SPEciAL - ALU-WEB.DE

SPEciAL - ALU-WEB.DE

SPEciAL - ALU-WEB.DE

Sie wollen auch ein ePaper? Erhöhen Sie die Reichweite Ihrer Titel.

YUMPU macht aus Druck-PDFs automatisch weboptimierte ePaper, die Google liebt.

EcONOMicS<br />

consumption of primary aluminium is<br />

expected to rise 5% this year. This will<br />

be the first year global production and<br />

consumption have declined over the<br />

last 15 years.<br />

Continuing weak demand led to<br />

further growth in inventories and<br />

falling prices. As a result, aluminium<br />

supply will surpass consumption by<br />

at least 1.65m tonnes over this year<br />

and about 1.4m tonnes in 2010, while<br />

a market deficit is not expected before<br />

the second half of 2012.<br />

The average aluminium cash<br />

price for ten months this year was<br />

USD1,585 per tonne, while the average<br />

for the year is expected to be about<br />

USD1,625 per tonne. LME aluminium<br />

stocks at the end of October were flat,<br />

at 4.56m tonnes, maintaining the level<br />

since August.<br />

Supply and demand<br />

Aluminium production in China rose<br />

to over 14m tonnes on a y/y basis in<br />

the last two months, while production<br />

in the Western world remained<br />

flat. Smelter production is stable in<br />

the Persian Gulf region, such as Dubal<br />

and Alba. Sohar Aluminium’s new<br />

smelter in Oman reached its first-stage<br />

capacity of 350,000 tpy in the second<br />

quarter. Moreover, Qatar Aluminium’s<br />

50-50 joint venture with Norwegian<br />

Norsk Hydro and state-owned<br />

Qatar Petroleum, with its capacity of<br />

585,000 tpy, will commence production<br />

in December 2009.<br />

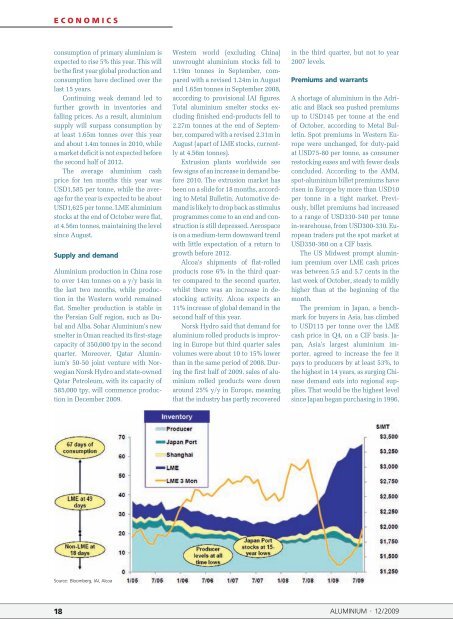

Source: Bloomberg, IAI, Alcoa<br />

Western world (excluding China)<br />

unwrought aluminium stocks fell to<br />

1.19m tonnes in September, compared<br />

with a revised 1.24m in August<br />

and 1.65m tonnes in September 2008,<br />

according to provisional IAI figures.<br />

Total aluminium smelter stocks excluding<br />

finished end-products fell to<br />

2.27m tonnes at the end of September,<br />

compared with a revised 2.31m in<br />

August (apart of LME stocks, currently<br />

at 4.56m tonnes).<br />

Extrusion plants worldwide see<br />

few signs of an increase in demand before<br />

2010. The extrusion market has<br />

been on a slide for 18 months, according<br />

to Metal Bulletin. Automotive demand<br />

is likely to drop back as stimulus<br />

programmes come to an end and construction<br />

is still depressed. Aerospace<br />

is on a medium-term downward trend<br />

with little expectation of a return to<br />

growth before 2012.<br />

Alcoa’s shipments of flat-rolled<br />

products rose 6% in the third quarter<br />

compared to the second quarter,<br />

whilst there was an increase in destocking<br />

activity. Alcoa expects an<br />

11% increase of global demand in the<br />

second half of this year.<br />

Norsk Hydro said that demand for<br />

aluminium rolled products is improving<br />

in Europe but third quarter sales<br />

volumes were about 10 to 15% lower<br />

than in the same period of 2008. During<br />

the first half of 2009, sales of aluminium<br />

rolled products were down<br />

around 25% y/y in Europe, meaning<br />

that the industry has partly recovered<br />

in the third quarter, but not to year<br />

2007 levels.<br />

Premiums and warrants<br />

A shortage of aluminium in the Adriatic<br />

and Black sea pushed premiums<br />

up to USD145 per tonne at the end<br />

of October, according to Metal Bulletin.<br />

Spot premiums in Western Europe<br />

were unchanged, for duty-paid<br />

at USD75-80 per tonne, as consumer<br />

restocking eases and with fewer deals<br />

concluded. According to the AMM,<br />

spot-aluminium billet premiums have<br />

risen in Europe by more than USD10<br />

per tonne in a tight market. Previously,<br />

billet premiums had increased<br />

to a range of USD330-340 per tonne<br />

in-warehouse, from USD300-330. European<br />

traders put the spot market at<br />

USD350-360 on a CIF basis.<br />

The US Midwest prompt aluminium<br />

premium over LME cash prices<br />

was between 5.5 and 5.7 cents in the<br />

last week of October, steady to mildly<br />

higher than at the beginning of the<br />

month.<br />

The premium in Japan, a benchmark<br />

for buyers in Asia, has climbed<br />

to USD115 per tonne over the LME<br />

cash price in Q4, on a CIF basis. Japan,<br />

Asia’s largest aluminium importer,<br />

agreed to increase the fee it<br />

pays to producers by at least 53%, to<br />

the highest in 14 years, as surging Chinese<br />

demand eats into regional supplies.<br />

That would be the highest level<br />

since Japan began purchasing in 1996,<br />

18 <strong>ALU</strong>MINIUM · 12/2009