p17n63qg7jmbh1r4fin71pds1p454.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

FOR THE YEAR ENDED 31 DECEMBER, 2012<br />

Expressed in Trinidad and Tobago dollars<br />

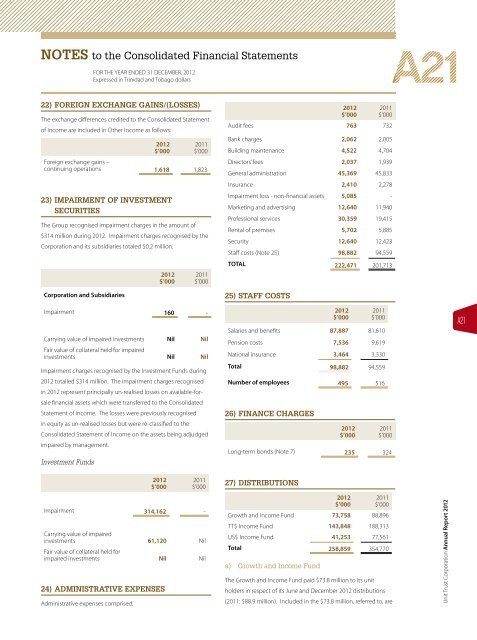

22) FOREIGN EXCHANGE GAINS/(LOSSES)<br />

The exchange differences credited to the Consolidated Statement<br />

of Income are included in Other Income as follows:<br />

2012<br />

$’000<br />

2011<br />

$’000<br />

Foreign exchange gains –<br />

continuing operations 1,618 1,823<br />

23) IMPAIRMENT OF INVESTMENT<br />

SECURITIES<br />

The Group recognised impairment charges in the amount of<br />

$314 million during 2012. Impairment charges recognised by the<br />

Corporation and its subsidiaries totaled $0.2 million.<br />

Corporation and Subsidiaries<br />

Impairment<br />

2012<br />

$’000<br />

160<br />

2011<br />

$’000<br />

Carrying value of impaired investments<br />

Fair value of collateral held for impaired<br />

Nil Nil<br />

investments Nil Nil<br />

Impairment charges recognised by the Investment Funds during<br />

2012 totalled $314 million. The impairment charges recognised<br />

in 2012 represent principally un-realised losses on available-forsale<br />

financial assets which were transferred to the Consolidated<br />

Statement of Income. The losses were previously recognised<br />

in equity as un-realised losses but were re-classified to the<br />

Consolidated Statement of Income on the assets being adjudged<br />

impaired by management.<br />

Investment Funds<br />

2012<br />

$’000<br />

-<br />

2011<br />

$’000<br />

Impairment 314,162 -<br />

Carrying value of impaired<br />

investments<br />

Fair value of collateral held for<br />

61,120 nil<br />

impaired investments Nil nil<br />

24) ADMINISTRATIVE EXPENSES<br />

Administrative expenses comprised:<br />

2012<br />

$’000<br />

2011<br />

$’000<br />

Audit fees 763 732<br />

Bank charges 2,062 2,005<br />

Building maintenance 4,522 4,704<br />

Directors’ fees 2,037 1,939<br />

General administration 45,369 45,833<br />

Insurance 2,410 2,278<br />

Impairment loss - non-financial assets 5,085 -<br />

Marketing and advertising 12,640 11,940<br />

Professional services 30,359 19,415<br />

Rental of premises 5,702 5,885<br />

Security 12,640 12,423<br />

Staff costs (note 25) 98,882 94,559<br />

TOTAL 222,471 201,713<br />

25) STAFF COSTS<br />

2012<br />

$’000<br />

2011<br />

$’000<br />

Salaries and benefits 87,887 81,610<br />

Pension costs 7,536 9,619<br />

national insurance 3,464 3,330<br />

Total 98,882 94,559<br />

Number of employees 495 516<br />

26) FINANCE CHARGES<br />

2012<br />

$’000<br />

2011<br />

$’000<br />

Long-term bonds (note 7) 235 324<br />

27) DISTRIBUTIONS<br />

2012<br />

$’000<br />

2011<br />

$’000<br />

Growth and Income Fund 73,758 88,896<br />

TT$ Income Fund 143,848 188,313<br />

US$ Income Fund 41,253 77,561<br />

Total 258,859 354,770<br />

a) Growth and Income fund<br />

The Growth and Income Fund paid $73.8 million to its unit<br />

holders in respect of its June and December 2012 distributions<br />

(2011: $88.9 million). Included in the $73.8 million, referred to, are<br />

A21<br />

Unit Trust Corporation Annual Report 2012<br />

A21