p17n63qg7jmbh1r4fin71pds1p454.pdf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A22<br />

A22<br />

| nET LOSS FROM DISCOnTInUED OPERATIOnS|<br />

Unit Trust Corporation Annual Report 2012<br />

Trinidad and Tobago Unit Trust Corporation<br />

Notes<br />

to the Consolidated<br />

Financial Statements<br />

distributions to Initial Capital Contributors of $0.3 million (2011:<br />

$0.4 million).<br />

b) tt$ Income fund<br />

Distributions in the TT$ Income Fund are made quarterly in<br />

February, May, August and november. Income accrued as at 31<br />

December, 2012 for distribution in the quarter ending February<br />

2013 amounted to $12.6 million (2011: $12.8 million).<br />

c) us$ Income fund<br />

Distributions in the US$ Income Fund are paid by calendar quarters.<br />

28) NET LOSS FROM DISCONTINUED<br />

OPERATIONS<br />

a) unit trust Corporation (belize) limited<br />

During 2011 the Unit Trust Corporation (Belize) Limited ceased<br />

operations and appointed a Liquidator who disposed of the assets<br />

of both the Fund and the company and has repaid both unit<br />

holders and creditors. The Liquidator expects to submit his final<br />

report during 2013. The Corporation does not expect to recover<br />

either its investment of $17.7 million or the advances outstanding<br />

at December 2011 - $0.4 million. These losses were recognised<br />

as a Loss on Discontinued Operations in the 2011 Consolidated<br />

Statement of Income.<br />

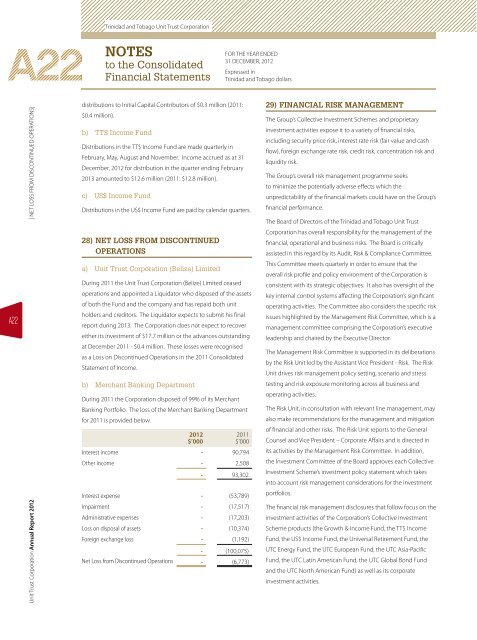

b) merchant banking department<br />

During 2011 the Corporation disposed of 99% of its Merchant<br />

Banking Portfolio. The loss of the Merchant Banking Department<br />

for 2011 is provided below.<br />

2012<br />

$’000<br />

FOR THE YEAR ENDED<br />

31 DECEMBER, 2012<br />

Expressed in<br />

Trinidad and Tobago dollars<br />

2011<br />

$’000<br />

Interest income - 90,794<br />

other income - 2,508<br />

- 93,302<br />

Interest expense - (53,789)<br />

Impairment - (17,517)<br />

administrative expenses - (17,203)<br />

Loss on disposal of assets - (10,374)<br />

foreign exchange loss - (1,192)<br />

- (100,075)<br />

net Loss from Discontinued operations - (6,773)<br />

29) FINANCIAL RISK MANAGEMENT<br />

The Group’s Collective Investment Schemes and proprietary<br />

investment activities expose it to a variety of financial risks,<br />

including security price risk, interest rate risk (fair value and cash<br />

flow), foreign exchange rate risk, credit risk, concentration risk and<br />

liquidity risk.<br />

The Group’s overall risk management programme seeks<br />

to minimize the potentially adverse effects which the<br />

unpredictability of the financial markets could have on the Group’s<br />

financial performance.<br />

The Board of Directors of the Trinidad and Tobago Unit Trust<br />

Corporation has overall responsibility for the management of the<br />

financial, operational and business risks. The Board is critically<br />

assisted in this regard by its Audit, Risk & Compliance Committee.<br />

This Committee meets quarterly in order to ensure that the<br />

overall risk profile and policy environment of the Corporation is<br />

consistent with its strategic objectives. It also has oversight of the<br />

key internal control systems affecting the Corporation’s significant<br />

operating activities. The Committee also considers the specific risk<br />

issues highlighted by the Management Risk Committee, which is a<br />

management committee comprising the Corporation’s executive<br />

leadership and chaired by the Executive Director.<br />

The Management Risk Committee is supported in its deliberations<br />

by the Risk Unit led by the Assistant Vice President - Risk. The Risk<br />

Unit drives risk management policy setting, scenario and stress<br />

testing and risk exposure monitoring across all business and<br />

operating activities.<br />

The Risk Unit, in consultation with relevant line management, may<br />

also make recommendations for the management and mitigation<br />

of financial and other risks. The Risk Unit reports to the General<br />

Counsel and Vice President – Corporate Affairs and is directed in<br />

its activities by the Management Risk Committee. In addition,<br />

the Investment Committee of the Board approves each Collective<br />

Investment Scheme’s investment policy statement which takes<br />

into account risk management considerations for the investment<br />

portfolios.<br />

The financial risk management disclosures that follow focus on the<br />

investment activities of the Corporation’s Collective Investment<br />

Scheme products (the Growth & Income Fund, the TT$ Income<br />

Fund, the US$ Income Fund, the Universal Retirement Fund, the<br />

UTC Energy Fund, the UTC European Fund, the UTC Asia-Pacific<br />

Fund, the UTC Latin American Fund, the UTC Global Bond Fund<br />

and the UTC north American Fund) as well as its corporate<br />

investment activities.