Asian Sky Quarterly 2022 Q3

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PRE-OWNED MARKET SPOTLIGHT: G650 & G650ER<br />

PRE-OWNED MAKET ANALYSIS<br />

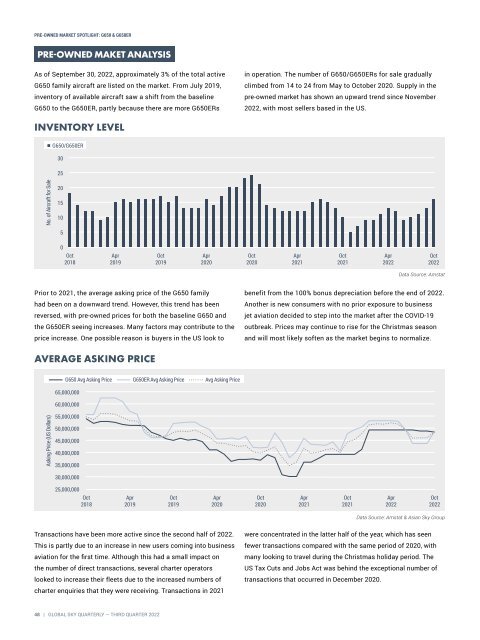

As of September 30, <strong>2022</strong>, approximately 3% of the total active<br />

G650 family aircraft are listed on the market. From July 2019,<br />

inventory of available aircraft saw a shift from the baseline<br />

G650 to the G650ER, partly because there are more G650ERs<br />

in operation. The number of G650/G650ERs for sale gradually<br />

climbed from 14 to 24 from May to October 2020. Supply in the<br />

pre-owned market has shown an upward trend since November<br />

<strong>2022</strong>, with most sellers based in the US.<br />

INVENTORY LEVEL<br />

G650/G650ER<br />

30<br />

25<br />

No. of Aircraft for Sale<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Oct<br />

2018<br />

Apr<br />

2019<br />

Oct<br />

2019<br />

Apr<br />

2020<br />

Oct<br />

2020<br />

Apr<br />

2021<br />

Oct<br />

2021<br />

Apr<br />

<strong>2022</strong><br />

Oct<br />

<strong>2022</strong><br />

Data Source: Amstat<br />

Prior to 2021, the average asking price of the G650 family<br />

had been on a downward trend. However, this trend has been<br />

reversed, with pre-owned prices for both the baseline G650 and<br />

the G650ER seeing increases. Many factors may contribute to the<br />

price increase. One possible reason is buyers in the US look to<br />

benefit from the 100% bonus depreciation before the end of <strong>2022</strong>.<br />

Another is new consumers with no prior exposure to business<br />

jet aviation decided to step into the market after the COVID-19<br />

outbreak. Prices may continue to rise for the Christmas season<br />

and will most likely soften as the market begins to normalize.<br />

AVERAGE ASKING PRICE<br />

G650 Avg Asking Price G650ER Avg Asking Price Avg Asking Price<br />

65,000,000<br />

60,000,000<br />

Asking Price (US Dollars)<br />

55,000,000<br />

50,000,000<br />

45,000,000<br />

40,000,000<br />

35,000,000<br />

30,000,000<br />

25,000,000<br />

Oct<br />

2018<br />

Apr<br />

2019<br />

Oct<br />

2019<br />

Apr<br />

2020<br />

Oct<br />

2020<br />

Apr<br />

2021<br />

Oct<br />

2021<br />

Apr<br />

<strong>2022</strong><br />

Oct<br />

<strong>2022</strong><br />

Data Source: Amstat & <strong>Asian</strong> <strong>Sky</strong> Group<br />

Transactions have been more active since the second half of <strong>2022</strong>.<br />

This is partly due to an increase in new users coming into business<br />

aviation for the first time. Although this had a small impact on<br />

the number of direct transactions, several charter operators<br />

looked to increase their fleets due to the increased numbers of<br />

were concentrated in the latter half of the year, which has seen<br />

fewer transactions compared with the same period of 2020, with<br />

many looking to travel during the Christmas holiday period. The<br />

US Tax Cuts and Jobs Act was behind the exceptional number of<br />

transactions that occurred in December 2020.<br />

charter enquiries that they were receiving. Transactions in 2021<br />

48 | GLOBAL SKY QUARTERLY — THIRD QUARTER <strong>2022</strong>