Formats

Formats

Formats

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

- 0 -

TRAINING MANNUAL – PRIASoft 2010<br />

TABLE OF CONTENTS<br />

Chapter Topic Page No.<br />

Chapter – I Introduction 1<br />

Chapter – II<br />

Chapter – III<br />

Chapter – IV<br />

Chapter – V<br />

Chapter – VI<br />

Annexure<br />

Panchayati Raj<br />

Institutions in India<br />

Introduction to system<br />

and types of Accounting<br />

Overview of PRI<br />

Accounts manual<br />

Understanding of<br />

financial formats<br />

prescribed by C & AG<br />

Step by Step entry of<br />

vouchers in PRIASoft<br />

8 – Model Accounting<br />

<strong>Formats</strong><br />

8 – Database <strong>Formats</strong><br />

- 1 -<br />

2-4<br />

5-6<br />

7-15<br />

16-26<br />

27-61<br />

63-91<br />

Definition 92-96

Chapter – 1<br />

Introduction<br />

1.1 Based on the recommendation of the Eleventh Finance Commission, for<br />

exercising proper control and securing better accountability, the formats<br />

for the preparation of budget and accounts and database on PRIs were<br />

prescribed by C&AG in 2002. These formats were further simplified in<br />

2007 for easy adoption at grass root level. The technical committee on<br />

budget and Accounting Standards for PRIs approved the simplified<br />

formats of accounts for PRIs basing on suggestion of sub committee for<br />

simple but robust accounting system on 29 th January 2009. As per<br />

decision of Ministry of Panchayati Raj, C & AG and NIC have worked<br />

together to bring out the new version of PRIASoft (Panchayati Raj<br />

Institution Accounting Software) that captures the suggested chart of<br />

accounts (Coding) and generates all reports in the formats prescribed by<br />

subcommittee on budget and accounting standard for PRIs.<br />

1.2 Basing upon the model national municipal accounts manual, Panchayati<br />

Raj Department Government of Orissa have decided to prepare a<br />

Training manual for PRI on model accounting system using PRIASoft.<br />

1.3 Since the development of model training manual and development of the<br />

accounting software are to be based on the model accounting manual, it<br />

has been decided to proceed with the development of Training manual<br />

for PRI on model accounting system using PRIASoft.<br />

1.4 Training manual for PRI on model accounting system using PRIASoft l<br />

contains introduction to system and types of accounting understanding of<br />

financial formats prescribed by C&AG along with entry of vouchers in<br />

PRIASoft required forms, formats, procedures for accounting entries,<br />

periodical statements, and reconciliation procedures.<br />

1.5 This training manual targets at elected PRI representatives, Functionaries<br />

associated with PR accounting system.<br />

- 2 -

Chapter – 2<br />

Panchayati Raj Institutions in<br />

Orissa<br />

2.1 Orissa Grama Panchayat Act was enacted in the year 1948.<br />

Subsequently in the year 1961, 3 tier system of Panchayati Raj<br />

Institutions was introduced in Orissa. Over the last 50 years Panchayati<br />

Raj Institutions have emerged as the powerful institutions in bringing<br />

about rapid and sustainable development and socio-economic<br />

transformation in rural Orissa. It has an integrated prospective towards<br />

improving the quality of lives of rural people and ensuring equity and<br />

effective peoples’ participation. 73rd amendment of the Constitution has<br />

conferred constitutional status to Panchayati Raj Institutions.<br />

2.2 The Provisions of Panchayats (Extension to Scheduled Areas)Act<br />

aims at empowering Panchayati Raj Institutions in Scheduled areas for<br />

economic development and social justice. In the year 2002, election to 3<br />

tier of Panchayati Raj Institutions held in conformity with 73rd<br />

amendment and PESA thereby empowering tribal people as envisaged<br />

under the PESA. The Government have the obligation to bring up<br />

Panchayati Raj Institutions as Institutions of Self -Government as per<br />

73rd amendment of the Constitution of India 1992. 73rd Amendment<br />

marks a new era in the federal set up of the country and provides<br />

constitutional status to the PRIs.<br />

2.3 The prime objectives of the three tiers Panchayati Raj System are to<br />

eradicate poverty, uplift standard of living of people in the rural areas,<br />

and bring about a healthy society by creating awareness for hygiene,<br />

sanitation and eradication of illiteracy. The state has established a State<br />

- 3 -

Election Commissioner to conduct the election of PRIs. The 73rd<br />

amendment of the Constitution mandates Government to endow the<br />

Panchayati Raj Institutions with such powers and authority as may be<br />

necessary to enable them to function as institutions of self-Government.<br />

It also provides that powers and responsibility shall be devolved upon<br />

PRIs subject to such conditions as may be specified therein, with respect<br />

to the preparation of plans for economic development and social justice<br />

and implementation of schemes for economic development and social<br />

justice as may be entrusted to them including those listed in the 11th<br />

Schedule.<br />

Eleventh Schedule lists 29 Subjects to Panchayats<br />

Agriculture, incl.<br />

extension<br />

Fisheries<br />

Land improvement,<br />

land reforms, consolidation<br />

soil conservation.<br />

Welfare of the weaker sections,<br />

in particular of SCs and STs<br />

Markets<br />

Fairs<br />

Social forestry<br />

farm forestry<br />

Rural housing Drinking water<br />

Education,<br />

including primary<br />

and secondary schools<br />

Health and sanitation<br />

hospitals. Primary health centres<br />

dispensaries<br />

Technical training<br />

vocational education<br />

Khadi, village and<br />

cottage industries<br />

Minor forest<br />

produce<br />

Family welfare<br />

Minor irrigation,<br />

water management<br />

watershed development<br />

- 4 -<br />

Fuel and fodder<br />

Poverty<br />

alleviation programme<br />

Adult and non-formal<br />

education<br />

Social Welfare,<br />

Welfare of handicapped and<br />

mentally retarded<br />

Roads, culverts,bridges,<br />

ferries, waterways<br />

other means of communication<br />

Small scale industries,<br />

food processing industries<br />

Animal husbandry,<br />

dairying and poultry<br />

Maintenance of<br />

community assets<br />

Public distribution<br />

system<br />

Libraries<br />

Cultural<br />

activities<br />

Women and<br />

Child development<br />

Nonconventional<br />

energy<br />

Rural electrification,<br />

distribution of<br />

electricity<br />

2.4 Way forward : Consequent upon growth of Local Government,<br />

devolution of functions including financial functions the strengthening<br />

and capacity building of PRIs members and local government staffs is<br />

badly needed. As one of the steps in that direction, this manual shall<br />

give an over view of Panchayat Accounting and Training Manual and<br />

understanding of financial statements.

2.5 Current System of Accounting : Traditional System of<br />

managing PRI Accounts<br />

Under the present traditional Accounting System for Panchayati Raj<br />

Institutions, though there were accounting rules for all the 3 tire<br />

Panchayati Raj Institutions, but there was no standardised procedure for<br />

maintaining & analysing the accounts and auditing the same.<br />

Moreover, only handwritten manual registers were being<br />

maintained at all the levels of Panchayati Raj Institutions for<br />

maintenance of their daily financial transactions.<br />

The manual Cash Books which were maintained at various levels<br />

were subject to manipulation at a later stage. It could be inferred that<br />

there was lack of transparency in maintaining the accounts in the<br />

traditional system. As it was not possible to physical audit each account<br />

of Gram Panchayat due to shortage of man power, the chance of<br />

manipulation of accounts at the Gram Panchayat level was even more.<br />

These shortcomings in the traditional accounting system gave the<br />

impetus to use Information Technology as a tool to maintain the<br />

accounts of the PRIs in a transparent manner. The main objective of<br />

maintaining the accounts using Information Technology to keep each<br />

transaction of the Panchayati Raj Institutions in public domain and also<br />

to facilitate the post-auditing in a simplified manner.<br />

- 5 -

Chapter – 3<br />

Introduction to system and<br />

types of Accounting<br />

3.1 Accounting is the practice or profession of maintaining financial<br />

records, noting expenses or revenues and determining how much one<br />

owes or it owned. A good Accounting system can put light on how the<br />

resources are being used properly.<br />

3.2 This chapter gives a bird’s eye views of the types of Accounting<br />

system, the current accounting system at PRIs.<br />

3.3 Types of Accounting System: There are several types of<br />

Accounting each of which reports revenue and earning differently from<br />

other methods. Two major accounting methods are accrual accounting<br />

and cash accounting. Cash accounting recognizes revenue and expenses<br />

in the order in which they are received or spent.<br />

3.4 The accounting systems can also be classified basing on the way<br />

transactions are recorded in the books of accounts either single entry or<br />

double entry accounting.<br />

3.5 What is Cash basis of Accounting: Cash basis system of<br />

accounting where the transactions are accounted based on actual cash<br />

receipts and cash payments.<br />

3.6 Salient features of Cash basis Accounting:<br />

• It is very simple.<br />

• When payment is received in shape of interest, sale of goods<br />

repayment of loan, revenue is recorded as the date of receipt of<br />

funds.<br />

- 6 -

• When payment is made transaction is recorded as expenditure<br />

3.7 Book Keeping :<br />

3.7.1 The process of recording the books of account i.e. cash, credit and<br />

other transaction is known as book keeping.<br />

3.7.2 Every time a cheque is written the book keeper records it with the<br />

date.<br />

3.7.3 Every time something is received it is recorded with date.<br />

3.7.4 Present model accounting prescribed by C & A. G for PRIs which is<br />

being adopted by Panchayati Raj Department, Government of Orissa is<br />

based on cash basis single entry accounting book keeping system.<br />

3.7.5 There is a trend to switch towards accrual based double entry book<br />

keeping system of accounting in present model accounting system.<br />

- 7 -

Chapter – 4<br />

Overview of PRI Accounts<br />

Manual<br />

4.1 Introduction: In terms of the Eleventh Finance Commission<br />

recommendation the formats prescribed by C & AG in 2002 were further<br />

simplified in 2007. A technical committee was formed. Technical<br />

Committee on budget and Accounting considered the need for developing<br />

simple and robust formats an account. A subcommittee was formed to<br />

research further on the same goal. The mandate of technical committee<br />

to the sub-committee inter alia include prescribing simple but robust<br />

accounting system for PRIs.<br />

4.2 Training manual for PRI on model accounting system using PRIASoft<br />

comprehensively details the accounting principles, procedures, guideline<br />

details of financial forms & formats.<br />

4.3 Salient Features of simplified format of Accounts<br />

� Facilitate better financial management of PRIs<br />

� Cash system of accounting<br />

� Captures 3 – tier head of account classification system<br />

� Accounts have to be kept in two parts.<br />

Part – I – Transactions of all receipts and expenditure<br />

Section – I : Receipt Head (Revenue Account) 0028-1601<br />

Expenditure Head (Revenue Account) 2049-3999<br />

- 8 -

Receipts Payments<br />

Revenue Receipts (0-1) Revenue Expenditure (2-3)<br />

- Tax Receipts<br />

*-0028-Taxes on Profession, Land<br />

revenue, etc<br />

- Non-Tax Receipt<br />

* 0049-Interest eared, etc<br />

- 2049 Interest payment<br />

- 2059 Maintenance of Community<br />

Assets, etc<br />

Section – II : Receipt Head (Capital Account) : 4000<br />

Expenditure Head (Capital Account) : 4202-5054<br />

Capital Receipts Capital Expenditure<br />

4000-Capital Receipts Capital Expenditure (4-5)<br />

4202-Capital outlay for education<br />

Other Receipts (800) 4216-Capital outlay on Rural Housing<br />

4515-Capital outlay on Panchayati Raj<br />

Programmes.<br />

Part – II – to record transactions relating to provident funds,<br />

loans, deposits and advances etc, with close to balances.<br />

Section – III Civil Deposits, Loan & Advance etc 7610-8658<br />

Part-II<br />

Receipts Payments<br />

-Loan Section<br />

-7610-Loans to Panchayat<br />

Employees<br />

- Pension & Provident fund<br />

- 8009 –Provident Fund<br />

- 8011- Insurance & Pension<br />

-Civil Deposits & Advances<br />

- 8443 – Civil Deposits<br />

- 8550 – Civil Advance<br />

- Suspenses Accounts<br />

- 8658 – Suspense Account<br />

- 9 -<br />

-Loan Section<br />

-7610-Loans to Panchayat<br />

Employees<br />

- Pension & Provident fund<br />

- 8009 –Provident Fund<br />

- 8011- Insurance & Pension<br />

-Civil Deposits & Advances<br />

- 8443 – Civil Deposits<br />

- 8550 – Civil Advance<br />

- Suspense Accounts<br />

- 8658 – Suspense Account<br />

4.4 Coding Structure of Chart of Accounts: The first four digit<br />

classification in the simplified system of accounting represents the major<br />

head.

4.5 Major head represent the function with exception in few cases.<br />

The allotment of code to each Major Head is as follows.<br />

0000 to 1999 – Head of Account represent Revenue receipt.<br />

2000 to 3999 – Revenue Expenditure<br />

4000 – Capital Receipt<br />

4000 to 5999 – Capital Expenditure<br />

6000 to 7999 – Loans & Advances field<br />

8000 - 8999 – Contingency fund and public fund which<br />

includes Pension and Provident fund, Deposits & Advance and<br />

Suspense Accounts.<br />

4.6 All the 29 functions listed in the eleventh schedule of the<br />

constitution are classified under 23 major heads.<br />

4.7 Exception in few cases<br />

2851 – Village and small scale industries<br />

2406 – Forestry<br />

2403 – Animal Husbandry, diary, poultry, fuel & fodder.<br />

2210– Health and Family welfare<br />

2205 – Art culture and libraries<br />

2202 – Education<br />

4.8 Apart from this following Major Heads have been opened to<br />

facilitate the PRIs to account their activities.<br />

2049 – Interest Payment<br />

2071 – Pension and other retirement benefits<br />

2515 – Panchayati Raj Programme<br />

4.9 For other transactions (Part – II) Panchayats may open following<br />

major heads<br />

7610 – Loans to Panchayat Employees<br />

8550 – Civil Advance<br />

8009 – Provident Fund<br />

8011 – Insurance and Pension Fund<br />

8443 – Civil Deposit<br />

- 10 -

4.10 Minor head: The 2 nd three digit classification is the minor head<br />

represent the programme /Unit of Expenditure within the functional<br />

major head. Few Major Heads of expenditure like 2851, 2406, 2403,<br />

2210, 2205 and 2202; the minor head represent the function due to<br />

clubbing of various functions as illustrated in the eleventh schedule.<br />

Clubbing of Schemes<br />

New Major Head / Schemes Old Major Head / Schemes<br />

2851 – Village and Small -Small Scale Industries including food<br />

Scale Industries<br />

processing units.<br />

-Khadi, Village and Cottage Industries<br />

2406-Forestry - Social Forestry and Farm forestry<br />

2403- Animal Husbandry,<br />

Dairy, Poultry and Fuel &<br />

Fodder<br />

2210- Health and Family<br />

Welfare<br />

- Minor Forest Produce<br />

- Animal Husbandry, Dairy & Poultry<br />

- Fuel & Fodder<br />

-Health and Sanitation including<br />

Hospitals, Primary Health Centre and<br />

Dispensaries. (Sanitation is taken under<br />

2215- under Water Supply and<br />

Sanitation)<br />

- Family Welfare<br />

2205- Art, Culture and - Library<br />

Library<br />

- Cultural Activities<br />

2202 – Education - Education including Primary and<br />

Secondary Schools.<br />

- Adult and non-Formal Education<br />

For all schemes, 2-digit sub-head for central and 2 digit<br />

alphanumeric for state schemes are incorporated after the minor head to<br />

identify the schemes under both receipt and payment constituting 4 tiers<br />

Account head as follow.<br />

Receipts Payments<br />

1601- Grants in aid 2501-Povert Alleviation Programme<br />

101-Grants from GOI 101-Central Schemes<br />

11- NREGA 11-NREGA<br />

700-Normal Plan<br />

796-Tribal Sub-plan(TSP)<br />

789-Schedule caste<br />

Sub-Plan (SCSP)<br />

- 11 -<br />

02-Wages (object head)

Whenever required the minor head 800-Other Receipt under<br />

Receipt Head and 800-Other Expenditure under Expenditure may be<br />

linked to the corresponding Major Head.<br />

The Minor head 901- Share of net proceeds assigned under in each<br />

Major head under Tax Receipts for recording the share of Panchayats<br />

received from Central and State Government.<br />

4.11 Third two digit classifications are the sub–head which<br />

represents the scheme.<br />

As mentioned in the PRIASoft, there are three types of Schemes<br />

representing as Central Scheme, State Specific Scheme and Own Fund of<br />

the PRI which are mapped as sub-head in Model Accounting System.<br />

Central Schemes have the two digit numeric code which is taken care off<br />

by Central user. States specific Schemes are assigned with two digit<br />

alphanumeric codes which are to be uploaded in the software at the<br />

State user login and PRIs have to map the schemes as per their<br />

requirements. Standard Sub-heads for Central and State Schemes are as<br />

follows.<br />

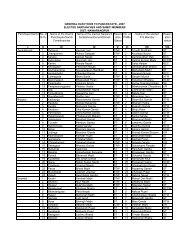

Standardised Sub-Heads for Some Central Schemes<br />

Scheme<br />

Code<br />

(Sub Head)<br />

Scheme Description<br />

11 Mahatma Gandhi National Rural Employment Guarantee<br />

Scheme (MGNREGS)<br />

12 Sampoorna Gramin Rozgar Yojana (SGRY)<br />

13 Swaranjayanti Gram Swarozgar Yojana(SGSY)<br />

14 Indira Awas Yojana (IAY)<br />

15 National Rural Health (NRHM)<br />

16 Accelerated Rural Water Supply Programme (ARWSP)<br />

17 Total Sanitation Campaign<br />

18 Mid Day Meal Scheme<br />

19 Sarva Shiksha Abhiyan<br />

20 Pradhan Mantri Gram Sadak Yojana (PMGSY)<br />

21 Integrated Watershed Management Programme<br />

22 Integrated Child Development Services (ICDS)<br />

- 12 -

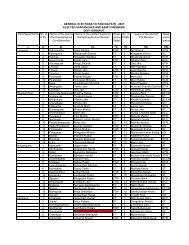

Standard Sub-Heads for State Schemes<br />

• BIJU GAJAPATI YOJANA (BGY )-BGY<br />

• BIJU GRAM JYOTI YOJANA-BGJY<br />

• BIJU KANDHAMAL YOJANA-BKY<br />

• BIJU KB K Y OJA NA- BKB K<br />

• Cement Concrete Road-CCR<br />

• CHIEF MINISTER RELIEF FUND-CMRF<br />

• DPAP WATERSHED-DW<br />

• GGY- GGY<br />

• Infrastruc ture Developm ent<br />

• IW D P W ATERSH ED (IW M P, IWD P -<br />

I,II,III)-IWDP<br />

• MADHUBABU PENSION YOJANA-MBPY<br />

• MINOR IRRIGATION PROJECT FOR<br />

PANCHAYAT SAMITI-MIP<br />

• ML AL AD-M L ALA D<br />

• Infrastruc ture Deveopment<br />

• MO KUDIA -MO KUDIA<br />

• Housi ng<br />

• OREDA GRANT-OREDAG<br />

• PUBLIC DISTRIBUTION SYSTEM-P DS<br />

• REPAIR OF BLOCK OFFICE BUILDING-<br />

BLDG<br />

STATE SC HEMES - O RISSA<br />

•RURAL ROAD (PANCHAYAT SAMITI, GRAM<br />

PANCHAYAT)-RR<br />

•SHG TRAINING (DWCRA,MVSN)-SHGT<br />

•SPECIAL PROBLEM - PLA N FUND-SPPF<br />

•STAFF SALAR Y AND OFFICE CONTIGENCY-<br />

SSAOC<br />

•ST AND SC DEVELOPMENT GRANT-SSDG<br />

•STATE FINANCE COMMISSION-SFC<br />

•Community Infrastructure<br />

oCESS<br />

oENTERTAINMENT TAX<br />

oKENDU L EAF GRANT (KL- GRANT)<br />

oPANCHAYAT INCENTIVES<br />

oSAIRAT<br />

•Individual Infrastructure<br />

oGRANTS-IN-AID(GIA)<br />

(HONORAR IUM,TA,DA & SITTING<br />

FEES)<br />

•TEACHER SALARY-TS<br />

•TRIPTI-TRIPTI<br />

•Capacity Building<br />

•Community Mobilization<br />

•Cr edit Linkage<br />

•UNDP GRANT-UNDPG<br />

•UNTIED FUND-UNF<br />

•WESTERN ORISSA DEVELOPMENT<br />

COUNCIL-WODC<br />

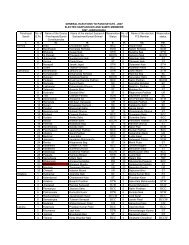

4.12 Object Head : Fourth two digit object head has been taken up to<br />

record the most commonly used item of expenditure. C & AG allowed<br />

opening object head as per requirement by the PRIs. The recommended<br />

object heads by the C & AG are as follows.<br />

- 13 -

The 01-Salary object head and 08- Other Expenses are clubbed<br />

with various items of expenditure by C Comptroller and Auditor General<br />

of India which are mentioned as follows. The PRIs may book various<br />

components of Salary in one object head i.e “01-Salaries” and<br />

similarly various contingent expenditure in one object head “08-Office<br />

Expenses “as mentioned below.<br />

Items included in Salary & OE<br />

Salaries: includes in these object head Other Expenses (2) includes in these object<br />

head<br />

(i) Pay of officers,<br />

(i) Local purchase of stationery,<br />

(ii) Dearness pay of officers,<br />

(ii) Liveries,<br />

(iii) Dearness Allowance of Officers, (iii) Telephone & trunk calls,<br />

(iv)Payof establishment,<br />

(iv) Furniture,<br />

(v) Dearness pay of establishment,<br />

(vi) Dearness Allowance of<br />

establishment,<br />

(vii) Bonus ,<br />

(v) Service postage stamps,<br />

(vi) Purchase of books & publications,<br />

(vii) Office expenses and miscellaneous ,<br />

(viii) Staff car,<br />

(ix) Water cooler,<br />

(viii) Interim relief,<br />

(x) Typewriter,<br />

(ix) Other allowances (CCA, HRA & other (xi) Purchase of accounting machine,<br />

fixed allowances),<br />

(xii) Charges paid to the State Government for<br />

(x) Children education allowances,<br />

(xi) LTC,<br />

Police Guards,<br />

(xiii) Hot and cold weather charges,<br />

(xiv) Electricity & water charges,<br />

(xii) Transport allowance.<br />

(xv) Purchase of photo copier,<br />

(xvi) Purchase of computer & laser printer.<br />

The object head is linked to only payment, but not to Receipt<br />

heads. However, some case, there are provisions for linking the receipt<br />

head to sub-plan Sectors like Normal Plan, Tribal Sub-Plan and Schedule<br />

Caste Sub-Plan (SCSP).<br />

- 14 -

4.13 Accounting Procedure<br />

1) The accounts are prepared on cash basis i.e. a transaction is only<br />

recorded when cash is received or paid.<br />

2) Period of accounts is a financial year as a period of 12 months from<br />

1 st April to 31st March ending of next year.<br />

3) Daily transactions shall be recorded in Cash Book.<br />

– The receipts are recorded on receipts side and payments on<br />

payments side.<br />

– Every day the cash book shall be closed and Closing Balance<br />

worked out would then form the Opening Balance for next day.<br />

– Classification / head of account for each transaction shall be<br />

clearly mentioned.<br />

4) Every day the details of transactions as recorded in the cash book.<br />

– Transferred to Register of Receipts if the transaction is receipts<br />

– Transferred to Register of Payments if it is payment.<br />

Daily transactions recorded will be transferred automatically either<br />

to register of receipts or to register of payments.<br />

5) At the end of the month total of receipt and payment up to object<br />

head should be shifted to monthly receipts and payment register.<br />

(Format – I)<br />

6) The monthly figure added to month’s progressive total and figures<br />

upto end of the current months can be worked out in the consolidated<br />

abstract register in (Format – II).<br />

7) Bank Reconciliation:<br />

– At the end of the month the bank and treasury reconciliation<br />

should be completed.<br />

– Differences between cash book, bank and treasury balances are<br />

to be rectified.<br />

– Corrections should be made then & there in the Register of<br />

Receipts and Register of Payments.<br />

- 15 -

– Totals in Register of Receipts and Payments can be struck which<br />

would give the total expenditure under each head of account<br />

for the month.<br />

8) Annual Receipts and Payment Account can be worked out at the<br />

end of the year.<br />

9) After closing of March Accounts, Reconciliation of Receipts and<br />

Expenditure figures with the Departments (online, where facility<br />

is available) should be carried out to detect any misclassification<br />

clear the unclassified transaction booked in the Suspense<br />

accounts and all transactions appearing as Transfer entries.<br />

The final progressive figure under each head be worked which<br />

completes the accounting process for that year.<br />

10) Receipts and Payment account is prepared on the basis of<br />

figures from the Consolidated Abstract.<br />

11) PRIs may prepare their budget of adopting the classifications<br />

prescribed in receipts and payment account and list of codes for<br />

function, programmes and activities prescribed.<br />

12) Refund of revenues/re-imbursement of expenditure of the current<br />

year is to be accounted as reduction of receipts/expenditure.<br />

13) Register of Receivable and Payable, Register of Movable and<br />

Immovable property, Register of Inventory, Register of Demand,<br />

Collection and Balance form integral part of the annual accounts.<br />

Maintenance of these register would help in subsequent switch<br />

over to the modified accrual system of accounting.<br />

- 16 -

Chapter – V<br />

Understanding of financial<br />

formats prescribed by C & AG<br />

5.1 Definition of Financial Statement<br />

Financial statements refer to income / expenditure statements and other<br />

supporting statements which are derived from accounting records.<br />

Financial statements give clear financial status of the organization.<br />

5.2 Apart from existing financial statements financial statements also<br />

include registers / statements to be generated basing on<br />

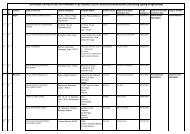

• Eight model accounting formats which are simple,<br />

comprehensive and robust<br />

• Eight formats on database finance of PRIs.<br />

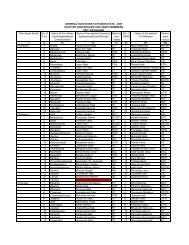

5.3 Eight Model Accounting <strong>Formats</strong><br />

Eight model accounting format as suggested by C & AG with<br />

reference to the Panchayat Rule includes<br />

Format – I Monthly / Annual receipts and payment<br />

accounts (Annexure – 5.1)<br />

Rule 100, 108, 133 (1), 133 (3), 138, 206 (e),<br />

206 (j), 234, 236 (b)<br />

Format – II Consolidated Abstract register<br />

(Annexure – 5.2)<br />

Rule 100 (2), 120, 234, 236 (b)<br />

Format - III Reconciliation Statement (Annexure – 5.3)<br />

Rule – 119 (2), 134 (9), 234, 236 (b)<br />

Format - IV Statement of Receivable and Payable<br />

(Annexure – 5.4)<br />

Rule – 43(1) , 100 (3), 138, 234, 236 (b)<br />

- 17 -

Format - V Register of immovable property<br />

(Annexure – 5.5)<br />

Rule – 55, 66 (3), 71, 234, 236 (b)<br />

(a) Road (b) Land (c) Others<br />

Format – VI Register of movable property<br />

(Annexure – 5.6)<br />

Rule – 55, 66 (3), 71, 143, 234, 236 (b)<br />

Format – VII Inventory Register (Annexure – 5.7)<br />

Rule – 32 (6), 143, 234, 236 (b)<br />

Format – VIII Demand Collection & Balance Register<br />

(Annexure – 5.8)<br />

Rule – 118 (1), 206 (f), 234, 236 (b)<br />

5.4 Format – I Monthly / Annual receipts and payment accounts<br />

� This register disclose the monthly receipt and expenditure of<br />

PRIs.<br />

� Since the financial statements are now prepared on cash basis<br />

the receipt and expenditure statement shall include all the<br />

receipt earned during the year and expenditure actually<br />

incurred.<br />

� Opening Balance should be recorded as per cash in hand, bank<br />

and treasury investments.<br />

� Daily transaction recorded in the cash book shall be<br />

transferred to register of receipt and register of payment.<br />

From the register of receipt and register of payment the total<br />

receipts and payments are to be posted to monthly receipt<br />

and payment account.<br />

� Budget estimates for receipt head is the receipt to be collected<br />

/ received by PRIs.<br />

� Amount actual is the actual receipt collected / expenditure<br />

incurred.<br />

� Budget estimates for the expenditure column is the amount<br />

estimated by the PRIs to incur expenditure under appropriate<br />

head during the financial year.<br />

- 18 -

� For PRIs accounts to be maintained in two parts.<br />

Note<br />

o Part I – To record all receipts and expenditure relating<br />

to Panchayat fund.<br />

o Part II - To record all receipts and expenditure relating<br />

A) Receipts<br />

to Provident fund loans deposits and advances etc.<br />

Following receipt entries shall be made in receipt side<br />

• Tax receipts<br />

• Non Tax receipts<br />

• Grants-in-aid<br />

• Capital receipts<br />

• Tax receipts<br />

Income of Panchayats from collection of different tax<br />

like<br />

� Registration fees<br />

� Street lightening<br />

� Drainage tax<br />

� License etc.<br />

are to be added in receipt side.<br />

This has been reflected in receipt major heads from<br />

0028 to 0045.<br />

• Non Tax receipts<br />

Income from non tax receipts includes<br />

� Interest from bank receipts<br />

� Market and fair<br />

� Cattle pond<br />

� Orchard<br />

� Pisciculture<br />

� Compost<br />

� Ferry ghats<br />

� Slaughter house and Cart stand<br />

� Rent received<br />

- 19 -

� Grain golas / Co-operative societies<br />

are to be added in receipt side.<br />

This has been reflected in receipt major heads from<br />

0049 to 0851<br />

• Grants-in-aid receipts<br />

Grants from Central Government Schemes, State<br />

Government Schemes and other institutions are to be added<br />

under grant –in –aid receipt head i.e. 1601.<br />

• Capital Account receipts<br />

Capital receipt includes income generated out of selling<br />

assets that have long term value. Capital receipt also<br />

includes market loan and external loans. Capital receipts is to<br />

be added under capital account receipt head i.e. 4000.<br />

B) Expenditure<br />

Payment register shall be maintained basing on payment /<br />

expenditure incurred under<br />

� Revenue Expenditure<br />

� Capital Expenditure<br />

� Revenue Expenditure<br />

Revenue Expenditure is an expenditure other than capital<br />

in nature being matched against the revenue.<br />

� Capital Expenditure<br />

Capital Expenditure is the expenditure incurred by the PRIs<br />

towards creation of capital assets out of the funds earmarked<br />

for it.<br />

5.5 Format – II Consolidated Abstract register<br />

♦ The consolidated abstract registers for receipt or payment are<br />

the registers derived from monthly receipt and payment<br />

accounts. At the end of each month the total receipt and<br />

payment is to be posted to monthly receipt and payment<br />

account. The monthly figure is to be added to progressive total<br />

and figures up to the end of the current month can be worked<br />

out in the consolidated abstract register.<br />

- 20 -

♦ Budget provision is the figure chalked out by PRIs during<br />

preparation of their own budget.<br />

5.6 Format – III Reconciliation Statement with Bank / Treasury<br />

♦ At the end of each month Panchayat Institutions may reconcile<br />

their figure with bank or treasury, if any discrepancy is found<br />

in between the cash in cash book and cash with bank /<br />

treasury.<br />

5.7 Format – IV Receivable and Payable register<br />

♦ This register is to be filled as per statements prescribed in<br />

format four.<br />

♦ Information to be recorded are<br />

o Amount receivable is any amount to be received in<br />

future towards collection of revenue.<br />

o Amount payable is the amount due to be paid in future<br />

towards any expenditure.<br />

o Filling up this format is a step towards maintaining<br />

accounts on accrual basis.<br />

5.8 Format – V Register of immovable property<br />

♦ This registers give a clear picture on maintenance of records<br />

regarding immovable properties like<br />

a) Roads<br />

b) Lands<br />

c) Others.<br />

a) Roads<br />

Information to be recorded<br />

• Name of the Road / Location<br />

• Starting to ending point<br />

• Total length in Km.<br />

• Average width<br />

• Date of construction<br />

• Date of repair<br />

• Total cost<br />

• Average cost of construction<br />

- 21 -

) Lands<br />

Information to be recorded<br />

c) Others<br />

• Date of transfer / purchase or acquisition<br />

• From whom transferred / purchase or acquired<br />

• Purpose of transfer / purchase or acquisition<br />

• Reference to agreement<br />

• Area of the land<br />

• Survey no with boundaries<br />

• Assessment or valuation (value of the property)<br />

• Whether boundaries sketch of the land is available<br />

• Building, if acquired with the land<br />

o Brief details of structure<br />

o Plinth area<br />

• Utilization of the land / building<br />

• Amount paid (Rs.)<br />

• No. date and voucher remarks<br />

• This format is used to keep record of immovable<br />

property other than roads and land<br />

• Date of acquisition, purchase, construction or<br />

received or transfer<br />

• No. and date of orders under which the property<br />

was acquired, purchased, constructed / transferred<br />

• Description and location of Assets<br />

• Purpose for which acquired<br />

• Valuation at the beginning of the year<br />

• Revaluation if any, the date and actual amount of<br />

revaluation (as per Rules)<br />

• Depreciation / Appreciation as per rules<br />

• Valuation of at the end of the year<br />

• If disposed date of disposal<br />

• Reasons for disposal with authority<br />

• Amount realized on disposal (in Rupees)<br />

- 22 -

• Initials of competent authority<br />

• Remarks<br />

5.9 Format – VI Register of movable property<br />

♦ Register of movable property is maintained as per format six.<br />

♦ This highlights on<br />

� Date of acquisition, purchase, receipt and transfer of<br />

movable property.<br />

� No. and date of orders under which the property was<br />

acquired, purchased, constructed / transferred<br />

� Description and situation of property<br />

� Whether the property is used for any purpose<br />

� Valuation at the beginning of the year<br />

� Revaluation if any, the date and actual amount of revaluation<br />

(as per Rules)<br />

� Depreciation as per rules<br />

� Valuation of at the end of the year<br />

� Whether disposed<br />

� Reasons / authority for disposal<br />

� Amount realized on disposal<br />

� Initial of competent authority<br />

� Remarks<br />

5.10 Format – VII Inventory Register<br />

♦ This register is maintained to record the issue of stock and store<br />

items<br />

♦ The format is used to keep record on<br />

� Opening balance of stock (Quantity and Value)<br />

� Voucher No. and date<br />

� From whom received<br />

� Receipts (Quantity and Value)<br />

� Total (Quantity and Value)<br />

� To whom issued and for which purpose<br />

� Issued or sold (Date, Quantity and Value)<br />

� Closing Balance (Quantity and Value)<br />

- 23 -

� Signature of the Issuing Officer<br />

� Signature of the Receiving Officer<br />

5.11 Format – VIII Demand collection & Balance Register<br />

♦ This register is maintained to assess the tax to be collected and<br />

tax collected against the due<br />

♦ Following information are to be recorded in demand collection<br />

and balance register<br />

� Name of the person from whom tax is to be collected<br />

� Reference serial no. in register of assesses<br />

� Demand for the current finance year<br />

� Arrear demand of previous years<br />

� Permission / Details of amount write off if any<br />

� Total tax amount due<br />

� Total amount collected<br />

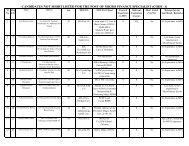

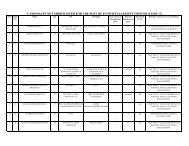

Database on Finances of PRIs / ULBs<br />

5.12 Format – 1 (Annexure – 5.9)<br />

♦ Opening Balance of this formats shall include closing balance of<br />

funds available under C.F.C / S.F.C and own sources<br />

♦ Budget allocation is the fund position to be received by PRIs<br />

earmarked for them<br />

♦ Amount received is the actual funds received<br />

♦ Target from own source (tax and non – tax)<br />

♦ Actual received from own source<br />

♦ Target for financial utilization for the current year<br />

♦ Actual financial utilization against the target and percentage of<br />

utilization<br />

♦ Details of the balance fund available i.e. fund parked at bank /<br />

PL account<br />

5.13 Format – 2 (Annexure – 5.10)<br />

♦ This format highlights on target income from own source i.e.<br />

tax revenue and non tax revenue and collection against the<br />

target.<br />

- 24 -

♦ Tax to be collected from Panchayat tax / property tax (target)<br />

and collection against the target, percentage of collection<br />

♦ Tax to be collected from Irrigation tax from Tube wells / water<br />

tax (target) and collection against the target, percentage of<br />

collection<br />

♦ Tax to be collected from Income from Hats/ Bazars/ Fish<br />

Ponds/ Cattle / Fairs/ Markets/ Slaughter houses (target) and<br />

collection against the target, percentage of collection<br />

5.14 Format – 3 (Annexure – 5.11)<br />

♦ This format highlights the total revenue / income of a PRI and<br />

expenditure incurred against this.<br />

♦ Income shall include own tax revenue, own non tax revenue,<br />

other revenue (bank interest) State Government grant, Central<br />

Government grant.<br />

♦ Expenditure shall be bifurcated<br />

• Expenditure on core services (Drinking water<br />

supply, Rural Sanitation, Street Lightening, Primary<br />

Education, Primary Health care Hospitals, Housing,<br />

Public Transportation and Rural Roads).<br />

• Expenditure on non core service (Administrative<br />

expenses)<br />

5.15 Format – 4 (Annexure – 5.12)<br />

♦ This format highlights on financial progress of all the schemes<br />

♦ This format gives clear picture on receipts from Center’s share<br />

and State’s share of the schemes and expenditure against the<br />

receipts.<br />

♦ Name of the scheme is to be mentioned<br />

♦ Opening Balance carried forward from closing balance of<br />

previous financial year is to be recorded<br />

♦ Receipts from Center’s share and State’s share is to be<br />

recorded<br />

♦ Target of utilization and funds actually utilized along with the<br />

percentage is to be recorded<br />

- 25 -

♦ Closing balance after the expenditure is to be reflected<br />

5.16 Format – 5 (Annexure – 5.13)<br />

♦ This gives the clear picture of expenditure profile of PRIs<br />

♦ Information to be recorded are<br />

o Expenditure on Salaries & Other Admin. Expenses<br />

o Terminal Benefits to Employees (Retirement, GIS<br />

settlements, death claims etc.)<br />

o Expenditure on Obligatory/ Core Function<br />

o Other Function<br />

o Maintenance of Assets<br />

♦ Total Expenditure is to be bifurcated as follows<br />

o Expenditure on Centrally Sponsored Schemes<br />

o Expenditure on State sponsored Schemes<br />

5.17 Format – 6 (Annexure – 5.14)<br />

♦ This format gives a picture on physical progress of funds<br />

allocated by Central Finance Commission and Sate Finance<br />

Commission<br />

♦ Information to be recorded are<br />

• Name of the scheme (CFC / SFC)<br />

• Name of the work taken under (CFC/SFC)<br />

• Target fixed for completion of the work<br />

• Percentage of completion<br />

• Reason for shortfall if any<br />

5.18 Format – 7 (Annexure – 5.15)<br />

♦ This format gives a picture on physical progress of<br />

programmes / schemes<br />

♦ Information to be recorded are<br />

� Annual target of work to be taken under different<br />

schemes or programmes<br />

� Completion status<br />

� Percentage of completion<br />

� Balance of work if any<br />

- 26 -

� Reason for shortfall if any<br />

5.19 Format – 8 (Annexure – 5.16)<br />

♦ This format gives a picture on Share of Revenue Transfers to<br />

PRIs / ULBs in State Revenue Expenditure<br />

♦ Information to be recorded<br />

o Revenue Exp. Of State Government, Actual incurred for<br />

previous year<br />

o Devolutions on PRIs<br />

o Percentage of Expenditure of PRIs in comparison to<br />

Expenditure of State Government<br />

o Revenue expenditure to be incurred as per budget<br />

estimate of the current year by the State Government.<br />

o Devolution on PRIs<br />

o Percentage of Expenditure of PRIs in comparison to<br />

Expenditure of State Government<br />

o Revenue expenditure to be incurred as per revised<br />

estimate of current year<br />

o Devolution on PRIs<br />

o Percentage of Expenditure of PRIs in comparison to<br />

Expenditure of State Government<br />

o Actual expenditure incurred by State Government<br />

o Devolution on PRIs<br />

o Percentage of Expenditure of PRIs in comparison to<br />

Expenditure of State Government for the current year<br />

- 27 -

Chapter – VI<br />

Step by Step entry of vouchers<br />

in PRIASoft<br />

6.1 With increase in fund-flow to the PRIs, it became imperative to put<br />

in place a system which could address to the challenges of maintaining<br />

the daily financial transaction of all the level of PRIs in a transparent<br />

manner.<br />

To begin with, implementation of online entries on Accounts of 3-tier<br />

PRIs and to know the flow of funds under different schemes in shape of<br />

Cash, Bank, Treasury and Advance, Panchatati Raj Department had been<br />

introduced with technical support of local NIC during the year 2002-2003<br />

- 28 -

through a software “PRIASoft” to know the balance of fund available in<br />

each tier of PRI in all the schemes. Scheme-wise monthly availability of<br />

fund at each tier was placed in the public domain. The month ending<br />

analysis of fund flow gave a broad picture of the utilisation of fund under<br />

different schemes/programs during the month. As it was not possible to<br />

capture information on daily financial transaction, this application was<br />

not very much useful from the point of view of accounting and auditing<br />

purpose. However, this experiment gave us the confidence to move to<br />

the next level of automation of PRI accounts.<br />

After lot of brainstorming at the Department level, it was decided to<br />

implement one Accounting Software customised to the requirement of<br />

Panchayati Raj Institutions at the level of Zilla Parishad and Panchayat<br />

Samiti placing the strong manpower and infrastructure.<br />

In the year 2004, Xavier Institute of Management(XIMB),<br />

Bhubaneswar which is a leading Management Institute in the State and<br />

has been declared as Centre of Excellence came up with proposal to<br />

develop an application tailor-made for maintaining the accounts of Zilla<br />

Parishad and Panchayat Samiti. With constant support and feedback<br />

from the functionaries of Panchayat Raj Department, Finance<br />

Department and Auditor General of Orissa the software development<br />

team of XIM made an attempt to devise an accounting software<br />

application for generating computerised cashbook based on double-entry<br />

accounting system. The Software Application which was developed using<br />

Oracle Database (Oracle-9i) as RDBMS was given the acronym of PAMIS<br />

(Panchayat Accounting Management Information System). To begin with<br />

the application was deployed in standalone computer systems in all Zilla<br />

Parishad (Zilla Panchayat) and Panchayat Samitis (Block Panchayat) in<br />

the year 2004-05. From 1 st of July,2007, the PAMIS generated cash book<br />

was made mandatory and declared as the official cashbook of Zilla<br />

Parishad and Panchayat Samiti with executive instruction from<br />

Panchayati Raj Department, Government of Orissa which could capture<br />

each financial transaction and resulted in accurate maintenance of<br />

- 29 -

accounts at DRDA/Block level discontinuing the earlier manual cash<br />

book.<br />

The Principal Accountant General and Finance Department of the<br />

State were consulted while designing formats for maintaining the<br />

accounts using this application. The web version of PAMIS was adopted<br />

in the year 2008 under the Oracle 10g database and the month ending<br />

report of the PAMIS was uploaded in the PRIASoft having citizen<br />

interface. This was done by mapping each scheme head to the<br />

appropriate scheme filled in the PRIASoft.<br />

However, PAMIS application does not recognise the Budget Head of<br />

account under the Model Accounting System for Panchayats, prescribed<br />

by the Comptroller and Auditor General and the Ministry of Panchayati<br />

Raj. , Government of India. By this time, the reports of the 13 th Finance<br />

Commission was made available for public consumption. As mentioned<br />

in the report of the 13 th Finance Commission, the performance grant<br />

was tied up with number of conditions to be fulfilled by the State<br />

Government, one of the conditions was to put in place standardise<br />

Account System for the PRIs.<br />

Other limitations of PAMIS were that it was not extended up to Gram<br />

Panchayat level; also it is single layer application which did not give any<br />

consolidated figures on the accounts of 3-tire PRIs. To overcome these<br />

challenges, PRIASoft-2010 was adopted by the State Government which<br />

has the features to address the challenges faced by the department in<br />

maintaining financial accounts of PRIs.<br />

6.2 Stages of evolution of PRIASoft : Through various stages of<br />

evolution, Department has arrived at this stage bringing the earlier<br />

version of PRIASoft of Fund Management and PAMIS to the current<br />

Model Accounting System for PRIs in PRISoft-2010 on transaction<br />

management. But this has been taken as challenge for us for<br />

implementation in the 3-tier PRIs.<br />

a. Participation and sharing : To begin with, a consultation workshop<br />

was oraganised on 10 th December 2009, which was attended by the<br />

- 30 -

Principal Accountant General; Examiner, Local Fund Audit; Director,<br />

Treasury; and representative NIC. In this consultative workshop the<br />

following decisions are taken:<br />

• The Technical Team of NIC, New Delhi to study the accounting<br />

system adopted in PAMIS and recommend mapping with the<br />

modified version of PRISoft-2010.<br />

• A trial implementation will be taken up at the Bhubaneswar<br />

Panchayat Samiti.<br />

b. Subsequently, another consultative meeting was organised on 4 th<br />

January 2010 which was also attended by Senior Officers from the<br />

office of Accountant General, State Finance Department, Examiner<br />

Local Fund Audit. In this meeting it was unanimously resolved that<br />

Chartered Accountant Firms empanelled with C & AG India will be<br />

entrusted with the responsibility to upload vouchers in the modified<br />

PRIASoft (PRIASoft-2010) and compile the accounts of the Gram<br />

Panchayats.<br />

c. Another meeting was held, which was attended by the Representative<br />

of Finance Department, NIC, Local Fund Audit and few functionaries of<br />

Panchayati Raj Institutions. In this meeting it was decided to test<br />

check the PRIASoft application is one of the Gram Panchayats under<br />

Bhubaneswar Panchayat Samiti. Also, the following administrative<br />

arrangements were made to fast track implementation of PRIASoft in<br />

the State :<br />

• The District Panchayat Officers were declared as the Nodal<br />

Officer for maintenance and rationalization of Gram<br />

Panchayat Accounts.<br />

• All the Gram Panchayat to keep their cash book updated and<br />

authenticated by the Competent Authority within 7 days.<br />

• The Gram Panchayats Extension Officers at the Panchayat<br />

Samiti level to ensure updation and authentication of the<br />

cash book of all Gram Panchayats.<br />

- 31 -

• All Gram Panchayats to keep their fund only in one bank as<br />

per the earlier instruction of the Panchayati Raj Department<br />

preferably in the nearest service branch of State Bank of<br />

India.<br />

d. A video Conferencing was organised with the Technical Team of NIC<br />

New Delhi on . The Technical Team washeaded by Sri D.C Mishra Sr.<br />

Technical Director NIC. Principal Secretary Panchayati Raj Department<br />

along with other officers attending the video conference and<br />

suggested important suggestions to be incorporated in the software to<br />

make it user friendly.<br />

e. Few inputs were communicated to NIC Team based on the findings<br />

while piloting the PRIASoft Application in the Bhubaneswar Panchayat<br />

Samiti and one Gram Panchayat.<br />

f. Ministry of Panchayati Raj then organised a workshop on model<br />

accounting system and PRIASoft on various issues pertaining to<br />

implementation of the simplified model accounting system. Two of our<br />

officers handling the PRIASoft attended the workshop and given<br />

valuable inputs for further modification of the application.<br />

g. Technical and Accounts Personnel from the Zilla Parishads were<br />

invited to attend the one workshop on PRIASoft on 3 rd June, 2010. A<br />

demonstration of the PRIASoft application was made before the<br />

participant and the very important feedbacks were gathered from the<br />

field functionaries, which was subsequently forwarded to the Technical<br />

Team of the NIC suggesting necessary modification in the software.<br />

h. Subsequently another Workshop was organised on 24 th July 2010,<br />

which was attended by the IT professional of Zilla Parishads and<br />

Panchayat Samitees. The NIC Team from New Delhi also attended the<br />

workshop. In this workshop issues relating to software management,<br />

training of functionaries and software modification were discussed in<br />

detail. The findings of this workshop were also forwarded to the<br />

Ministry of Panchayati Raj.<br />

- 32 -

i. Ministry of Panchayati Raj organised an workshop on 19 th and 20 th<br />

August 2010 which was attended by the Principal Secretary and two<br />

other Technical Persons of the Department.<br />

j. During 15 th 16 th and 17 th September 2010, a workshop on Model<br />

Accounting System and PRIASoft were organised for ZP and the<br />

Panchayat Samiti functionaries specifically Account Professionals and<br />

IT professionals.<br />

6.3 Procedure of entry of vouchers in modified PRIASoft<br />

6.3.1 User Login<br />

The user can login to PRIASoft as a Administrator and a General<br />

user. As a Administrator, he can able to enter Master data and also<br />

vaoching. But as a general user, he can only do transaction entry in the<br />

software.<br />

Selection of Administration/User: Zillaparishad / Block Panchyat<br />

Administration / Village Panchayat Administration are to be done.<br />

- 33 -

6.3.2 Selection of Role<br />

At the present scenario, after login to the district user, it is<br />

necessary to select the role in which you will have to work i.e ZP or BP or<br />

GP.<br />

6.3.3 Master Data Entry.<br />

- 34 -

6.3.4 Financial year is to be set once in a financial year. OB will be<br />

automatically carried forward to next financial year.<br />

6.3.5 Schemes available for operation for G.P / PS/ZP is to be mapped as<br />

per the recruitment of Administration.<br />

- 35 -

6.3.6 Treasury details. Treasury name, Treasury name in local<br />

language, Treasury code (4digit), Treasury location are to be entered.<br />

6.3.6.1 Treasury Mapping: All treasury of the district were entered<br />

at the district level Administrator login. Panchayat Samiti and DRDA have<br />

to map the treasury coming in their jurisdiction as illustrated below.<br />

- 36 -

6.3.6.2 Treasury Account: Adding of Personal Ledger Account<br />

number is to be added in the master data as per the detail illustrated<br />

below.<br />

6.3.6.3 Mapping of Treasury Account Number to scheme:<br />

Mapping the schemes to the Treasury Account number has to be don9e<br />

before any transaction entry.<br />

6.3.7 Bank Details<br />

6.3.7.1 Bank Branch details: All bank branches of the district shall<br />

be entered in the master database as per the following details through<br />

administrative login. DRDA, Block and GPs shall have to map as per their<br />

requirement against these branch branches at their login.<br />

� Bank name<br />

� Branch code<br />

� MICR code<br />

� IFC – RTGS code<br />

� BSR (Basic Statistical Return) code<br />

- 37 -

6.3.7.2 Mapping of Bank Branch to PRI Unit :The procedure of<br />

mapping of bank branches to PRI units is below.<br />

� Bank name<br />

� Name of PRI<br />

� Bank name to be selected<br />

� Select bank branches<br />

- 38 -

6.3.7.3 Mapping of Bank Account Number to Schemes :<br />

Software has the provision to map a single bank account number to<br />

multiple schemes and also a single scheme to multiple bank accounts i.e<br />

many to many topology.<br />

6.3.7.4 Cheque Book Detail : PRIASoft software has the<br />

provision to capture the details of each cheque of bank account under<br />

which transaction shall be made. The detail process of capturing cheque<br />

detail is illustrated below.<br />

- 39 -

6.4 Post Office Detail :<br />

6.4.1 Details of the head Post Office: Name of the Post Office and<br />

Type either Head Office or Sub-Office are the mandatory field in the<br />

software which are required for recording transactions through post<br />

office.<br />

6.4.2 Mapping of Post Office Account number to the Scheme: One<br />

to one, one to many and many to many mapping facility are available in<br />

the software.<br />

- 40 -

6.5 Employee Detail: Employee code and employee name are the<br />

mandatory fields. These<br />

6.6 Agency Detail : The master of Agencies involved with the PRI are<br />

to be recorded to capture their day-to-day financial involvement with<br />

PRI.<br />

- 41 -

6.7 Resident Detail : The master data for resident detail is required<br />

to be captured for recording the history of assistance.<br />

6.8 Stock Detail : Each PRI will have some stock for taking up<br />

development works. For such, cement, building material etc. are<br />

required. The details of stock purchase and utilisation can be recorded in<br />

PRIASoft.<br />

- 42 -

6.9 Case Record : Each work executed by the PRI has one unique<br />

case record. This case record will tell the current progress and history of<br />

the work. So before going to record the detail transaction of a work, the<br />

case record details are recorded in PRIAsoft.<br />

6.10 Opening Balance: Opening Balance of each scheme shall be<br />

entered in the software as on 1 st April, 2010. Actual fund available in<br />

Bank pass book as on 1 st April,2010 shall be taken in opening and any<br />

negative balance in the bank pass book should be reconciled<br />

immediately.<br />

- 43 -

6.10.1 Data Entry Screen of Opening Balance<br />

6.10.1.1 Advance to Agency: Advance can be given either to Agency<br />

or Employee to execute any work. Agency is further categorised as PRI,<br />

Line Department and Others. When any advance is given it will be<br />

booked under the Major Head 8550-Civil Advance and when the agency<br />

receives the fund, it will receive under 8550-Civil Advance as the same<br />

major head appear in both Receipt and Payment side with corresponding<br />

minor and object head.<br />

- 44 -

6.10.1.2 Advance to Employee(1): Advances given to employees<br />

for any personnel loan can be booked under Major Head 7610-Loans to<br />

Panchayat Employees with corresponding minor head such as 101 House<br />

Building Advance, 102- Motor Car/Cycle Advance, 103-Cycle Advance,<br />

104-Festival Advance.<br />

6.10.1.3 Advance to Employee (2): Advances given to employees<br />

for execution of project/work can be booked under major head 8550-<br />

Civil Advance with corresponding minor head such as 101-Advance to<br />

PRI functionaries.<br />

6.10.1.4 Stock Opening Balance<br />

- 45 -

6.11 Voucher Entry in PRIASoft<br />

Every organization records its financial transaction in a cash book.<br />

Each financial transaction is called a voucher. There are 4 types of<br />

financial transactions i.e. 1. Receipt, 2. Payment, 3. Contra and 4.<br />

Journal. PRIASoft has also provision to record the financial trasaction<br />

through above 4 types of vouchers.<br />

Receipt Transaction<br />

All type of receipts like Grant-in –aid, Interest received, Refund of<br />

Advance, Sale of Gunny Bags / Cement Bags, Own Income etc. are<br />

captured under this type of transaction.<br />

Payment Transaction<br />

All type of payment / expenditure like payment to Executants/<br />

Agencies/ Employees, Interest Paid, Advance paid, Royality/ Security<br />

paid, salary paid etc. are captured under this type of transaction.<br />

Contra Transaction<br />

Any transaction between cash to bank or bank to cash or bank to<br />

bank within a cash book / scheme without changing the total closing<br />

balance is classified as contra transaction.<br />

Journal Transaction<br />

Any transaction without involvement of cash or bank is classified as<br />

Journal Transaction. Any rectification i.e. wrong entry, advance<br />

adjustment, issue of stock etc. are to be handled through Journal<br />

Voucher.<br />

- 46 -

Each transaction has 6 components in PRIASoft. They are Add, Modify,<br />

View, Delete, Freeze and Unfreeze.<br />

6.11.1 Receipt Transaction : There are 5 types of Receipt<br />

transactions. They are Direct, Transfer, Advance Receipt, Refund of<br />

Advance and Cancellation of Cheque.<br />

- 47 -

6.11.1.1 Receipt – Direct : Receipt in shape of cash, cheque, bank<br />

draft are recorded in Direct Receipt.<br />

6.11.1.2 Receipt – Transfer : Receipt of funds through transfer from<br />

State to ZP, ZP to PS and PS to GP (within the PRI) is recorded in<br />

Transfer Receipt. A good feature in PRIASoft is that a Payment Transfer<br />

of ZP to PS or GP will automatically make Receipt Voucher in PS or GP<br />

respectively. Receipt of this can automatically be intimated to the higher<br />

tier by way of SMS or e-mail.<br />

Step 1<br />

- 48 -

Step 2<br />

6.11.1.3 Receipt – Advance Receipt : Receipt of funds from outside<br />

the PRI for execution of their work can be recorded through Advance<br />

Receipt.<br />

6.11.1.4 Receipt – Refund of Advance : If advance have already<br />

been given to a Line Department, Employee or Agency, after execution<br />

of the work by them, they refund the balance amount. This recorded in<br />

refund of advance.<br />

Step 1<br />

- 49 -

Step 2<br />

Step 3<br />

6.11.1.5 Receipt – Cancellation of Cheque : If amount already paid<br />

through cheque and cancelled for any reason can be accounted for.<br />

Step 1<br />

- 50 -

Step 2<br />

Step 3<br />

6.11.2 Payment Transaction : There 5 types of Payment<br />

Transactions. They are<br />

- 51 -

6.11.2.1 Payment – Expenditure: All type of expenditure with or<br />

without deduction, adjustment, kind adjustment etc. are recorded<br />

through this transaction.<br />

Expenditure 1<br />

Expenditure 2<br />

- 52 -

6.11.2.2 Payment – Transfer : Transfer of funds from higher tier to<br />

lower tier i.e. ZP to PS or GP, PS to GP.<br />

6.11.2.3 Payment Advances : Payment of advance to Line<br />

Department, Agency or Employee are recorded in this type of trasaction.<br />

- 53 -

6.11.2.4 Payment - Receipt Cancellation :<br />

Previously received amount through cheque can be cancelled by this<br />

trasaction.<br />

6.11.3 Contra : Transaction involving both cash and bank are<br />

recroded through contra voucher. E.g. Withdrawal money from Bank to<br />

Cash or deposit of money in bank or transfer of money from one bank<br />

account to another bank account in a scheme is called contra. Here the<br />

balance of the scheme does not chage.<br />

- 54 -

6.11.4 Journal : A journal voucher is created where there is no<br />

bank or cash transaction but this type of voucher helps the financial<br />

transaction to adjust the outstanding advances, rectification of wrong<br />

entries, adjustment work bills and provisioning expenditure of coming<br />

year in the current year. There are 5 types of journa vouchers in<br />

PRIASoft. They are Receipt Rectification, Expenditure Rectification,<br />

Advance Rectification, Advance Adjustment and Deduction.<br />

6.11.4.1 Journal – Receipt Rectification : Wrong booking of receipt<br />

can be corrected in later days.<br />

- 55 -

6.11.4.2 Journal-Expenditure Rectification : Wrong entry of<br />

expenditure can be rectified in later days. E.g. if you have already<br />

booked “expenditure on material” instead of “expenditure on unskilled<br />

wage”, in later days it can be rectified without tearing the cash book of<br />

the precious date.<br />

6.11.4.3 Journal – Advance Rectification : Wrong book of advance<br />

can be rectified.<br />

- 56 -

6.11.4.4 Journal – Advance Adjustment : Outstanding advance can<br />

be adjusted against the bill by booking the advance as expenditure.<br />

6.11.4.5 Journal – Deduction : The deduction of Royalty, VAT etc.<br />

can be recorded in a journal voucher where there is no payment.<br />

The following reports are available in PRIASoft Portal for day to day<br />

monitoring of Accounting of PRIs:<br />

- 57 -

Reports available in PRIASoft<br />

1. Day Book<br />

This module facilitates the user to view the Day Book Report. Day<br />

Book option is available in the Report menu under Report >> Day<br />

Book. For accessing this option the user must be logged in to the<br />

application as PRI Administrator or PRI User. The PRI Administrator<br />

can be assigned the role of Zilla Panchayat Administrator, Block<br />

Panchayat Administrator or Village Panchayat Administrator. Similarly,<br />

the PRI User can be assigned the role of Zilla Panchayat User, Block<br />

Panchayat User or Village Panchayat User.<br />

2. Monthly Cash Book Report<br />

This module facilitates the user to view the MonthlyCash Book<br />

Report. MonthlyDay Book option is available in the Report menu under<br />

Report >> Monthly Cash Book. For accessing this option the user<br />

must be logged in to the application as PRI Administrator or PRI<br />

User. The PRI Administrator can be assigned the role of Zilla Panchayat<br />

Administrator, Block Panchayat Administrator or Village Panchayat<br />

Administrator. Similarly, the PRI User can be assigned the role of Zilla<br />

Panchayat User, Block Panchayat User or Village Panchayat User.<br />

3. Scheme-Wise Cash Book Report<br />

This module facilitates the user to view the Scheme-WiseCash<br />

Book Report. Scheme-WiseDay Book option is available in the Report<br />

menu under Report >> Scheme-Wise Cash Book. For accessing this<br />

option the user must be logged in to the application as PRI<br />

Administrator or PRI User. The PRI Administrator can be assigned the<br />

role of Zilla Panchayat Administrator, Block Panchayat Administrator or<br />

Village Panchayat Administrator. Similarly, the PRI User can be<br />

assigned the role of Zilla Panchayat User, Block Panchayat User or<br />

Village Panchayat User.<br />

- 58 -

4. Ledger Book Report<br />

This module facilitates the user to view the LedgerBook Report.<br />

LedgerBook option is available in the Report menu under Report >><br />

Ledger Book. For accessing this option the user must be logged in to<br />

the application as PRI Administrator or PRI User. The PRI<br />

Administrator can be assigned the role of Zilla Panchayat Administrator,<br />

Block Panchayat Administrator or Village Panchayat Administrator.<br />

Similarly, the PRI User can be assigned the role of Zilla Panchayat User,<br />

Block Panchayat User or Village Panchayat User.<br />

5. Scheme-Wise Journal Book Report<br />

This module facilitates the user to view the Scheme-WiseJournal<br />

Book Report. Scheme-WiseJournal Book option is available in the Report<br />

menu under Report >> Scheme-Wise Journal Book. For accessing<br />

this option the user must be logged in to the application as PRI<br />

Administrator or PRI User. The PRI Administrator can be assigned the<br />

role of Zilla Panchayat Administrator, Block Panchayat Administrator or<br />

Village Panchayat Administrator. Similarly, the PRI User can be<br />

assigned the role of Zilla Panchayat User, Block Panchayat User or<br />

Village Panchayat User.<br />

6. Scheme-wise Cheques Receipt Register<br />

This module facilitates the user to view the Scheme-Wise<br />

Cheques Receipt Register Report. Scheme-Wise Cheques Receipt<br />

Register option is available in the Report menu under Report >><br />

Scheme-Wise Cheques Receipt Register. For accessing this option the<br />

user must be logged in to the application as PRI Administrator or<br />

PRI User. The PRI Administrator can be assigned the role of Zilla<br />

Panchayat Administrator, Block Panchayat Administrator or<br />

Village Panchayat Administrator. Similarly, the PRI User can be<br />

assigned the role of Zilla Panchayat User, Block Panchayat User<br />

or Village Panchayat User.<br />

- 59 -

7. Scheme-Wise Cheques Issue Register Report<br />

This module facilitates the user to view the Scheme-Wise Cheques<br />

Issue Register Report. Scheme-Wise Cheques Issue Register option is available<br />

in the Report menu under Report >> Scheme-Wise Cheques Issue<br />

Register. For accessing this option the user must be logged in to the<br />

application as PRI Administrator or PRI User. The PRI Administrator<br />

can be assigned the role of Zilla Panchayat Administrator, Block<br />

Panchayat Administrator or Village Panchayat Administrator. Similarly,<br />

the PRI User can be assigned the role of Zilla Panchayat User, Block<br />

Panchayat User or Village Panchayat User.<br />

8. Register of Advances Report<br />

This module facilitates the user to view the Register of Advances<br />

Report. Register of Advances option is available in the Report menu<br />

under Report >> Register of Advances. For accessing this option the<br />

user must be logged in to the application as PRI Administrator or PRI<br />

User. The PRI Administrator can be assigned the role of Zilla Panchayat<br />

Administrator, Block Panchayat Administrator or Village Panchayat<br />

Administrator. Similarly, the PRI User can be assigned the role of Zilla<br />

Panchayat User, Block Panchayat User or Village Panchayat User.<br />

9. Register of Receivable and Payable<br />

This module facilitates the user to view the Register of Receivable and<br />

Payable. Register of Receivable and Payable option is available in the<br />

Report menu under Report >> Register of Receivable and Payable.<br />

For accessing this option the user must be logged in to the application as<br />

PRI Administrator or PRI User. The PRI Administrator can be<br />

assigned the role of Zilla Panchayat Administrator, Block Panchayat<br />

Administrator or Village Panchayat Administrator. Similarly, the PRI<br />

User can be assigned the role of Zilla Panchayat User, Block Panchayat<br />

User or Village Panchayat User.<br />

- 60 -

10. Annual Receipts and Payments Accounts<br />

This module facilitates the user to view the Annual Receipts and<br />

Payments Accounts Report. Annual Receipts and Payments Accounts<br />

option is available in the Report menu under Report >> Annual<br />

Receipts and Payments Accounts. For accessing this option the user<br />

must be logged in to the application as PRI Administrator or PRI<br />

User. The PRI Administrator can be assigned the role of Zilla Panchayat<br />

Administrator, Block Panchayat Administrator or Village Panchayat<br />

Administrator. Similarly, the PRI User can be assigned the role of Zilla<br />

Panchayat User, Block Panchayat User or Village Panchayat User.<br />

11. Consolidated abstract register Report<br />

This module facilitates the user to view the Consolidated abstract<br />

registerReport. Consolidated abstract registeroption is available in the<br />

Report menu under Report >> Consolidated abstract register. For<br />

accessing this option the user must be logged in to the application as<br />

PRI Administrator or PRI User. The PRI Administrator can be<br />

assigned the role of Zilla Panchayat Administrator, Block Panchayat<br />

Administrator or Village Panchayat Administrator. Similarly, the PRI<br />

User can be assigned the role of Zilla Panchayat User, Block Panchayat<br />

User or Village Panchayat User.<br />

12. Monthly Reconciliation Statement Report<br />

This module facilitates the user to view the Monthly Reconciliation<br />

StatementReport. Monthly Reconciliation Statementoption is available in<br />

the Report menu under Report >> Monthly Reconciliation<br />

Statement. For accessing this option the user must be logged in to the<br />

application as PRI Administrator or PRI User. The PRI Administrator<br />

can be assigned the role of Zilla Panchayat Administrator, Block<br />

Panchayat Administrator or Village Panchayat Administrator. Similarly,<br />

- 61 -

the PRI User can be assigned the role of Zilla Panchayat User, Block<br />

Panchayat User or Village Panchayat User.<br />

13. Stock register Report<br />

This module facilitates the user to view the Stockregister Report.<br />

Stockregister option is available in the Report menu under Report >><br />

Stock register. For accessing this option the user must be logged in to<br />

the application as PRI Administrator or PRI User. The PRI<br />

Administrator can be assigned the role of Zilla Panchayat Administrator,<br />

Block Panchayat Administrator or Village Panchayat Administrator.<br />

Similarly, the PRI User can be assigned the role of Zilla Panchayat User,<br />

Block Panchayat User or Village Panchayat User.<br />

14. Closing Balance Report<br />

This module facilitates the user to view the Closing Balance Report.<br />

Closing Balance Report option is available in the Report menu under<br />

Report >> Closing Balance Report. For accessing this option the user<br />

must be logged in to the application as PRI Administrator or PRI<br />

User. The PRI Administrator can be assigned the role of Zilla Panchayat<br />

Administrator, Block Panchayat Administrator or Village Panchayat<br />

Administrator. Similarly, the PRI User can be assigned the role of Zilla<br />

Panchayat User, Block Panchayat User or Village Panchayat User.<br />

15. Head of Accounts Report<br />

This module facilitates the user to view the Head of AccountsReport.<br />

Head of Accountsoption is available in the Report menu under Report<br />