Tesco plc Annual Report and Financial Statements 2008

Tesco plc Annual Report and Financial Statements 2008

Tesco plc Annual Report and Financial Statements 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

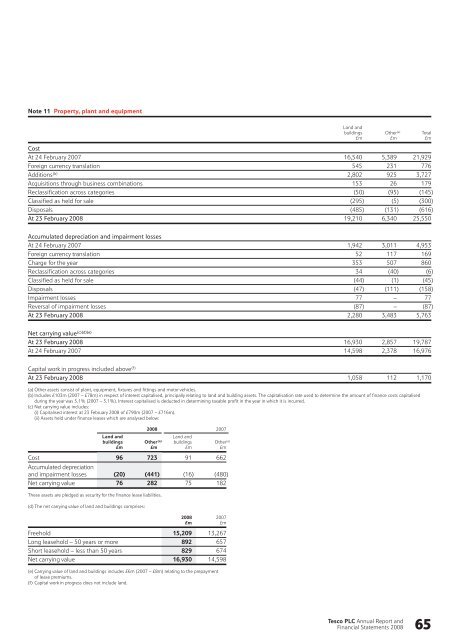

Note 11 Property, plant <strong>and</strong> equipment<br />

L<strong>and</strong> <strong>and</strong><br />

buildings Other (a) Total<br />

£m £m £m<br />

Cost<br />

At 24 February 2007 16,540 5,389 21,929<br />

Foreign currency translation 545 231 776<br />

Additions (b) 2,802 925 3,727<br />

Acquisitions through business combinations 153 26 179<br />

Reclassification across categories (50) (95) (145)<br />

Classified as held for sale (295) (5) (300)<br />

Disposals (485) (131) (616)<br />

At 23 February <strong>2008</strong> 19,210 6,340 25,550<br />

Accumulated depreciation <strong>and</strong> impairment losses<br />

At 24 February 2007 1,942 3,011 4,953<br />

Foreign currency translation 52 117 169<br />

Charge for the year 353 507 860<br />

Reclassification across categories 34 (40) (6)<br />

Classified as held for sale (44) (1) (45)<br />

Disposals (47) (111) (158)<br />

Impairment losses 77 – 77<br />

Reversal of impairment losses (87) – (87)<br />

At 23 February <strong>2008</strong> 2,280 3,483 5,763<br />

Net carrying value (c)(d)(e)<br />

At 23 February <strong>2008</strong> 16,930 2,857 19,787<br />

At 24 February 2007 14,598 2,378 16,976<br />

Capital work in progress included above (f)<br />

At 23 February <strong>2008</strong> 1,058 112 1,170<br />

(a) Other assets consist of plant, equipment, fixtures <strong>and</strong> fittings <strong>and</strong> motor vehicles.<br />

(b) Includes £103m (2007 – £78m) in respect of interest capitalised, principally relating to l<strong>and</strong> <strong>and</strong> building assets. The capitalisation rate used to determine the amount of finance costs capitalised<br />

during the year was 5.1% (2007 – 5.1%). Interest capitalised is deducted in determining taxable profit in the year in which it is incurred.<br />

(c) Net carrying value includes:<br />

(i) Capitalised interest at 23 February <strong>2008</strong> of £790m (2007 – £716m).<br />

(ii) Assets held under finance leases which are analysed below:<br />

<strong>2008</strong> 2007<br />

L<strong>and</strong> <strong>and</strong> L<strong>and</strong> <strong>and</strong><br />

buildings Other (a) buildings Other (a)<br />

£m £m £m £m<br />

Cost 96 723 91 662<br />

Accumulated depreciation<br />

<strong>and</strong> impairment losses (20) (441) (16) (480)<br />

Net carrying value 76 282 75 182<br />

These assets are pledged as security for the finance lease liabilities.<br />

(d) The net carrying value of l<strong>and</strong> <strong>and</strong> buildings comprises:<br />

<strong>2008</strong> 2007<br />

£m £m<br />

Freehold 15,209 13,267<br />

Long leasehold – 50 years or more 892 657<br />

Short leasehold – less than 50 years 829 674<br />

Net carrying value 16,930 14,598<br />

(e) Carrying value of l<strong>and</strong> <strong>and</strong> buildings includes £6m (2007 – £8m) relating to the prepayment<br />

of lease premiums.<br />

(f) Capital work in progress does not include l<strong>and</strong>.<br />

<strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong><br />

<strong>Financial</strong> <strong>Statements</strong> <strong>2008</strong> 65