Energy: Oil & Gas - Bahamas Petroleum Company Plc

Energy: Oil & Gas - Bahamas Petroleum Company Plc

Energy: Oil & Gas - Bahamas Petroleum Company Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

November 5, 2010 Europe: <strong>Energy</strong>: <strong>Oil</strong> & <strong>Gas</strong> - E&P<br />

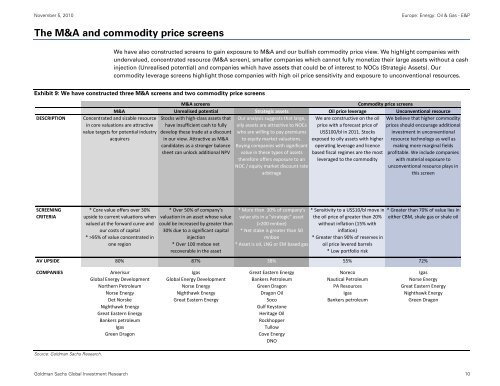

The M&A and commodity price screens<br />

We have also constructed screens to gain exposure to M&A and our bullish commodity price view. We highlight companies with<br />

undervalued, concentrated resource (M&A screen), smaller companies which cannot fully monetize their large assets without a cash<br />

injection (Unrealised potential) and companies which have assets that could be of interest to NOCs (Strategic Assets). Our<br />

commodity leverage screens highlight those companies with high oil price sensitivity and exposure to unconventional resources.<br />

Exhibit 9: We have constructed three M&A screens and two commodity price screens<br />

M&A screens Commodity price screens<br />

M&A Unrealised potential Strategic assets <strong>Oil</strong> price leverage Unconventional resource<br />

DESCRIPTION Concentrated and sizable resource Stocks with high‐class assets that Our analysis suggests that large, We are constructive on the oil We believe that higher commodity<br />

in core valuations are attractive have insufficient cash to fully oily assets are attractive to NOCs price with a forecast price of prices should encourage additional<br />

value targets for potential industry develop these trade at a discount who are willing to pay premiums US$100/bl in 2011. Stocks investment in unconventional<br />

acquirers<br />

in our view. Attractive as M&A to equity market valuations. exposed to oily assets with higher resource technology as well as<br />

candidates as a stronger balance Buying companies with significant operating leverage and licence making more marginal fields<br />

sheet can unlock additional NPV value in these types of assets based fiscal regimes are the most profitable. We include companies<br />

therefore offers exposure to an leveraged to the commodity with material exposure to<br />

NOC / equity market discount rate<br />

unconventional resource plays in<br />

arbitrage<br />

this screen<br />

SCREENING<br />

CRITERIA<br />

Source: Goldman Sachs Research.<br />

* Core value offers over 30%<br />

upside to current valuations when<br />

valued at the forward curve and<br />

our costs of capital<br />

* >95% of value concentrated in<br />

one region<br />

* Over 50% of company's<br />

valuation in an asset whose value<br />

could be increased by greater than<br />

30% due to a significant capital<br />

injection<br />

* Over 100 mnboe net<br />

recoverable in the asset<br />

* More than 30% of company's<br />

value sits in a "strategic" asset<br />

(>200 mnboe)<br />

* Net stake is greater than 50<br />

mnboe<br />

* Asset is oil, LNG or EM based gas<br />

* Sensitivity to a US$10/bl move in<br />

the oil price of greater than 20%<br />

without inflation (15% with<br />

inflation)<br />

* Greater than 90% of reserves in<br />

oil price levered barrels<br />

* Low portfolio risk<br />

* Greater than 70% of value lies in<br />

either CBM, shale gas or shale oil<br />

AV UPSIDE 80% 87% 38% 55% 72%<br />

COMPANIES<br />

Amerisur Igas Great Eastern <strong>Energy</strong> Noreco Igas<br />

Global <strong>Energy</strong> Development Global <strong>Energy</strong> Development Bankers <strong>Petroleum</strong> Nautical <strong>Petroleum</strong> Norse <strong>Energy</strong><br />

Northern <strong>Petroleum</strong> Norse <strong>Energy</strong> Green Dragon PA Resources Great Eastern <strong>Energy</strong><br />

Norse <strong>Energy</strong> Nighthawk <strong>Energy</strong> Dragon <strong>Oil</strong> Igas Nighthawk <strong>Energy</strong><br />

Det Norske Great Eastern <strong>Energy</strong> Soco Bankers petroleum Green Dragon<br />

Nighthawk <strong>Energy</strong> Gulf Keystone<br />

Great Eastern <strong>Energy</strong> Heritage <strong>Oil</strong><br />

Bankers petroleum Rockhopper<br />

Igas Tullow<br />

Green Dragon Cove <strong>Energy</strong><br />

DNO<br />

Goldman Sachs Global Investment Research 10