Annual Report 2002 (pdf, 1319K) - WestLB

Annual Report 2002 (pdf, 1319K) - WestLB

Annual Report 2002 (pdf, 1319K) - WestLB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

34<br />

Services<br />

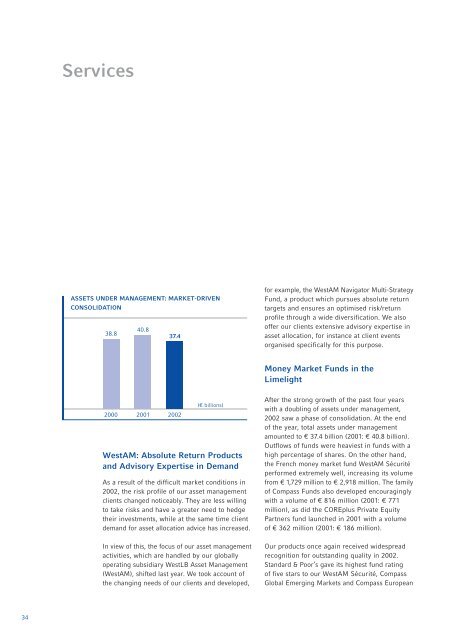

ASSETS UNDER MANAGEMENT: MARKET-DRIVEN<br />

CONSOLIDATION<br />

38.8<br />

40.8<br />

37.4<br />

2000 2001 <strong>2002</strong><br />

(€ billions)<br />

WestAM: Absolute Return Products<br />

and Advisory Expertise in Demand<br />

As a result of the difficult market conditions in<br />

<strong>2002</strong>, the risk profile of our asset management<br />

clients changed noticeably. They are less willing<br />

to take risks and have a greater need to hedge<br />

their investments, while at the same time client<br />

demand for asset allocation advice has increased.<br />

In view of this, the focus of our asset management<br />

activities, which are handled by our globally<br />

operating subsidiary <strong>WestLB</strong> Asset Management<br />

(WestAM), shifted last year. We took account of<br />

the changing needs of our clients and developed,<br />

for example, the WestAM Navigator Multi-Strategy<br />

Fund, a product which pursues absolute return<br />

targets and ensures an optimised risk/return<br />

profile through a wide diversification. We also<br />

offer our clients extensive advisory expertise in<br />

asset allocation, for instance at client events<br />

organised specifically for this purpose.<br />

Money Market Funds in the<br />

Limelight<br />

After the strong growth of the past four years<br />

with a doubling of assets under management,<br />

<strong>2002</strong> saw a phase of consolidation. At the end<br />

of the year, total assets under management<br />

amounted to € 37.4 billion (2001: € 40.8 billion).<br />

Outflows of funds were heaviest in funds with a<br />

high percentage of shares. On the other hand,<br />

the French money market fund WestAM Sécurité<br />

performed extremely well, increasing its volume<br />

from € 1,729 million to € 2,918 million. The family<br />

of Compass Funds also developed encouragingly<br />

with a volume of € 816 million (2001: € 771<br />

million), as did the COREplus Private Equity<br />

Partners fund launched in 2001 with a volume<br />

of € 362 million (2001: € 186 million).<br />

Our products once again received widespread<br />

recognition for outstanding quality in <strong>2002</strong>.<br />

Standard & Poor’s gave its highest fund rating<br />

of five stars to our WestAM Sécurité, Compass<br />

Global Emerging Markets and Compass European