Annual Report 2010 - Baltika Breweries

Annual Report 2010 - Baltika Breweries

Annual Report 2010 - Baltika Breweries

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Position<br />

Liquidity and efficiency<br />

Due to high operating profit<br />

in <strong>2010</strong> and working capital<br />

optimization, as well as the<br />

implementation of the strategy<br />

for investing in priority projects,<br />

the Company accumulated<br />

a considerable volume<br />

of free cash flow, the major<br />

share of which was used for<br />

dividend payments according<br />

to a resolution adopted at the<br />

<strong>Annual</strong> General Shareholders<br />

Meeting. Dividends paid<br />

by the Company in <strong>2010</strong><br />

exceeded RUB 27 billion,<br />

of which RUB 21 billion<br />

were 2009 dividends and<br />

the rest — the interim <strong>2010</strong><br />

dividends. Temporarily free cash<br />

funds were used by the Company<br />

for short-term investments on the<br />

capital market.<br />

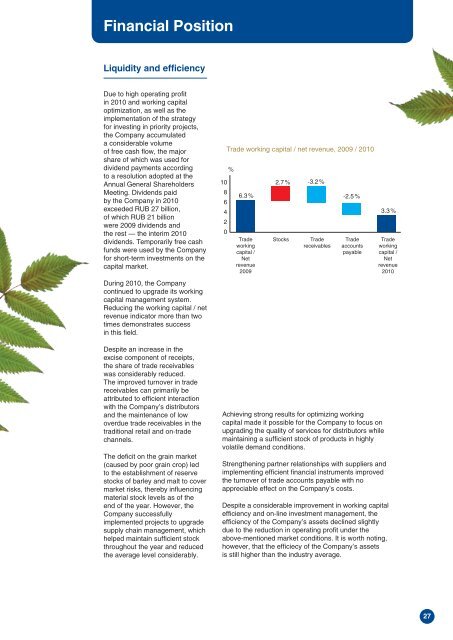

During <strong>2010</strong>, the Company<br />

continued to upgrade its working<br />

capital management system.<br />

Reducing the working capital / net<br />

revenue indicator more than two<br />

times demonstrates success<br />

in this field.<br />

Despite an increase in the<br />

excise component of receipts,<br />

the share of trade receivables<br />

was considerably reduced.<br />

The improved turnover in trade<br />

receivables can primarily be<br />

attributed to efficient interaction<br />

with the Company’s distributors<br />

and the maintenance of low<br />

overdue trade receivables in the<br />

traditional retail and on-trade<br />

channels.<br />

The deficit on the grain market<br />

(caused by poor grain crop) led<br />

to the establishment of reserve<br />

stocks of barley and malt to cover<br />

market risks, thereby influencing<br />

material stock levels as of the<br />

end of the year. However, the<br />

Company successfully<br />

implemented projects to upgrade<br />

supply chain management, which<br />

helped maintain sufficient stock<br />

throughout the year and reduced<br />

the average level considerably.<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Trade working capital / net revenue, 2009 / <strong>2010</strong><br />

%<br />

6.3 %<br />

Trade<br />

working<br />

capital /<br />

Net<br />

revenue<br />

2009<br />

2.7 %<br />

-3.2 %<br />

Stocks Trade<br />

receivables<br />

-2.5 %<br />

Trade<br />

accounts<br />

payable<br />

Achieving strong results for optimizing working<br />

capital made it possible for the Company to focus on<br />

upgrading the quality of services for distributors while<br />

maintaining a sufficient stock of products in highly<br />

volatile demand conditions.<br />

Strengthening partner relationships with suppliers and<br />

implementing efficient financial instruments improved<br />

the turnover of trade accounts payable with no<br />

appreciable effect on the Company’s costs.<br />

Despite a considerable improvement in working capital<br />

efficiency and on-line investment management, the<br />

efficiency of the Company’s assets declined slightly<br />

due to the reduction in operating profit under the<br />

above-mentioned market conditions. It is worth noting,<br />

however, that the efficiecy of the Company’s assets<br />

is still higher than the industry average.<br />

3.3 %<br />

Trade<br />

working<br />

capital /<br />

Net<br />

revenue<br />

<strong>2010</strong><br />

27