ARCO VARA AS - NASDAQ OMX Baltic

ARCO VARA AS - NASDAQ OMX Baltic

ARCO VARA AS - NASDAQ OMX Baltic

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

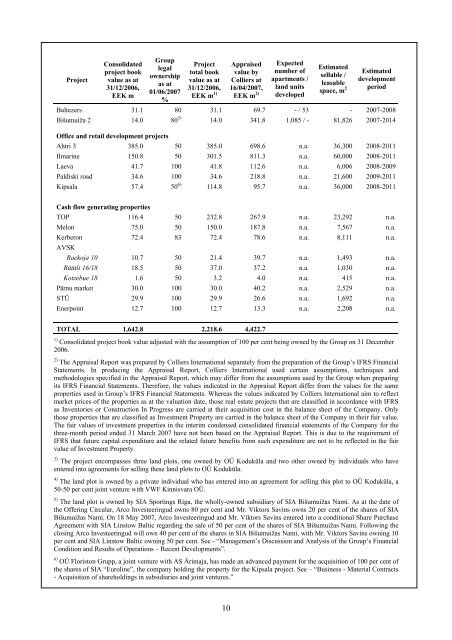

Project<br />

Consolidated<br />

project book<br />

value as at<br />

31/12/2006,<br />

EEK m<br />

Group<br />

legal<br />

ownership<br />

as at<br />

01/06/2007<br />

%<br />

Project<br />

total book<br />

value as at<br />

31/12/2006,<br />

EEK m 1)<br />

10<br />

Appraised<br />

value by<br />

Colliers at<br />

16/04/2007,<br />

EEK m 2)<br />

Expected<br />

number of<br />

apartments /<br />

land units<br />

developed<br />

Estimated<br />

sellable /<br />

leasable<br />

space, m 2<br />

Estimated<br />

development<br />

period<br />

Baltezers 31.1 80 31.1 69.7 - / 53 - 2007-2008<br />

Bišumuiža 2 14.0 80 5) 14.0 341.8 1,085 / - 81,826 2007-2014<br />

Office and retail development projects<br />

Ahtri 3 385.0 50 385.0 698.6 n.a. 36,300 2008-2011<br />

Ilmarine 150.8 50 301.5 811.3 n.a. 60,000 2008-2011<br />

Laeva 41.7 100 41.8 112.6 n.a. 6,006 2008-2009<br />

Paldiski road 34.6 100 34.6 218.8 n.a. 21,600 2009-2011<br />

Kipsala 57.4 50 6) 114.8 95.7 n.a. 36,000 2008-2011<br />

Cash flow generating properties<br />

TOP 116.4 50 232.8 267.9 n.a. 23,292 n.a.<br />

Melon 75.0 50 150.0 187.8 n.a. 7,567 n.a.<br />

Kerberon<br />

AVSK<br />

72.4 83 72.4 78.6 n.a. 8,111 n.a.<br />

Raekoja 10 10.7 50 21.4 39.7 n.a. 1,493 n.a.<br />

Rüütli 16/18 18.5 50 37.0 37.2 n.a. 1,030 n.a.<br />

Kotzebue 18 1.6 50 3.2 4.0 n.a. 415 n.a.<br />

Pärnu market 30.0 100 30.0 40.2 n.a. 2,529 n.a.<br />

STÜ 29.9 100 29.9 26.6 n.a. 1,692 n.a.<br />

Enerpoint 12.7 100 12.7 13.3 n.a. 2,208 n.a.<br />

TOTAL 1,642.8 2,218.6 4,422.7<br />

1)<br />

Consolidated project book value adjusted with the assumption of 100 per cent being owned by the Group on 31 December<br />

2006.<br />

2) The Appraisal Report was prepared by Colliers International separately from the preparation of the Group’s IFRS Financial<br />

Statements. In producing the Appraisal Report, Colliers International used certain assumptions, techniques and<br />

methodologies specified in the Appraisal Report, which may differ from the assumptions used by the Group when preparing<br />

its IFRS Financial Statements. Therefore, the values indicated in the Appraisal Report differ from the values for the same<br />

properties used in Group’s IFRS Financial Statements. Whereas the values indicated by Colliers International aim to reflect<br />

market prices of the properties as at the valuation date, those real estate projects that are classified in accordance with IFRS<br />

as Inventories or Construction In Progress are carried at their acquisition cost in the balance sheet of the Company. Only<br />

those properties that are classified as Investment Property are carried in the balance sheet of the Company in their fair value.<br />

The fair values of investment properties in the interim condensed consolidated financial statements of the Company for the<br />

three-month period ended 31 March 2007 have not been based on the Appraisal Report. This is due to the requirement of<br />

IFRS that future capital expenditure and the related future benefits from such expenditure are not to be reflected in the fair<br />

value of Investment Property.<br />

3) The project encompasses three land plots, one owned by OÜ Koduküla and two other owned by individuals who have<br />

entered into agreements for selling these land plots to OÜ Koduküla.<br />

4) The land plot is owned by a private individual who has entered into an agreement for selling this plot to OÜ Koduküla, a<br />

50-50 per cent joint venture with VWF Kinnisvara OÜ.<br />

5) The land plot is owned by SIA Sportings Riga, the wholly-owned subsidiary of SIA Bišumuižas Nami. As at the date of<br />

the Offering Circular, Arco Investeeringud owns 80 per cent and Mr. Viktors Savins owns 20 per cent of the shares of SIA<br />

Bišumuižas Nami. On 18 May 2007, Arco Investeeringud and Mr. Viktors Savins entered into a conditional Share Purchase<br />

Agreement with SIA Linstow <strong>Baltic</strong> regarding the sale of 50 per cent of the shares of SIA Bišumuižas Nami. Following the<br />

closing Arco Investeeringud will own 40 per cent of the shares in SIA Bišumuižas Nami, with Mr. Viktors Savins owning 10<br />

per cent and SIA Linstow <strong>Baltic</strong> owning 50 per cent. See - “Management’s Discussion and Analysis of the Group’s Financial<br />

Condition and Results of Operations – Recent Developments”.<br />

6) OÜ Floriston Grupp, a joint venture with <strong>AS</strong> Ärimaja, has made an advanced payment for the acquisition of 100 per cent of<br />

the shares of SIA “Euroline”, the company holding the property for the Kipsala project. See – “Business - Material Contracts<br />

- Acquisition of shareholdings in subsidiaries and joint ventures.”