Download het supplement - KCE

Download het supplement - KCE

Download het supplement - KCE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

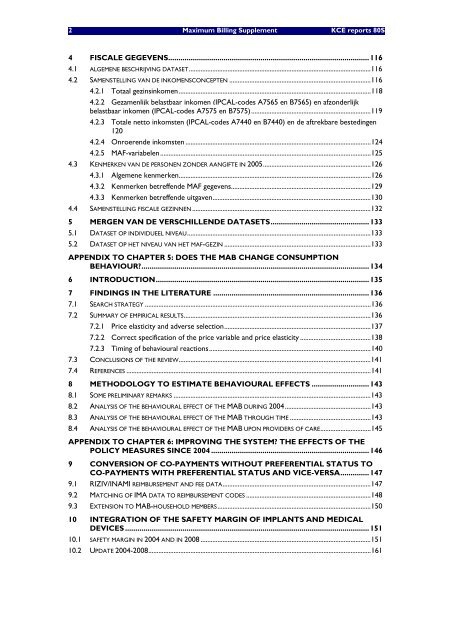

2 Maximum Billing Supplement <strong>KCE</strong> reports 80S<br />

4 FISCALE GEGEVENS..................................................................................................116<br />

4.1 ALGEMENE BESCHRIJVING DATASET............................................................................................................116<br />

4.2 SAMENSTELLING VAN DE INKOMENSCONCEPTEN ....................................................................................116<br />

4.2.1 Totaal gezinsinkomen..................................................................................................................118<br />

4.2.2 Gezamenlijk belastbaar inkomen (IPCAL-codes A7565 en B7565) en afzonderlijk<br />

belastbaar inkomen (IPCAL-codes A7575 en B7575).......................................................................119<br />

4.2.3 Totale netto inkomsten (IPCAL-codes A7440 en B7440) en de aftrekbare bestedingen<br />

120<br />

4.2.4 Onroerende inkomsten ..............................................................................................................124<br />

4.2.5 MAF-variabelen.............................................................................................................................125<br />

4.3 KENMERKEN VAN DE PERSONEN ZONDER AANGIFTE IN 2005................................................................126<br />

4.3.1 Algemene kenmerken..................................................................................................................126<br />

4.3.2 Kenmerken betreffende MAF gegevens...................................................................................129<br />

4.3.3 Kenmerken betreffende uitgaven..............................................................................................130<br />

4.4 SAMENSTELLING FISCALE GEZINNEN ..........................................................................................................132<br />

5 MERGEN VAN DE VERSCHILLENDE DATASETS................................................133<br />

5.1 DATASET OP INDIVIDUEEL NIVEAU.............................................................................................................133<br />

5.2 DATASET OP HET NIVEAU VAN HET MAF-GEZIN .......................................................................................133<br />

APPENDIX TO CHAPTER 5: DOES THE MAB CHANGE CONSUMPTION<br />

BEHAVIOUR?...............................................................................................................134<br />

6 INTRODUCTION........................................................................................................135<br />

7 FINDINGS IN THE LITERATURE ............................................................................136<br />

7.1 SEARCH STRATEGY ......................................................................................................................................136<br />

7.2 SUMMARY OF EMPIRICAL RESULTS...............................................................................................................136<br />

7.2.1 Price elasticity and adverse selection.......................................................................................137<br />

7.2.2 Correct specification of the price variable and price elasticity ..........................................138<br />

7.2.3 Timing of behavioural reactions................................................................................................140<br />

7.3 CONCLUSIONS OF THE REVIEW..................................................................................................................141<br />

7.4 REFERENCES .................................................................................................................................................141<br />

8 METHODOLOGY TO ESTIMATE BEHAVIOURAL EFFECTS ............................143<br />

8.1 SOME PRELIMINARY REMARKS .....................................................................................................................143<br />

8.2 ANALYSIS OF THE BEHAVIOURAL EFFECT OF THE MAB DURING 2004...................................................143<br />

8.3 ANALYSIS OF THE BEHAVIOURAL EFFECT OF THE MAB THROUGH TIME ................................................143<br />

8.4 ANALYSIS OF THE BEHAVIOURAL EFFECT OF THE MAB UPON PROVIDERS OF CARE..............................145<br />

APPENDIX TO CHAPTER 6: IMPROVING THE SYSTEM? THE EFFECTS OF THE<br />

POLICY MEASURES SINCE 2004 .............................................................................146<br />

9 CONVERSION OF CO-PAYMENTS WITHOUT PREFERENTIAL STATUS TO<br />

CO-PAYMENTS WITH PREFERENTIAL STATUS AND VICE-VERSA..............147<br />

9.1 RIZIV/INAMI REIMBURSEMENT AND FEE DATA........................................................................................147<br />

9.2 MATCHING OF IMA DATA TO REIMBURSEMENT CODES ..........................................................................148<br />

9.3 EXTENSION TO MAB-HOUSEHOLD MEMBERS...........................................................................................150<br />

10 INTEGRATION OF THE SAFETY MARGIN OF IMPLANTS AND MEDICAL<br />

DEVICES .......................................................................................................................151<br />

10.1 SAFETY MARGIN IN 2004 AND IN 2008 .....................................................................................................151<br />

10.2 UPDATE 2004-2008....................................................................................................................................161