You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MARKET OVERVIEW<br />

TOP CHARTER MODELS<br />

CORP.<br />

AIRLINER<br />

LONG<br />

RANGE<br />

5 2 2<br />

BBJ ACJ319 ACJ318<br />

15 13 11 9 7<br />

Global 6000 G550 Global 5000 Falcon 7X Global<br />

Express XRS<br />

Very Light (4%)<br />

Light (31%)<br />

CHARTER FLEET BY SIZE CATEGORY<br />

339<br />

Corp. Airliner (5%)<br />

Long Range (23%)<br />

LARGE<br />

15 11 11 10 9<br />

Falcon 2000<br />

Challenger<br />

800/850<br />

Challenger<br />

604<br />

Legacy<br />

600 / 650<br />

G450<br />

Medium (13%)<br />

Large (24%)<br />

MEDIUM<br />

LIGHT<br />

VERY<br />

LIGHT<br />

12 6 6 5 5<br />

Hawker<br />

800/XP<br />

Learjet 60 XR G200 Hawker<br />

850XP<br />

Citation 550 Citation 525A Citation 560XL Westwind 1/2<br />

(II/IISP/SII/Bravo) (CJ2/CJ2+) (Excel/XLS/XLS+)<br />

Citation<br />

680(Sovereign/+)<br />

16 12 11 9 7<br />

6 4 3<br />

Citation<br />

510(Mustang)<br />

Phenom 100 Citation 525<br />

(M2/CJ1/+)<br />

Citation<br />

560(V/Ultra)<br />

>20 years (29%)<br />

16-20 years (16%)<br />

CHARTER FLEET BY AGE<br />

339<br />

0-5 years (11%)<br />

6-10 years (18%)<br />

11-15 years (26%)<br />

CHARTER FLEET SIZE CATEGORY BY COUNTRY/REGION<br />

Corp. Airliner Long Range Large Medium Light Very Light<br />

TOTAL<br />

AIRCRAFT 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<br />

BASE COUNTRY/REGION<br />

AUSTRALIA<br />

MAINLAND CHINA<br />

INDIA<br />

SINGAPORE<br />

JAPAN<br />

PHILIPPINES<br />

THAILAND<br />

INDONESIA<br />

MALAYSIA<br />

NEW ZEALAND<br />

HONG KONG SAR<br />

TAIWAN<br />

SOUTH KOREA<br />

VIETNAM<br />

81<br />

71<br />

60<br />

22<br />

17<br />

17<br />

14<br />

13<br />

11<br />

10<br />

9<br />

4<br />

3<br />

2<br />

3% 9% 15%<br />

10% 54% 9%<br />

4%<br />

37% 41%<br />

10%<br />

8%<br />

7% 11%<br />

33%<br />

10%<br />

32%<br />

7%<br />

45%<br />

5%<br />

27%<br />

23%<br />

6%<br />

53%<br />

12% 29%<br />

6% 23% 18% 53%<br />

14% 50% 29%<br />

7%<br />

8% 8% 53%<br />

23% 8%<br />

9% 36%<br />

36%<br />

19%<br />

20% 30% 10% 20%<br />

20%<br />

11%<br />

67% 22%<br />

50% 50%<br />

33%<br />

67%<br />

50%<br />

50%<br />

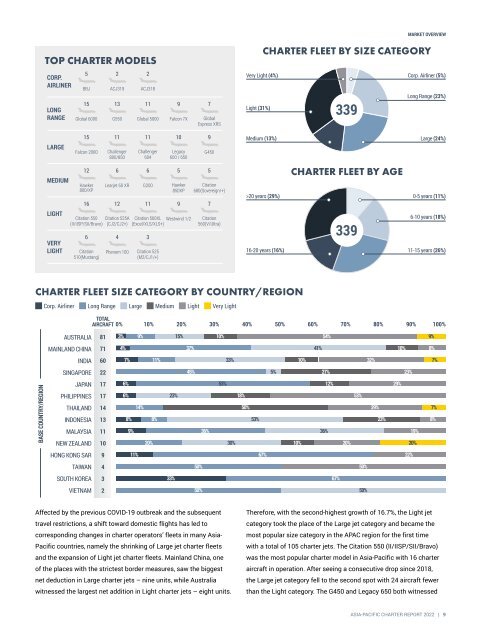

Affected by the previous COVID-19 outbreak and the subsequent<br />

travel restrictions, a shift toward domestic flights has led to<br />

corresponding changes in charter operators’ fleets in many Asia-<br />

Pacific countries, namely the shrinking of Large jet charter fleets<br />

and the expansion of Light jet charter fleets. Mainland China, one<br />

of the places with the strictest border measures, saw the biggest<br />

net deduction in Large charter jets – nine units, while Australia<br />

witnessed the largest net addition in Light charter jets – eight units.<br />

Therefore, with the second-highest growth of 16.7%, the Light jet<br />

category took the place of the Large jet category and became the<br />

most popular size category in the APAC region for the first time<br />

with a total of 105 charter jets. The Citation 550 (II/IISP/SII/Bravo)<br />

was the most popular charter model in Asia-Pacific with 16 charter<br />

aircraft in operation. After seeing a consecutive drop since 2018,<br />

the Large jet category fell to the second spot with 24 aircraft fewer<br />

than the Light category. The G450 and Legacy 650 both witnessed<br />

ASIA-PACIFIC CHARTER REPORT <strong>2022</strong> | 9