p17n63qg7jmbh1r4fin71pds1p454.pdf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolidated Financial Statements<br />

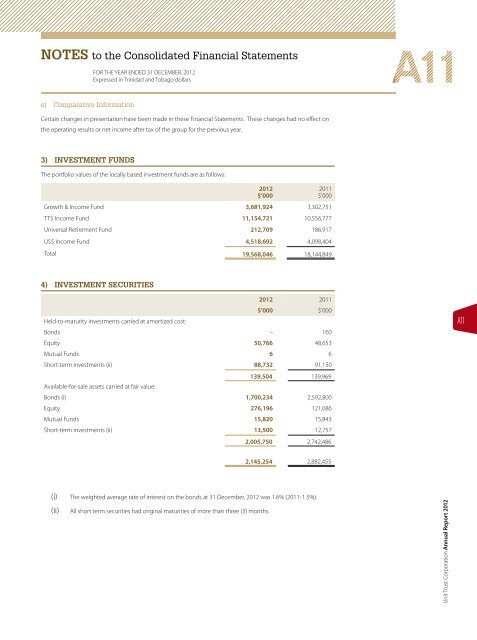

s) Comparative Information<br />

FOR THE YEAR ENDED 31 DECEMBER, 2012<br />

Expressed in Trinidad and Tobago dollars<br />

Certain changes in presentation have been made in these Financial Statements. These changes had no effect on<br />

the operating results or net income after tax of the group for the previous year.<br />

3) INVESTMENT FUNDS<br />

The portfolio values of the locally based investment funds are as follows:<br />

2012<br />

$’000<br />

2011<br />

$’000<br />

Growth & Income Fund 3,681,924 3,302,751<br />

TT$ Income Fund 11,154,721 10,556,777<br />

Universal Retirement Fund 212,709 186,917<br />

US$ Income Fund 4,518,692 4,098,404<br />

Total 19,568,046 18,144,849<br />

4) INVESTMENT SECURITIES<br />

2012 2011<br />

$’000 $’000<br />

Held-to-maturity investments carried at amortized cost:<br />

Bonds - 160<br />

Equity 50,766 48,653<br />

Mutual Funds 6 6<br />

Short-term investments (ii) 88,732 91,150<br />

Available-for-sale assets carried at fair value:<br />

139,504 139,969<br />

Bonds (i) 1,700,234 2,592,800<br />

Equity 276,196 121,086<br />

Mutual Funds 15,820 15,843<br />

Short-term investments (ii) 13,500 12,757<br />

2,005,750 2,742,486<br />

2,145,254 2,882,455<br />

(i) The weighted average rate of interest on the bonds at 31 December, 2012 was 1.6% (2011: 1.5%).<br />

(ii) All short term securities had original maturities of more than three (3) months.<br />

A11<br />

Unit Trust Corporation Annual Report 2012<br />

A11