play<br />

a leading role, meaning Class II buses<br />

deployed for school transport services.<br />

In this segment, 2022 marked a return to<br />

2019 volumes (2,400 units), putting an<br />

end to a two-year period of… growth.<br />

Yes, over 2,600 and over 2,800 intercity<br />

buses registered in 2020 and 2021 embody<br />

an inverse trend to that generally<br />

attributable to the pandemic. The Class<br />

I market has remained almost stable, leading<br />

to a boom in 2021. Tourist coaches<br />

are collapsing, but it is the proverbial discovery<br />

of America: in 2022, a good half<br />

of them were registered compared to the<br />

2019 figure. An almost stable downsizing<br />

since 2020 onwards. A collapse, moreover,<br />

limited to vehicles over 15 tons. For<br />

the range between 8 and 15 tons, the lan-<br />

22<br />

23

OUTLOOKS<br />

The main markets, France<br />

and Germany, experienced<br />

a real explosion in volumes<br />

in ‘20 and ‘21 in one<br />

segment each: Class II in<br />

France, Class I in Germany.<br />

Peaks between 20 and<br />

30 percent more than the<br />

2019 figure. A dynamic that<br />

has no counterpart in the<br />

other countries analyzed<br />

and which appears to be<br />

attributable, mainly in the<br />

German case, to a real<br />

‘diesel bus rush’ in view of<br />

the Clean Vehicle Directive,<br />

which sets the constraint<br />

of a 45 percent share of low<br />

emission buses and 22.5<br />

percent of zero emission in<br />

the context of public tenders<br />

starting from 8/2021.<br />

2019, which was in line with a nice hat<br />

trick that started in 2016. The drop in the<br />

urban segment is consistent with the total<br />

trend, while the Class III saw a surge in<br />

2022.<br />

The diesel rush<br />

Some final considerations that unite several<br />

countries. The main continental markets,<br />

France and Germany, experienced<br />

a real explosion in volumes in 2020 and<br />

2021 in one segment each: Class II in<br />

France, Class I in Germany. Peaks between<br />

20 and 30 percent more than the<br />

2019 figure. A dynamic that has no counterpart<br />

in the other countries analyzed and<br />

which appears to be attributable, mainly<br />

in the German case, to a real ‘diesel bus<br />

rush’ in view of the Clean vehicle directive,<br />

which, as well known, sets the quota<br />

of a 45 percent share of ‘low emission’<br />

buses (and 22.5 percent of ‘zero emission’)<br />

in the context of public tenders<br />

starting from August 2021. There is also<br />

the effect, especially in the German case,<br />

of a tumultuous concentration of transit<br />

activities in the hands of large operators,<br />

with small players swept away by the<br />

pandemic. Large operators who, simultaneously<br />

with the takeover of local companies,<br />

have begun to renew their fleets<br />

to buffer the consequences of particularly<br />

high average age. Another consideration.<br />

For the world of Class III it is simplistic<br />

to speak of contraction. The 6,133 vehicles<br />

registered in 2019 became 2,799 in<br />

2022. Minus 54 percent. It is known that<br />

2019 was a particularly prosperous year<br />

for the world of tourist coaches. The year<br />

in which the (failed) Blablabus project<br />

was launched and the foundations of the<br />

Itabus project (recently acquired by Italo...)<br />

were laid in Italy. These were the<br />

litmus tests of a market perceived to be<br />

growing rapidly, a harbinger of profits.<br />

A few months later, the ‘black swan’ arrived.<br />

Today, the main barriers to growing<br />

again are called dilation of delivery<br />

times (aka supply chain crisis) and lack<br />

of drivers. Combined with anti-inflation<br />

maneuvers that have a heavy impact<br />

on leasing costs. Riccardo Schiavo<br />

dslide is much more limited.<br />

Let’s move on to Germany, where the<br />

city bus market did very well, up to<br />

3,942 registrations in 2021. 34 percent<br />

more than the 2019 value. The intercity<br />

bus market is stable. Coaches collapse:<br />

the sum of registrations in the last three<br />

years is slightly higher than the 2019 figure.<br />

In 2022, a thousand coaches were<br />

‘left behind’ compared to 2019. Only<br />

the United Kingdom, among the markets<br />

analysed, suffered a comparable decline,<br />

as we will see shortly.<br />

Coach business in numbers<br />

In Italy, 2019 had brought exceptional<br />

numbers. Over 3,000 registered vehicles<br />

in that year. The last three years have<br />

seen the market spiral around 2,400 buses.<br />

What about the 600 ‘lost’ pieces?<br />

They are mostly coaches. A market that<br />

reached 965 registrations in Class III in<br />

FOUR YEARS UNDER THE LENS<br />

France Germany Italy UK Spain TOT segment<br />

2022 City buses 2,012 2,819 782 1,326 887 7,826<br />

Intercity buses 2,425 1,021 1,230 - 256 4,932<br />

Coaches 635 495 430 515 724 2,799<br />

Total 5,072 4,335 2,442 1,841 1,867 15,557<br />

2021 City buses 2,660 3,942 1,166 1,222 908 9,898<br />

Intercity buses 2,845 1,309 872 - 234 5,260<br />

Coaches 546 478 398 421 380 2,223<br />

Total 6,<strong>05</strong>1 5,729 2,436 1,643 1,522 17,381<br />

2020 City buses 1,913 3,791 1,027 1,142 985 8,858<br />

Intercity buses 2,624 1,362 898 - 294 5,178<br />

Coaches 765 558 394 382 526 2,625<br />

Total 5,302 5,711 2,319 1,524 1,8<strong>05</strong> 16,661<br />

2019 City buses 2,044 2,900 1,219 1,799 1,212 9,174<br />

Intercity buses 2,400 1,387 897 - 398 5,082<br />

Coaches 1,372 1,340 965 1,307 1,149 6,133<br />

Total 5,816 5,627 3,081 3,106 2,759 20,389<br />

Bus and coach registrations above 8 tonnes. Elaboration by Sustainable Bus on data by<br />

Chatrou CME Solutions.<br />

2019 has seen the coach segment settle<br />

in the last three years around 400 units.<br />

A bad setback, in 2022, for the Class I.<br />

The past year, on the other hand, decreed<br />

a conspicuous expansion of the Class II<br />

segment, which alone covered the exact<br />

half of the overall market above 8 tons.<br />

A fun fact: 2019 was an exceptional year<br />

also for articulated vehicles: 253 registered<br />

vehicles, well above the sum of vehicles<br />

registered in the three years between<br />

2020 and 2022.<br />

Let’s fly across the Channel. In the United<br />

Kingdom, urban buses have contracted<br />

by a quarter. Coaches sank: the Class III<br />

registered between 2020 and 2022 equal<br />

those registered in the last year before<br />

the pandemic. It is a market in which, it is<br />

legitimate to assume, the effects of Brexit<br />

have been added to the effects of Covid<br />

and the raw materials crisis in decreeing<br />

a truly dramatic reduction in volumes: the<br />

average for the triennium 2020-2022 corresponds<br />

to half of the registered vehicles<br />

in 2019. This, in turn, in contrast with the<br />

continental markets, was characterized by<br />

volumes that were 20 percent lower compared<br />

to the period 2015-2017.<br />

We end our overview in Spain. The total<br />

market for 2020-2022 is worth, on average,<br />

1,700 pieces a year. A third less than<br />

Analysis | Manufacturing | Supply<br />

Acoustic Testing<br />

Solution Design<br />

Material Expertise<br />

Manufacturing Expertise<br />

Visit our site<br />

today to<br />

learn more!<br />

24<br />

ventac.com<br />

+ 353 (0) 45 851 500<br />

info@ventac.com

OUTLOOKS<br />

By James Nix, freight manager<br />

at European research<br />

and advocacy group<br />

Transport & Environment.<br />

In this article, he discusses<br />

the increasing trend of cities<br />

buying electric buses<br />

and the need for a ramped<br />

up supply to meet the<br />

rising demand.<br />

«EU LAW NEEDS TO BOOST THE DEPLOYMENT OF ELECTRIC <strong>BUS</strong>ES»<br />

FIT FOR ZERO<br />

EMISSION?<br />

Law-makers should set a 2027 deadline for<br />

100 per cent zero emission urban bus sales,<br />

or supply will fall behind demand, according to<br />

Transport & Environment<br />

Cities are increasingly buying electric<br />

buses. Almost one in three<br />

newly-registered urban buses in<br />

2022 was zero emission. That’s a<br />

doubling of the 2020 sales share, putting cities<br />

on track to buy 100% zero emission from<br />

2026 (see graph).<br />

It’s important therefore that the supply of<br />

these buses is ramped up at the same speed.<br />

Greater scale will reduce prices. Unfortunately<br />

the European Commission is leaving cities<br />

short in this regard. Its recent proposal to<br />

clean up new urban buses (as part of a draft<br />

law that also covers trucks and coaches) requires<br />

urban bus manufacturers to provide<br />

100% zero emission sales only in 2030. As a<br />

result, supply would lag behind demand by<br />

three to four years.<br />

Across vehicle types, the function of EU law<br />

is to lead - not follow - market developments.<br />

The bloc’s car CO2 targets essentially forced<br />

carmakers to supply electric cars – vehicles<br />

that motorists already wanted to buy. Urban<br />

buses should be no different.<br />

A draft law in front of the Parliament<br />

Thankfully, the draft law is now before the<br />

European Parliament and member states.<br />

Both institutions are expected to set out their<br />

positions on the proposal by early Autumn,<br />

and have the power to bring the date forward<br />

from 2030 to 2027.<br />

Leading cities across Europe are only buying<br />

zero emission buses – or have pledged to do<br />

so by 2025. These include Amsterdam, Barcelona,<br />

Berlin, Birmingham, Copenhagen,<br />

Hamburg, Heidelberg, Liverpool, London,<br />

Madrid, Greater Manchester, Milan, Oslo,<br />

Oxford, Paris, Rome, Rotterdam, and Warsaw.<br />

Add to this all other Dutch cities, Denmark’s<br />

six largest municipalities, Irish cities,<br />

leading Bulgarian and Romanian cities, and<br />

a number of German cities not mentioned<br />

above. As the number of pledges grows, it’s<br />

becoming increasingly difficult to compile<br />

a complete list of all municipalities leaving<br />

diesel and gas buses behind.<br />

Last October, in a letter with more than 30<br />

signatories, cities joined health organisations,<br />

green groups and public transport<br />

stakeholders to call on the European Commission<br />

to propose 2027 as the year from<br />

when all new urban bus sales are zero emission.<br />

Already, Daimler has pledged to only<br />

26<br />

27

OUTLOOKS<br />

FIGURES, TRENDS, GOALS<br />

Share ZE buses in city bus market<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

100% 100% 100%<br />

16% 23% 30%<br />

12%<br />

2019 2020 2021 2022 <strong>2023</strong> 2024 2025 2026 2027 2028 2029 2030<br />

● Continuation of observed growth<br />

● EU Commission proposal<br />

Sales target needed for all new urban buses to be zero-emission from 2027.<br />

Source: Transport & Environment<br />

● T&E recommendations<br />

Electric is cheaper than<br />

alternative powertrains<br />

which have been adopted<br />

in the past, such as biogas.<br />

As experts such as<br />

the International Council<br />

on Clean Transportation<br />

point out, biogas can’t be<br />

made widely available at<br />

reasonable cost, and the<br />

amount that’s available is<br />

more efficiently used than<br />

in transport. Also, in terms<br />

of citizens’ health, gaseous<br />

fuels still release air<br />

pollutants, whether fossil<br />

gas or biogas. To reduce<br />

climate emissions, air pollution<br />

and energy use as<br />

much as possible, electric<br />

is the best answer.<br />

sell zero emission urban buses from 2030 in<br />

Europe. And other OEMs are only focusing<br />

on electric technologies for the city bus segment.<br />

It’s now time for law-makers to nudge<br />

bus-makers beyond their own internal corporate<br />

targets.<br />

Electric buses are ripe for universal adoption.<br />

For example, 96% of new buses registered<br />