Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ACEM</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

54<br />

NOTES TO THE FINANCIAL<br />

STATEMENTS for the year ended 30 June <strong>2011</strong><br />

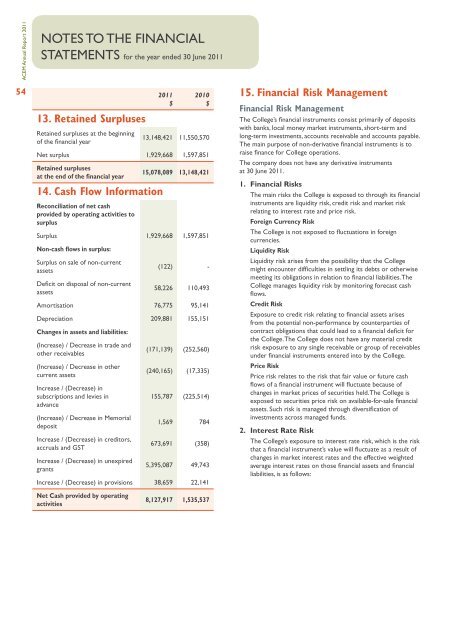

13. Retained Surpluses<br />

<strong>2011</strong><br />

$<br />

2010<br />

$<br />

Retained surpluses at the beginning<br />

of the fi nancial year<br />

13,148,421 11,550,570<br />

Net surplus 1,929,668 1,597,851<br />

Retained surpluses<br />

at the end of the fi nancial year<br />

15,078,089 13,148,421<br />

14. Cash Flow Information<br />

Reconciliation of net cash<br />

provided by operating activities to<br />

surplus<br />

Surplus 1,929,668 1,597,851<br />

Non-cash fl ows in surplus:<br />

Surplus on sale of non-current<br />

assets<br />

(122) -<br />

Defi cit on disposal of non-current<br />

assets<br />

58,226 110,493<br />

Amortisation 76,775 95,141<br />

Depreciation 209,881 155,151<br />

Changes in assets and liabilities:<br />

(Increase) / Decrease in trade and<br />

other receivables<br />

(Increase) / Decrease in other<br />

current assets<br />

Increase / (Decrease) in<br />

subscriptions and levies in<br />

advance<br />

(171,139) (252,560)<br />

(240,165) (17,335)<br />

155,787 (225,514)<br />

(Increase) / Decrease in Memorial<br />

deposit<br />

1,569 784<br />

Increase / (Decrease) in creditors,<br />

accruals and GST<br />

673,691 (358)<br />

Increase / (Decrease) in unexpired<br />

grants<br />

5,395,087 49,743<br />

Increase / (Decrease) in provisions 38,659 22,141<br />

Net Cash provided by operating<br />

activities<br />

8,127,917 1,535,537<br />

15. Financial Risk Management<br />

Financial Risk Management<br />

The College’s fi nancial instruments consist primarily of deposits<br />

with banks, local money market instruments, short-term and<br />

long-term investments, accounts receivable and accounts payable.<br />

The main purpose of non-derivative fi nancial instruments is to<br />

raise fi nance for College operations.<br />

The company does not have any derivative instruments<br />

at 30 June <strong>2011</strong>.<br />

1. Financial Risks<br />

The main risks the College is exposed to through its fi nancial<br />

instruments are liquidity risk, credit risk and market risk<br />

relating to interest rate and price risk.<br />

Foreign Currency Risk<br />

The College is not exposed to fl uctuations in foreign<br />

currencies.<br />

Liquidity Risk<br />

Liquidity risk arises from the possibility that the College<br />

might encounter diffi culties in settling its debts or otherwise<br />

meeting its obligations in relation to fi nancial liabilities. The<br />

College manages liquidity risk by monitoring forecast cash<br />

fl ows.<br />

Credit Risk<br />

Exposure to credit risk relating to fi nancial assets arises<br />

from the potential non-performance by counterparties of<br />

contract obligations that could lead to a fi nancial defi cit for<br />

the College. The College does not have any material credit<br />

risk exposure to any single receivable or group of receivables<br />

under fi nancial instruments entered into by the College.<br />

Price Risk<br />

Price risk relates to the risk that fair value or future cash<br />

fl ows of a fi nancial instrument will fl uctuate because of<br />

changes in market prices of securities held. The College is<br />

exposed to securities price risk on available-for-sale fi nancial<br />

assets. Such risk is managed through diversifi cation of<br />

investments across managed funds.<br />

2. Interest Rate Risk<br />

The College’s exposure to interest rate risk, which is the risk<br />

that a fi nancial instrument’s value will fl uctuate as a result of<br />

changes in market interest rates and the effective weighted<br />

average interest rates on those fi nancial assets and fi nancial<br />

liabilities, is as follows: