Tesco plc Annual Report and Financial Statements 2008

Tesco plc Annual Report and Financial Statements 2008

Tesco plc Annual Report and Financial Statements 2008

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Group financial statements continued<br />

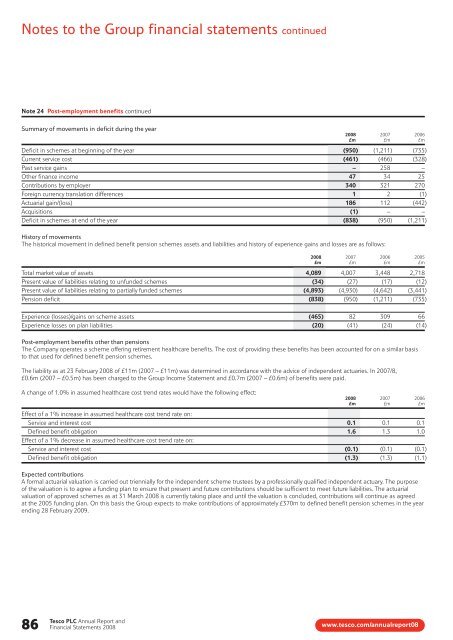

Note 24 Post-employment benefits continued<br />

Summary of movements in deficit during the year<br />

<strong>2008</strong> 2007 2006<br />

£m £m £m<br />

Deficit in schemes at beginning of the year (950) (1,211) (735)<br />

Current service cost (461) (466) (328)<br />

Past service gains – 258 –<br />

Other finance income 47 34 25<br />

Contributions by employer 340 321 270<br />

Foreign currency translation differences 1 2 (1)<br />

Actuarial gain/(loss) 186 112 (442)<br />

Acquisitions (1) – –<br />

Deficit in schemes at end of the year (838) (950) (1,211)<br />

History of movements<br />

The historical movement in defined benefit pension schemes assets <strong>and</strong> liabilities <strong>and</strong> history of experience gains <strong>and</strong> losses are as follows:<br />

<strong>2008</strong> 2007 2006 2005<br />

£m £m £m £m<br />

Total market value of assets 4,089 4,007 3,448 2,718<br />

Present value of liabilities relating to unfunded schemes (34) (27) (17) (12)<br />

Present value of liabilities relating to partially funded schemes (4,893) (4,930) (4,642) (3,441)<br />

Pension deficit (838) (950) (1,211) (735)<br />

Experience (losses)/gains on scheme assets (465) 82 309 66<br />

Experience losses on plan liabilities (20) (41) (24) (14)<br />

Post-employment benefits other than pensions<br />

The Company operates a scheme offering retirement healthcare benefits. The cost of providing these benefits has been accounted for on a similar basis<br />

to that used for defined benefit pension schemes.<br />

The liability as at 23 February <strong>2008</strong> of £11m (2007 – £11m) was determined in accordance with the advice of independent actuaries. In 2007/8,<br />

£0.6m (2007 – £0.5m) has been charged to the Group Income Statement <strong>and</strong> £0.7m (2007 – £0.6m) of benefits were paid.<br />

A change of 1.0% in assumed healthcare cost trend rates would have the following effect:<br />

<strong>2008</strong> 2007 2006<br />

£m £m £m<br />

Effect of a 1% increase in assumed healthcare cost trend rate on:<br />

Service <strong>and</strong> interest cost 0.1 0.1 0.1<br />

Defined benefit obligation 1.6 1.3 1.0<br />

Effect of a 1% decrease in assumed healthcare cost trend rate on:<br />

Service <strong>and</strong> interest cost (0.1) (0.1) (0.1)<br />

Defined benefit obligation (1.3) (1.3) (1.1)<br />

Expected contributions<br />

A formal actuarial valuation is carried out triennially for the independent scheme trustees by a professionally qualified independent actuary. The purpose<br />

of the valuation is to agree a funding plan to ensure that present <strong>and</strong> future contributions should be sufficient to meet future liabilities. The actuarial<br />

valuation of approved schemes as at 31 March <strong>2008</strong> is currently taking place <strong>and</strong> until the valuation is concluded, contributions will continue as agreed<br />

at the 2005 funding plan. On this basis the Group expects to make contributions of approximately £370m to defined benefit pension schemes in the year<br />

ending 28 February 2009.<br />

86<br />

<strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong><br />

<strong>Financial</strong> <strong>Statements</strong> <strong>2008</strong><br />

www.tesco.com/annualreport08