ARCO VARA AS - NASDAQ OMX Baltic

ARCO VARA AS - NASDAQ OMX Baltic

ARCO VARA AS - NASDAQ OMX Baltic

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

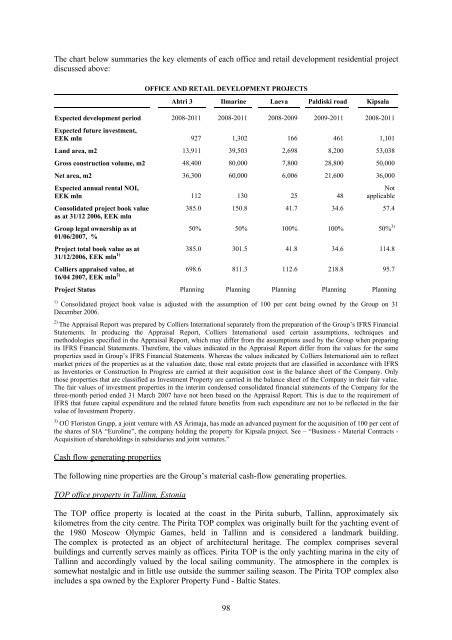

The chart below summaries the key elements of each office and retail development residential project<br />

discussed above:<br />

OFFICE AND RETAIL DEVELOPMENT PROJECTS<br />

Ahtri 3 Ilmarine Laeva Paldiski road Kipsala<br />

Expected development period 2008-2011 2008-2011 2008-2009 2009-2011 2008-2011<br />

Expected future investment,<br />

EEK mln<br />

927 1,302 166 461 1,101<br />

Land area, m2 13,911 39,503 2,698 8,200 53,038<br />

Gross construction volume, m2 48,400 80,000 7,800 28,800 50,000<br />

Net area, m2 36,300 60,000 6,006 21,600 36,000<br />

Expected annual rental NOI,<br />

EEK mln<br />

Consolidated project book value<br />

as at 31/12 2006, EEK mln<br />

Group legal ownership as at<br />

01/06/2007, %<br />

112 130 25 48<br />

98<br />

Not<br />

applicable<br />

385.0 150.8 41.7 34.6 57.4<br />

50% 50% 100% 100% 50% 3)<br />

Project total book value as at<br />

31/12/2006, EEK mln 1)<br />

385.0 301.5 41.8 34.6 114.8<br />

Colliers appraised value, at<br />

16/04 2007, EEK mln 2)<br />

698.6 811.3 112.6 218.8 95.7<br />

Project Status Planning Planning Planning Planning Planning<br />

1)<br />

Consolidated project book value is adjusted with the assumption of 100 per cent being owned by the Group on 31<br />

December 2006.<br />

2) The Appraisal Report was prepared by Colliers International separately from the preparation of the Group’s IFRS Financial<br />

Statements. In producing the Appraisal Report, Colliers International used certain assumptions, techniques and<br />

methodologies specified in the Appraisal Report, which may differ from the assumptions used by the Group when preparing<br />

its IFRS Financial Statements. Therefore, the values indicated in the Appraisal Report differ from the values for the same<br />

properties used in Group’s IFRS Financial Statements. Whereas the values indicated by Colliers International aim to reflect<br />

market prices of the properties as at the valuation date, those real estate projects that are classified in accordance with IFRS<br />

as Inventories or Construction In Progress are carried at their acquisition cost in the balance sheet of the Company. Only<br />

those properties that are classified as Investment Property are carried in the balance sheet of the Company in their fair value.<br />

The fair values of investment properties in the interim condensed consolidated financial statements of the Company for the<br />

three-month period ended 31 March 2007 have not been based on the Appraisal Report. This is due to the requirement of<br />

IFRS that future capital expenditure and the related future benefits from such expenditure are not to be reflected in the fair<br />

value of Investment Property.<br />

3) OÜ Floriston Grupp, a joint venture with <strong>AS</strong> Ärimaja, has made an advanced payment for the acquisition of 100 per cent of<br />

the shares of SIA “Euroline”, the company holding the property for Kipsala project. See – “Business - Material Contracts -<br />

Acquisition of shareholdings in subsidiaries and joint ventures.”<br />

Cash flow generating properties<br />

The following nine properties are the Group’s material cash-flow generating properties.<br />

TOP office property in Tallinn, Estonia<br />

The TOP office property is located at the coast in the Pirita suburb, Tallinn, approximately six<br />

kilometres from the city centre. The Pirita TOP complex was originally built for the yachting event of<br />

the 1980 Moscow Olympic Games, held in Tallinn and is considered a landmark building.<br />

The complex is protected as an object of architectural heritage. The complex comprises several<br />

buildings and currently serves mainly as offices. Pirita TOP is the only yachting marina in the city of<br />

Tallinn and accordingly valued by the local sailing community. The atmosphere in the complex is<br />

somewhat nostalgic and in little use outside the summer sailing season. The Pirita TOP complex also<br />

includes a spa owned by the Explorer Property Fund - <strong>Baltic</strong> States.