p17n63qg7jmbh1r4fin71pds1p454.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

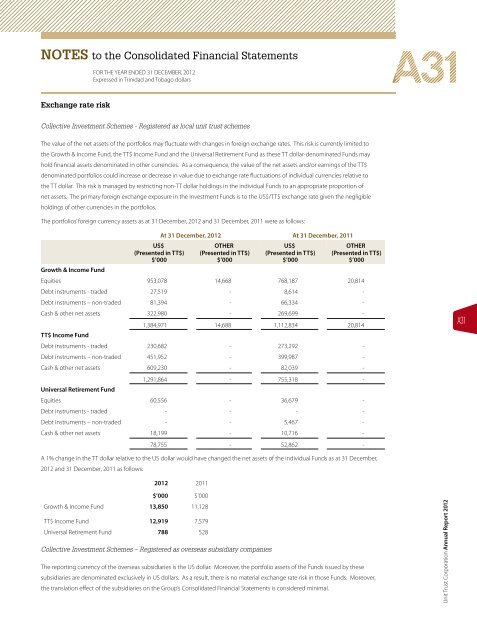

Exchange rate risk<br />

FOR THE YEAR ENDED 31 DECEMBER, 2012<br />

Expressed in Trinidad and Tobago dollars<br />

Collective Investment Schemes - Registered as local unit trust schemes<br />

The value of the net assets of the portfolios may fluctuate with changes in foreign exchange rates. This risk is currently limited to<br />

the Growth & Income Fund, the TT$ Income Fund and the Universal Retirement Fund as these TT dollar-denominated Funds may<br />

hold financial assets denominated in other currencies. As a consequence, the value of the net assets and/or earnings of the TT$<br />

denominated portfolios could increase or decrease in value due to exchange rate fluctuations of individual currencies relative to<br />

the TT dollar. This risk is managed by restricting non-TT dollar holdings in the individual Funds to an appropriate proportion of<br />

net assets. The primary foreign exchange exposure in the Investment Funds is to the US$/TT$ exchange rate given the negligible<br />

holdings of other currencies in the portfolios.<br />

The portfolios’ foreign currency assets as at 31 December, 2012 and 31 December, 2011 were as follows:<br />

At 31 December, 2012 At 31 December, 2011<br />

US$ OTHER US$ OTHER<br />

(Presented in TT$) (Presented in TT$) (Presented in TT$) (Presented in TT$)<br />

$’000<br />

$’000<br />

$’000<br />

$’000<br />

Growth & Income Fund<br />

Equities 953,078 14,668 768,187 20,814<br />

Debt instruments - traded 27,519 - 8,614 -<br />

Debt instruments – non-traded 81,394 - 66,334 -<br />

Cash & other net assets 322,980 - 269,699 -<br />

TT$ Income Fund<br />

1,384,971 14,688 1,112,834 20,814<br />

Debt instruments - traded 230,682 - 273,292 -<br />

Debt instruments – non-traded 451,952 - 399,987 -<br />

Cash & other net assets 609,230 - 82,039 -<br />

Universal Retirement Fund<br />

1,291,864 - 755,318 -<br />

Equities 60,556 - 36,679 -<br />

Debt instruments - traded - - - -<br />

Debt instruments – non-traded - - 5,467 -<br />

Cash & other net assets 18,199 - 10,716 -<br />

78,755 - 52,862 -<br />

A 1% change in the TT dollar relative to the US dollar would have changed the net assets of the individual Funds as at 31 December,<br />

2012 and 31 December, 2011 as follows:<br />

2012 2011<br />

$’000 $’000<br />

Growth & Income Fund 13,850 11,128<br />

TT$ Income Fund 12,919 7,579<br />

Universal Retirement Fund 788 528<br />

Collective Investment Schemes – Registered as overseas subsidiary companies<br />

The reporting currency of the overseas subsidiaries is the US dollar. Moreover, the portfolio assets of the Funds issued by these<br />

subsidiaries are denominated exclusively in US dollars. As a result, there is no material exchange rate risk in those Funds. Moreover,<br />

the translation effect of the subsidiaries on the Group’s Consolidated Financial Statements is considered minimal.<br />

A31<br />

Unit Trust Corporation Annual Report 2012<br />

A31