Financeability tests and their role in price regulation - IPART - NSW ...

Financeability tests and their role in price regulation - IPART - NSW ...

Financeability tests and their role in price regulation - IPART - NSW ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

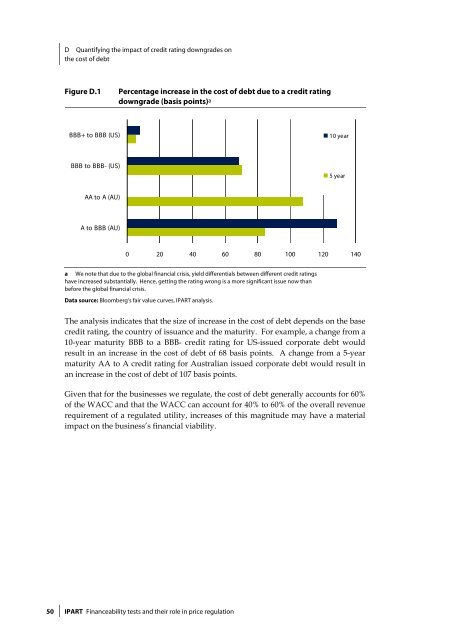

D Quantify<strong>in</strong>g the impact of credit rat<strong>in</strong>g downgrades on<br />

the cost of debt<br />

Figure D.1 Percentage <strong>in</strong>crease <strong>in</strong> the cost of debt due to a credit rat<strong>in</strong>g<br />

downgrade (basis po<strong>in</strong>ts)a<br />

BBB+ to BBB (US)<br />

BBB to BBB- (US)<br />

AA to A (AU)<br />

A to BBB (AU)<br />

0 20 40 60 80 100 120 140<br />

a We note that due to the global f<strong>in</strong>ancial crisis, yield differentials between different credit rat<strong>in</strong>gs<br />

have <strong>in</strong>creased substantially. Hence, gett<strong>in</strong>g the rat<strong>in</strong>g wrong is a more significant issue now than<br />

before the global f<strong>in</strong>ancial crisis.<br />

Data source: Bloomberg’s fair value curves, <strong>IPART</strong> analysis.<br />

50 <strong>IPART</strong> <strong>F<strong>in</strong>anceability</strong> <strong>tests</strong> <strong>and</strong> <strong>their</strong> <strong>role</strong> <strong>in</strong> <strong>price</strong> <strong>regulation</strong><br />

10 year<br />

5 year<br />

The analysis <strong>in</strong>dicates that the size of <strong>in</strong>crease <strong>in</strong> the cost of debt depends on the base<br />

credit rat<strong>in</strong>g, the country of issuance <strong>and</strong> the maturity. For example, a change from a<br />

10-year maturity BBB to a BBB- credit rat<strong>in</strong>g for US-issued corporate debt would<br />

result <strong>in</strong> an <strong>in</strong>crease <strong>in</strong> the cost of debt of 68 basis po<strong>in</strong>ts. A change from a 5-year<br />

maturity AA to A credit rat<strong>in</strong>g for Australian issued corporate debt would result <strong>in</strong><br />

an <strong>in</strong>crease <strong>in</strong> the cost of debt of 107 basis po<strong>in</strong>ts.<br />

Given that for the bus<strong>in</strong>esses we regulate, the cost of debt generally accounts for 60%<br />

of the WACC <strong>and</strong> that the WACC can account for 40% to 60% of the overall revenue<br />

requirement of a regulated utility, <strong>in</strong>creases of this magnitude may have a material<br />

impact on the bus<strong>in</strong>ess’s f<strong>in</strong>ancial viability.