Tesco plc Annual Report and Financial Statements 2008

Tesco plc Annual Report and Financial Statements 2008

Tesco plc Annual Report and Financial Statements 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Group financial statements continued<br />

Note 10 Goodwill <strong>and</strong> other intangible assets continued<br />

Impairment of goodwill<br />

Goodwill arising on business combinations is not amortised but is reviewed for impairment on an annual basis or more frequently if there are indications<br />

that goodwill may be impaired. Goodwill acquired in a business combination is allocated to groups of cash-generating units according to the level at<br />

which management monitor that goodwill.<br />

Recoverable amounts for cash-generating units are based on the higher of value in use <strong>and</strong> fair value less costs to sell. Value in use is calculated from cash<br />

flow projections for five years using data from the Group’s latest internal forecasts, the results of which are reviewed by the Board. The key assumptions<br />

for the value in use calculations are those regarding discount rates, growth rates <strong>and</strong> expected changes in margins. Management estimate discount rates<br />

using pre-tax rates that reflect the current market assessment of the time value of money <strong>and</strong> the risks specific to the cash-generating units. Changes in<br />

selling prices <strong>and</strong> direct costs are based on past experience <strong>and</strong> expectations of future changes in the market.<br />

The recoverable amounts of China, Japan <strong>and</strong> Turkey were based on fair value less costs to sell. Fair value less costs to sell is the amount for which the<br />

cash-generating unit could be exchanged between knowledgeable, willing parties in an arm’s length transaction less costs to sell. Management undertakes<br />

an assessment of relevant market data including, where available, recent market transactions for similar assets in the retail industry. Fair value is also<br />

calculated from cash flow projections for five years using data from the Group’s latest internal forecasts, including future capital expenditure, the results<br />

of which are reviewed by the Board. The key assumptions for the fair value calculations are those regarding discount rates, growth rates, expected changes<br />

in margins <strong>and</strong> capital expenditure. Management estimate discount rates using post-tax rates that reflect the current market assessment of the time value<br />

of money <strong>and</strong> the risks specific to the cash-generating units. Changes in selling prices <strong>and</strong> direct costs are based on past experience <strong>and</strong> expectations of<br />

future changes in the market.<br />

The forecasts are extrapolated beyond five years based on estimated long-term average growth rates of generally 3%-4% (2007: 3%-4%).<br />

The pre-tax discount rates used to calculate value in use range from 8%-24% (2007: 10%-17%). The post-tax discount rates used to calculate fair value<br />

less costs to sell range from 5%-20%. These discount rates are derived from the Group’s post-tax weighted average cost of capital as adjusted for the<br />

specific risks relating to each geographical region.<br />

In February <strong>2008</strong> <strong>and</strong> 2007 impairment reviews were performed by comparing the carrying value of goodwill with the recoverable amount of the<br />

cash-generating units to which goodwill has been allocated. Management determined that there has been no impairment.<br />

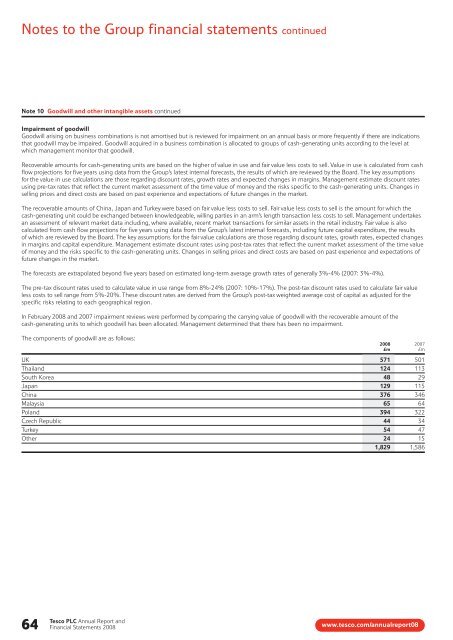

The components of goodwill are as follows:<br />

64<br />

<strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong><br />

<strong>Financial</strong> <strong>Statements</strong> <strong>2008</strong><br />

<strong>2008</strong> 2007<br />

£m £m<br />

UK 571 501<br />

Thail<strong>and</strong> 124 113<br />

South Korea 48 29<br />

Japan 129 115<br />

China 376 346<br />

Malaysia 65 64<br />

Pol<strong>and</strong> 394 322<br />

Czech Republic 44 34<br />

Turkey 54 47<br />

Other 24 15<br />

1,829 1,586<br />

www.tesco.com/annualreport08