Financeability tests and their role in price regulation - IPART - NSW ...

Financeability tests and their role in price regulation - IPART - NSW ...

Financeability tests and their role in price regulation - IPART - NSW ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

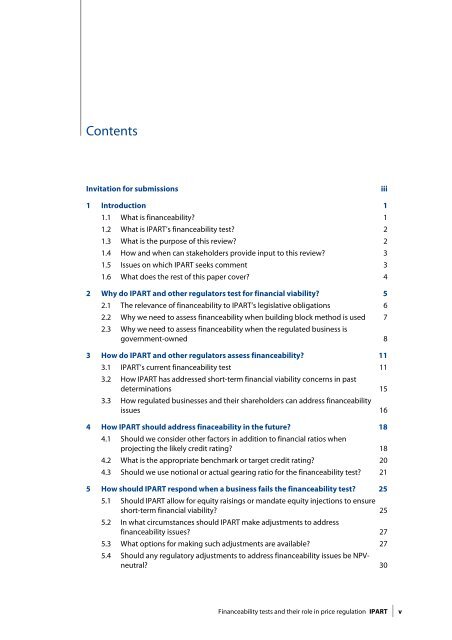

Contents<br />

Contents<br />

Invitation for submissions iii<br />

1 Introduction 1<br />

1.1 What is f<strong>in</strong>anceability? 1<br />

1.2 What is <strong>IPART</strong>’s f<strong>in</strong>anceability test? 2<br />

1.3 What is the purpose of this review? 2<br />

1.4 How <strong>and</strong> when can stakeholders provide <strong>in</strong>put to this review? 3<br />

1.5 Issues on which <strong>IPART</strong> seeks comment 3<br />

1.6 What does the rest of this paper cover? 4<br />

2 Why do <strong>IPART</strong> <strong>and</strong> other regulators test for f<strong>in</strong>ancial viability? 5<br />

2.1 The relevance of f<strong>in</strong>anceability to <strong>IPART</strong>’s legislative obligations 6<br />

2.2 Why we need to assess f<strong>in</strong>anceability when build<strong>in</strong>g block method is used 7<br />

2.3 Why we need to assess f<strong>in</strong>anceability when the regulated bus<strong>in</strong>ess is<br />

government-owned 8<br />

3 How do <strong>IPART</strong> <strong>and</strong> other regulators assess f<strong>in</strong>anceability? 11<br />

3.1 <strong>IPART</strong>’s current f<strong>in</strong>anceability test 11<br />

3.2 How <strong>IPART</strong> has addressed short-term f<strong>in</strong>ancial viability concerns <strong>in</strong> past<br />

determ<strong>in</strong>ations 15<br />

3.3 How regulated bus<strong>in</strong>esses <strong>and</strong> <strong>their</strong> shareholders can address f<strong>in</strong>anceability<br />

issues 16<br />

4 How <strong>IPART</strong> should address f<strong>in</strong>aceability <strong>in</strong> the future? 18<br />

4.1 Should we consider other factors <strong>in</strong> addition to f<strong>in</strong>ancial ratios when<br />

project<strong>in</strong>g the likely credit rat<strong>in</strong>g? 18<br />

4.2 What is the appropriate benchmark or target credit rat<strong>in</strong>g? 20<br />

4.3 Should we use notional or actual gear<strong>in</strong>g ratio for the f<strong>in</strong>anceability test? 21<br />

5 How should <strong>IPART</strong> respond when a bus<strong>in</strong>ess fails the f<strong>in</strong>anceability test? 25<br />

5.1 Should <strong>IPART</strong> allow for equity rais<strong>in</strong>gs or m<strong>and</strong>ate equity <strong>in</strong>jections to ensure<br />

short-term f<strong>in</strong>ancial viability? 25<br />

5.2 In what circumstances should <strong>IPART</strong> make adjustments to address<br />

f<strong>in</strong>anceability issues? 27<br />

5.3 What options for mak<strong>in</strong>g such adjustments are available? 27<br />

5.4 Should any regulatory adjustments to address f<strong>in</strong>anceability issues be NPVneutral?<br />

30<br />

<strong>F<strong>in</strong>anceability</strong> <strong>tests</strong> <strong>and</strong> <strong>their</strong> <strong>role</strong> <strong>in</strong> <strong>price</strong> <strong>regulation</strong> <strong>IPART</strong> v