Tesco plc Annual Report and Financial Statements 2008

Tesco plc Annual Report and Financial Statements 2008

Tesco plc Annual Report and Financial Statements 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

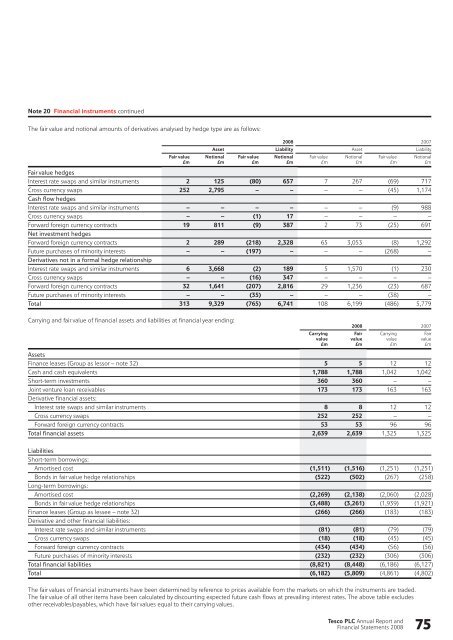

Note 20 <strong>Financial</strong> instruments continued<br />

The fair value <strong>and</strong> notional amounts of derivatives analysed by hedge type are as follows:<br />

<strong>2008</strong> 2007<br />

Asset Liability Asset Liability<br />

Fair value Notional Fair value Notional Fair value Notional Fair value Notional<br />

£m £m £m £m £m £m £m £m<br />

Fair value hedges<br />

Interest rate swaps <strong>and</strong> similar instruments 2 125 (80) 657 7 267 (69) 717<br />

Cross currency swaps 252 2,795 – – – – (45) 1,174<br />

Cash flow hedges<br />

Interest rate swaps <strong>and</strong> similar instruments – – – – – – (9) 988<br />

Cross currency swaps – – (1) 17 – – – –<br />

Forward foreign currency contracts 19 811 (9) 387 2 73 (25) 691<br />

Net investment hedges<br />

Forward foreign currency contracts 2 289 (218) 2,328 65 3,053 (8) 1,292<br />

Future purchases of minority interests – – (197) – – – (268) –<br />

Derivatives not in a formal hedge relationship<br />

Interest rate swaps <strong>and</strong> similar instruments 6 3,668 (2) 189 5 1,570 (1) 230<br />

Cross currency swaps – – (16) 347 – – – –<br />

Forward foreign currency contracts 32 1,641 (207) 2,816 29 1,236 (23) 687<br />

Future purchases of minority interests – – (35) – – – (38) –<br />

Total 313 9,329 (765) 6,741 108 6,199 (486) 5,779<br />

Carrying <strong>and</strong> fair value of financial assets <strong>and</strong> liabilities at financial year ending:<br />

<strong>2008</strong> 2007<br />

Carrying Fair Carrying Fair<br />

value value value value<br />

£m £m £m £m<br />

Assets<br />

Finance leases (Group as lessor – note 32) 5 5 12 12<br />

Cash <strong>and</strong> cash equivalents 1,788 1,788 1,042 1,042<br />

Short-term investments 360 360 – –<br />

Joint venture loan receivables 173 173 163 163<br />

Derivative financial assets:<br />

Interest rate swaps <strong>and</strong> similar instruments 8 8 12 12<br />

Cross currency swaps 252 252 – –<br />

Forward foreign currency contracts 53 53 96 96<br />

Total financial assets 2,639 2,639 1,325 1,325<br />

Liabilities<br />

Short-term borrowings:<br />

Amortised cost (1,511) (1,516) (1,251) (1,251)<br />

Bonds in fair value hedge relationships (522) (502) (267) (258)<br />

Long-term borrowings:<br />

Amortised cost (2,269) (2,138) (2,060) (2,028)<br />

Bonds in fair value hedge relationships (3,488) (3,261) (1,939) (1,921)<br />

Finance leases (Group as lessee – note 32) (266) (266) (183) (183)<br />

Derivative <strong>and</strong> other financial liabilities:<br />

Interest rate swaps <strong>and</strong> similar instruments (81) (81) (79) (79)<br />

Cross currency swaps (18) (18) (45) (45)<br />

Forward foreign currency contracts (434) (434) (56) (56)<br />

Future purchases of minority interests (232) (232) (306) (306)<br />

Total financial liabilities (8,821) (8,448) (6,186) (6,127)<br />

Total (6,182) (5,809) (4,861) (4,802)<br />

The fair values of financial instruments have been determined by reference to prices available from the markets on which the instruments are traded.<br />

The fair value of all other items have been calculated by discounting expected future cash flows at prevailing interest rates. The above table excludes<br />

other receivables/payables, which have fair values equal to their carrying values.<br />

<strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong><br />

<strong>Financial</strong> <strong>Statements</strong> <strong>2008</strong> 75