Equilibrium Growth, Inflation, and Bond Yields - Duke University's ...

Equilibrium Growth, Inflation, and Bond Yields - Duke University's ...

Equilibrium Growth, Inflation, and Bond Yields - Duke University's ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

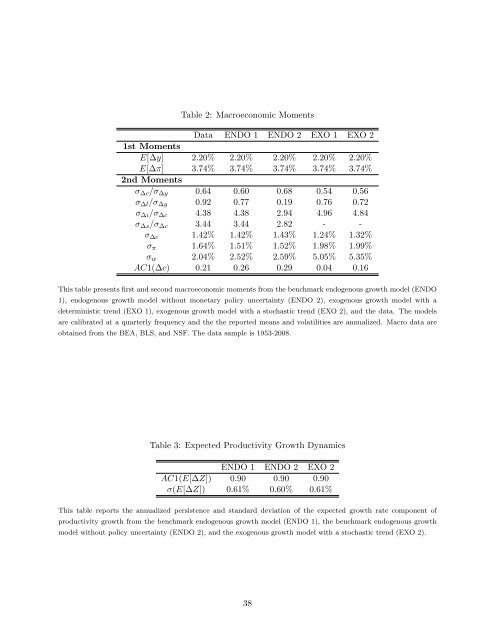

Table 2: Macroeconomic Moments<br />

Data ENDO 1 ENDO 2 EXO 1 EXO 2<br />

1st Moments<br />

E[∆y] 2.20% 2.20% 2.20% 2.20% 2.20%<br />

E[∆π]<br />

2nd Moments<br />

3.74% 3.74% 3.74% 3.74% 3.74%<br />

σ∆c/σ∆y 0.64 0.60 0.68 0.54 0.56<br />

σ∆l/σ∆y 0.92 0.77 0.19 0.76 0.72<br />

σ∆i/σ∆c 4.38 4.38 2.94 4.96 4.84<br />

σ∆s/σ∆c 3.44 3.44 2.82 - -<br />

σ∆c 1.42% 1.42% 1.43% 1.24% 1.32%<br />

σπ 1.64% 1.51% 1.52% 1.98% 1.99%<br />

σw 2.04% 2.52% 2.59% 5.05% 5.35%<br />

AC1(∆c) 0.21 0.26 0.29 0.04 0.16<br />

This table presents first <strong>and</strong> second macroeconomic moments from the benchmark endogenous growth model (ENDO<br />

1), endogenous growth model without monetary policy uncertainty (ENDO 2), exogenous growth model with a<br />

deterministic trend (EXO 1), exogenous growth model with a stochastic trend (EXO 2), <strong>and</strong> the data. The models<br />

are calibrated at a quarterly frequency <strong>and</strong> the the reported means <strong>and</strong> volatilities are annualized. Macro data are<br />

obtained from the BEA, BLS, <strong>and</strong> NSF. The data sample is 1953-2008.<br />

Table 3: Expected Productivity <strong>Growth</strong> Dynamics<br />

ENDO 1 ENDO 2 EXO 2<br />

AC1(E[∆Z]) 0.90 0.90 0.90<br />

σ(E[∆Z]) 0.61% 0.60% 0.61%<br />

This table reports the annualized persistence <strong>and</strong> st<strong>and</strong>ard deviation of the expected growth rate component of<br />

productivity growth from the benchmark endogenous growth model (ENDO 1), the benchmark endogenous growth<br />

model without policy uncertainty (ENDO 2), <strong>and</strong> the exogenous growth model with a stochastic trend (EXO 2).<br />

38