Equilibrium Growth, Inflation, and Bond Yields - Duke University's ...

Equilibrium Growth, Inflation, and Bond Yields - Duke University's ...

Equilibrium Growth, Inflation, and Bond Yields - Duke University's ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

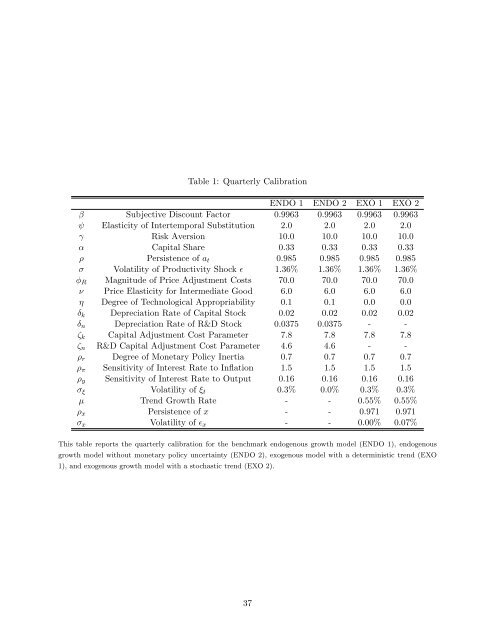

Table 1: Quarterly Calibration<br />

ENDO 1 ENDO 2 EXO 1 EXO 2<br />

β Subjective Discount Factor 0.9963 0.9963 0.9963 0.9963<br />

ψ Elasticity of Intertemporal Substitution 2.0 2.0 2.0 2.0<br />

γ Risk Aversion 10.0 10.0 10.0 10.0<br />

α Capital Share 0.33 0.33 0.33 0.33<br />

ρ Persistence of at 0.985 0.985 0.985 0.985<br />

σ Volatility of Productivity Shock ɛ 1.36% 1.36% 1.36% 1.36%<br />

φR Magnitude of Price Adjustment Costs 70.0 70.0 70.0 70.0<br />

ν Price Elasticity for Intermediate Good 6.0 6.0 6.0 6.0<br />

η Degree of Technological Appropriability 0.1 0.1 0.0 0.0<br />

δk Depreciation Rate of Capital Stock 0.02 0.02 0.02 0.02<br />

δn Depreciation Rate of R&D Stock 0.0375 0.0375 - -<br />

ζk Capital Adjustment Cost Parameter 7.8 7.8 7.8 7.8<br />

ζn R&D Capital Adjustment Cost Parameter 4.6 4.6 - -<br />

ρr Degree of Monetary Policy Inertia 0.7 0.7 0.7 0.7<br />

ρπ Sensitivity of Interest Rate to <strong>Inflation</strong> 1.5 1.5 1.5 1.5<br />

ρy Sensitivity of Interest Rate to Output 0.16 0.16 0.16 0.16<br />

σξ Volatility of ξt 0.3% 0.0% 0.3% 0.3%<br />

µ Trend <strong>Growth</strong> Rate - - 0.55% 0.55%<br />

ρx Persistence of x - - 0.971 0.971<br />

σx Volatility of ɛx - - 0.00% 0.07%<br />

This table reports the quarterly calibration for the benchmark endogenous growth model (ENDO 1), endogenous<br />

growth model without monetary policy uncertainty (ENDO 2), exogenous model with a deterministic trend (EXO<br />

1), <strong>and</strong> exogenous growth model with a stochastic trend (EXO 2).<br />

37