wcms_161662

wcms_161662

wcms_161662

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

14. There is a concern that, whether through design or lack of capacity, investments by NOCs<br />

in conventional hydrocarbons will not keep pace with demand growth, while restricted<br />

access to resources will prevent IOCs from making up the shortfall. Production at such<br />

IOCs as ExxonMobil, British Petroleum (BP), Royal Dutch/Shell and Chevron is declining<br />

or stagnating. Thus, IOCs and NOCs compete for resources, reserves and ultimately for<br />

customers, but there is also a good deal of collaboration among them. Many fields are<br />

co-owned by several companies, with one company acting as lead operator. 9<br />

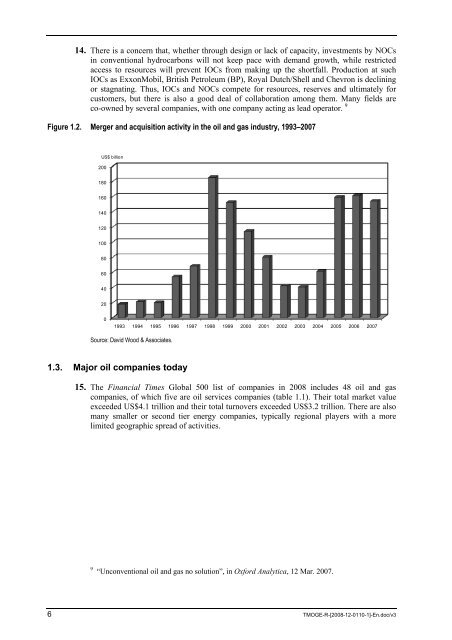

Figure 1.2. Merger and acquisition activity in the oil and gas industry, 1993–2007<br />

US$ billion<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Source: David Wood & Associates.<br />

1.3. Major oil companies today<br />

15. The Financial Times Global 500 list of companies in 2008 includes 48 oil and gas<br />

companies, of which five are oil services companies (table 1.1). Their total market value<br />

exceeded US$4.1 trillion and their total turnovers exceeded US$3.2 trillion. There are also<br />

many smaller or second tier energy companies, typically regional players with a more<br />

limited geographic spread of activities.<br />

9 “Unconventional oil and gas no solution”, in Oxford Analytica, 12 Mar. 2007.<br />

6 TMOGE-R-[2008-12-0110-1]-En.doc/v3