Energy: Oil & Gas - Bahamas Petroleum Company Plc

Energy: Oil & Gas - Bahamas Petroleum Company Plc

Energy: Oil & Gas - Bahamas Petroleum Company Plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

November 5, 2010 Europe: <strong>Energy</strong>: <strong>Oil</strong> & <strong>Gas</strong> - E&P<br />

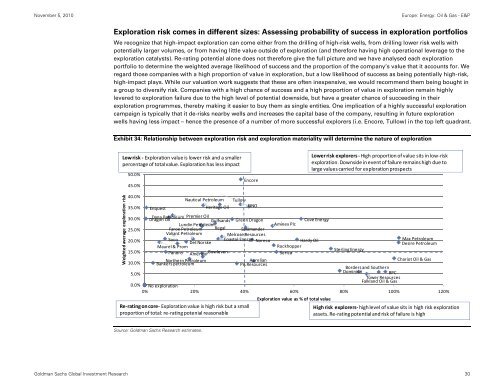

Exploration risk comes in different sizes: Assessing probability of success in exploration portfolios<br />

We recognize that high-impact exploration can come either from the drilling of high-risk wells, from drilling lower risk wells with<br />

potentially larger volumes, or from having little value outside of exploration (and therefore having high operational leverage to the<br />

exploration catalysts). Re-rating potential alone does not therefore give the full picture and we have analysed each exploration<br />

portfolio to determine the weighted average likelihood of success and the proportion of the company’s value that it accounts for. We<br />

regard those companies with a high proportion of value in exploration, but a low likelihood of success as being potentially high-risk,<br />

high-impact plays. While our valuation work suggests that these are often inexpensive, we would recommend them being bought in<br />

a group to diversify risk. Companies with a high chance of success and a high proportion of value in exploration remain highly<br />

levered to exploration failure due to the high level of potential downside, but have a greater chance of succeeding in their<br />

exploration programmes, thereby making it easier to buy them as single entities. One implication of a highly successful exploration<br />

campaign is typically that it de-risks nearby wells and increases the capital base of the company, resulting in future exploration<br />

wells having less impact – hence the presence of a number of more successful explorers (i.e. Encore, Tullow) in the top left quadrant.<br />

Exhibit 34: Relationship between exploration risk and exploration materiality will determine the nature of exploration<br />

Low risk ‐ Exploration value is lower risk and a smaller<br />

percentage of total value. Exploration has less impact<br />

Weighted average exploration risk<br />

50.0%<br />

45.0%<br />

40.0%<br />

35.0%<br />

Enquest<br />

30.0%<br />

25.0%<br />

20.0%<br />

15.0%<br />

Dana <strong>Petroleum</strong> Premier <strong>Oil</strong><br />

Dragon <strong>Oil</strong><br />

Gulfsands Green Dragon<br />

Lundin <strong>Petroleum</strong><br />

Faroe <strong>Petroleum</strong> Regal Salamander<br />

Valiant <strong>Petroleum</strong><br />

Melrose Resources<br />

Soco<br />

Coastal <strong>Energy</strong><br />

Det Norske<br />

Noreco<br />

Maurel & Prom<br />

Panoro Amerisur<br />

Bowleven<br />

Cove <strong>Energy</strong><br />

Aminex <strong>Plc</strong><br />

Hardy <strong>Oil</strong><br />

Rockhopper<br />

Serica<br />

Sterling <strong>Energy</strong><br />

Max <strong>Petroleum</strong><br />

Desire <strong>Petroleum</strong><br />

10.0%<br />

5.0%<br />

0.0%<br />

Northern <strong>Petroleum</strong><br />

Bankers petroleum<br />

No exploration<br />

Aurelian<br />

PA Resources<br />

Chariot <strong>Oil</strong> & <strong>Gas</strong><br />

Borders and Southern<br />

Dominion<br />

BPC<br />

Tower Resources<br />

Falkland <strong>Oil</strong> & <strong>Gas</strong><br />

0% 20% 40% 60% 80% 100% 120%<br />

Re‐rating on core‐ Exploration value is high risk but a small<br />

proportion of total: re‐rating potenial reasonable<br />

Source: Goldman Sachs Research estimates.<br />

Encore<br />

Nautical <strong>Petroleum</strong> Tullow<br />

Heritage <strong>Oil</strong> DNO<br />

Exploration value as % of total value<br />

Lowerrisk explorers ‐ High proportion of value sits in low‐risk<br />

exploration. Downside in event of failure remains high due to<br />

large values carried for exploration prospects<br />

High risk explorers‐ high level of value sits in high risk exploration<br />

assets. Re‐rating potential and risk of failure is high<br />

Goldman Sachs Global Investment Research 30