Equilibrium Growth, Inflation, and Bond Yields - Duke University's ...

Equilibrium Growth, Inflation, and Bond Yields - Duke University's ...

Equilibrium Growth, Inflation, and Bond Yields - Duke University's ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

a<br />

" n<br />

E[" z]<br />

5.5<br />

5<br />

4.5<br />

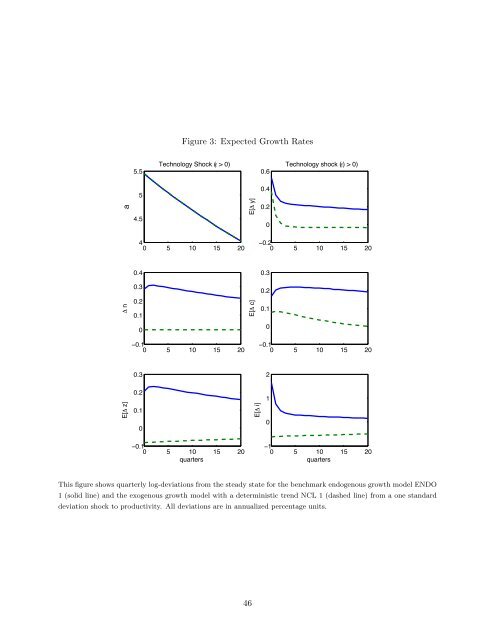

Figure 3: Expected <strong>Growth</strong> Rates<br />

Technology Shock (! > 0)<br />

4<br />

0 5 10 15 20<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

0<br />

−0.1<br />

0 5 10 15 20<br />

0.3<br />

0.2<br />

0.1<br />

0<br />

−0.1<br />

0 5 10<br />

quarters<br />

15 20<br />

E[" y]<br />

E[" c]<br />

E[" i]<br />

0.6<br />

0.4<br />

0.2<br />

0<br />

Technology shock (!) > 0)<br />

−0.2<br />

0 5 10 15 20<br />

0.3<br />

0.2<br />

0.1<br />

0<br />

−0.1<br />

0 5 10 15 20<br />

2<br />

1<br />

0<br />

−1<br />

0 5 10<br />

quarters<br />

15 20<br />

This figure shows quarterly log-deviations from the steady state for the benchmark endogenous growth model ENDO<br />

1 (solid line) <strong>and</strong> the exogenous growth model with a deterministic trend NCL 1 (dashed line) from a one st<strong>and</strong>ard<br />

deviation shock to productivity. All deviations are in annualized percentage units.<br />

46