p17n63qg7jmbh1r4fin71pds1p454.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

FOR THE YEAR ENDED 31 DECEMBER, 2012<br />

Expressed in Trinidad and Tobago dollars<br />

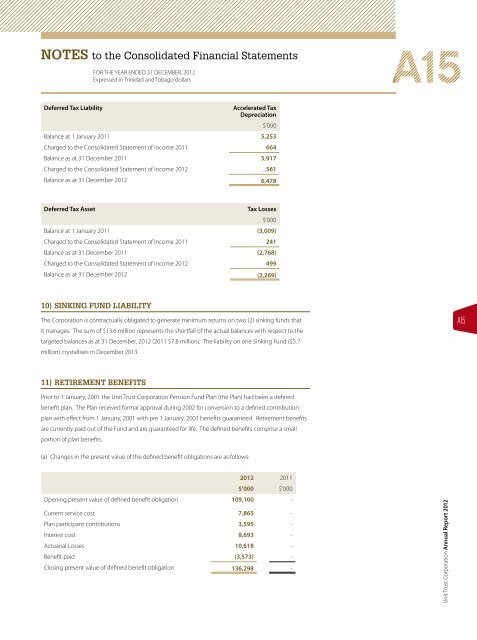

Deferred Tax Liability Accelerated Tax<br />

Depreciation<br />

$’000<br />

Balance at 1 January 2011 5,253<br />

Charged to the Consolidated Statement of Income 2011 664<br />

Balance as at 31 December 2011 5,917<br />

Charged to the Consolidated Statement of Income 2012 _561<br />

Balance as at 31 December 2012 6,478<br />

Deferred Tax Asset Tax Losses<br />

$’000<br />

Balance at 1 January 2011 (3,009)<br />

Charged to the Consolidated Statement of Income 2011 241<br />

Balance as at 31 December 2011 (2,768)<br />

Charged to the Consolidated Statement of Income 2012 499<br />

Balance as at 31 December 2012 (2,269)<br />

10) SINKING FUND LIABILITY<br />

The Corporation is contractually obligated to generate minimum returns on two (2) sinking funds that<br />

it manages. The sum of $13.6 million represents the shortfall of the actual balances with respect to the<br />

targeted balances as at 31 December, 2012 (2011 $7.8 million). The liability on one Sinking Fund ($5.7<br />

million) crystallises in December 2013.<br />

11) RETIREMENT BENEFITS<br />

Prior to 1 January, 2001 the Unit Trust Corporation Pension Fund Plan (the Plan) had been a defined<br />

benefit plan. The Plan received formal approval during 2002 for conversion to a defined contribution<br />

plan with effect from 1 January, 2001 with pre 1 January, 2001 benefits guaranteed. Retirement benefits<br />

are currently paid out of the Fund and are guaranteed for life. The defined benefits comprise a small<br />

portion of plan benefits.<br />

(a) Changes in the present value of the defined benefit obligations are as follows:<br />

2012 2011<br />

$’000 $’000<br />

Opening present value of defined benefit obligation 109,100 -<br />

Current service cost 7,865 -<br />

Plan participant contributions 3,595 -<br />

Interest cost 8,693 -<br />

Actuarial Losses 10,618 -<br />

Benefit paid (3,573) -<br />

Closing present value of defined benefit obligation 136,298 -<br />

A15<br />

Unit Trust Corporation Annual Report 2012<br />

A15