Financeability tests and their role in price regulation - IPART - NSW ...

Financeability tests and their role in price regulation - IPART - NSW ...

Financeability tests and their role in price regulation - IPART - NSW ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>F<strong>in</strong>anceability</strong> <strong>tests</strong> <strong>and</strong> <strong>their</strong> <strong>role</strong> <strong>in</strong> <strong>price</strong> <strong>regulation</strong> <strong>IPART</strong><br />

43<br />

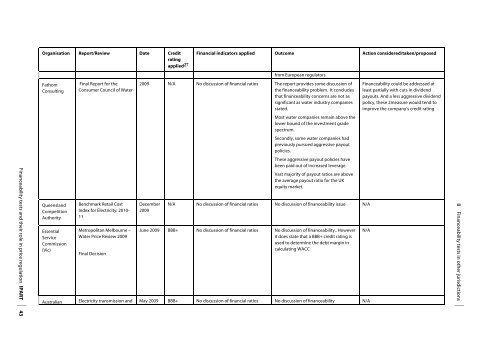

Organisation Report/Review Date Credit<br />

rat<strong>in</strong>g<br />

applied 27<br />

Fathom<br />

Consult<strong>in</strong>g<br />

Queensl<strong>and</strong><br />

Competition<br />

Authority<br />

Essential<br />

Service<br />

Commission<br />

(Vic)<br />

F<strong>in</strong>al Report for the<br />

Consumer Council of Water<br />

Benchmark Retail Cost<br />

Index for Electricity: 2010-<br />

11<br />

Metropolitan Melbourne –<br />

Water Price Review 2009<br />

F<strong>in</strong>al Decision<br />

F<strong>in</strong>ancial <strong>in</strong>dicators applied Outcome Action considered/taken/proposed<br />

from European regulators<br />

2009 N/A No discussion of f<strong>in</strong>ancial ratios The report provides some discussion of<br />

the f<strong>in</strong>anceability problem. It concludes<br />

that f<strong>in</strong>anceability concerns are not as<br />

significant as water <strong>in</strong>dustry companies<br />

stated.<br />

Most water companies rema<strong>in</strong> above the<br />

lower bound of the <strong>in</strong>vestment grade<br />

spectrum.<br />

Secondly, some water companies had<br />

previously pursued aggressive payout<br />

policies.<br />

These aggressive payout policies have<br />

been paid out of <strong>in</strong>creased leverage.<br />

Vast majority of payout ratios are above<br />

the average payout ratio for the UK<br />

equity market.<br />

December<br />

2009<br />

N/A No discussion of f<strong>in</strong>ancial ratios No discussion of f<strong>in</strong>anceability issue<br />

June 2009 BBB+ No discussion of f<strong>in</strong>ancial ratios No discussion of f<strong>in</strong>anceability,. However<br />

it does state that a BBB+ credit rat<strong>in</strong>g is<br />

used to determ<strong>in</strong>e the debt marg<strong>in</strong> <strong>in</strong><br />

calculat<strong>in</strong>g WACC<br />

Australian Electricity transmission <strong>and</strong> May 2009 BBB+ No discussion of f<strong>in</strong>ancial ratios No discussion of f<strong>in</strong>anceability N/A<br />

<strong>F<strong>in</strong>anceability</strong> could be addressed at<br />

least partially with cuts <strong>in</strong> dividend<br />

payouts. And a less aggressive dividend<br />

policy, these 2measure would tend to<br />

improve the company’s credit rat<strong>in</strong>g<br />

N/A<br />

N/A<br />

B <strong>F<strong>in</strong>anceability</strong> <strong>tests</strong> <strong>in</strong> other jurisdictions