Tesco plc Annual Report and Financial Statements 2008

Tesco plc Annual Report and Financial Statements 2008

Tesco plc Annual Report and Financial Statements 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

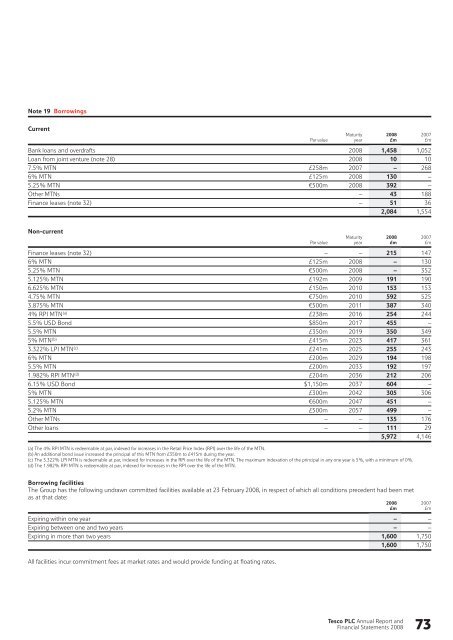

Note 19 Borrowings<br />

Current<br />

Maturity <strong>2008</strong> 2007<br />

Par value year £m £m<br />

Bank loans <strong>and</strong> overdrafts <strong>2008</strong> 1,458 1,052<br />

Loan from joint venture (note 28) <strong>2008</strong> 10 10<br />

7.5% MTN £258m 2007 – 268<br />

6% MTN £125m <strong>2008</strong> 130 –<br />

5.25% MTN €500m <strong>2008</strong> 392 –<br />

Other MTNs – 43 188<br />

Finance leases (note 32) – 51 36<br />

2,084 1,554<br />

Non-current<br />

Maturity <strong>2008</strong> 2007<br />

Par value year £m £m<br />

Finance leases (note 32) – – 215 147<br />

6% MTN £125m <strong>2008</strong> – 130<br />

5.25% MTN €500m <strong>2008</strong> – 352<br />

5.125% MTN £192m 2009 191 190<br />

6.625% MTN £150m 2010 153 153<br />

4.75% MTN €750m 2010 592 525<br />

3.875% MTN €500m 2011 387 340<br />

4% RPI MTN (a) £238m 2016 254 244<br />

5.5% USD Bond $850m 2017 455 –<br />

5.5% MTN £350m 2019 350 349<br />

5% MTN (b) £415m 2023 417 361<br />

3.322% LPI MTN (c) £241m 2025 255 243<br />

6% MTN £200m 2029 194 198<br />

5.5% MTN £200m 2033 192 197<br />

1.982% RPI MTN (d) £204m 2036 212 206<br />

6.15% USD Bond $1,150m 2037 604 –<br />

5% MTN £300m 2042 305 306<br />

5.125% MTN €600m 2047 451 –<br />

5.2% MTN £500m 2057 499 –<br />

Other MTNs – – 135 176<br />

Other loans – – 111 29<br />

5,972 4,146<br />

(a) The 4% RPI MTN is redeemable at par, indexed for increases in the Retail Price Index (RPI) over the life of the MTN.<br />

(b) An additional bond issue increased the principal of this MTN from £350m to £415m during the year.<br />

(c) The 3.322% LPI MTN is redeemable at par, indexed for increases in the RPI over the life of the MTN. The maximum indexation of the principal in any one year is 5%, with a minimum of 0%.<br />

(d) The 1.982% RPI MTN is redeemable at par, indexed for increases in the RPI over the life of the MTN.<br />

Borrowing facilities<br />

The Group has the following undrawn committed facilities available at 23 February <strong>2008</strong>, in respect of which all conditions precedent had been met<br />

as at that date:<br />

<strong>2008</strong> 2007<br />

£m £m<br />

Expiring within one year – –<br />

Expiring between one <strong>and</strong> two years – –<br />

Expiring in more than two years 1,600 1,750<br />

1,600 1,750<br />

All facilities incur commitment fees at market rates <strong>and</strong> would provide funding at floating rates.<br />

<strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong><br />

<strong>Financial</strong> <strong>Statements</strong> <strong>2008</strong> 73