ARCO VARA AS - NASDAQ OMX Baltic

ARCO VARA AS - NASDAQ OMX Baltic

ARCO VARA AS - NASDAQ OMX Baltic

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

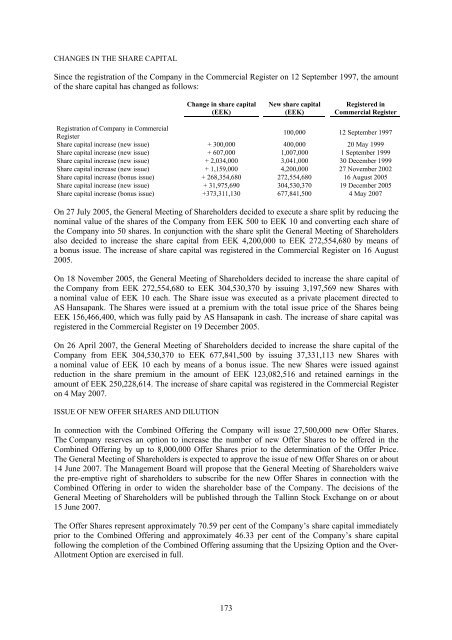

CHANGES IN THE SHARE CAPITAL<br />

Since the registration of the Company in the Commercial Register on 12 September 1997, the amount<br />

of the share capital has changed as follows:<br />

Change in share capital<br />

(EEK)<br />

173<br />

New share capital<br />

(EEK)<br />

Registered in<br />

Commercial Register<br />

Registration of Company in Commercial<br />

Register<br />

100,000 12 September 1997<br />

Share capital increase (new issue) + 300,000 400,000 20 May 1999<br />

Share capital increase (new issue) + 607,000 1,007,000 1 September 1999<br />

Share capital increase (new issue) + 2,034,000 3,041,000 30 December 1999<br />

Share capital increase (new issue) + 1,159,000 4,200,000 27 November 2002<br />

Share capital increase (bonus issue) + 268,354,680 272,554,680 16 August 2005<br />

Share capital increase (new issue) + 31,975,690 304,530,370 19 December 2005<br />

Share capital increase (bonus issue) +373,311,130 677,841,500 4 May 2007<br />

On 27 July 2005, the General Meeting of Shareholders decided to execute a share split by reducing the<br />

nominal value of the shares of the Company from EEK 500 to EEK 10 and converting each share of<br />

the Company into 50 shares. In conjunction with the share split the General Meeting of Shareholders<br />

also decided to increase the share capital from EEK 4,200,000 to EEK 272,554,680 by means of<br />

a bonus issue. The increase of share capital was registered in the Commercial Register on 16 August<br />

2005.<br />

On 18 November 2005, the General Meeting of Shareholders decided to increase the share capital of<br />

the Company from EEK 272,554,680 to EEK 304,530,370 by issuing 3,197,569 new Shares with<br />

a nominal value of EEK 10 each. The Share issue was executed as a private placement directed to<br />

<strong>AS</strong> Hansapank. The Shares were issued at a premium with the total issue price of the Shares being<br />

EEK 156,466,400, which was fully paid by <strong>AS</strong> Hansapank in cash. The increase of share capital was<br />

registered in the Commercial Register on 19 December 2005.<br />

On 26 April 2007, the General Meeting of Shareholders decided to increase the share capital of the<br />

Company from EEK 304,530,370 to EEK 677,841,500 by issuing 37,331,113 new Shares with<br />

a nominal value of EEK 10 each by means of a bonus issue. The new Shares were issued against<br />

reduction in the share premium in the amount of EEK 123,082,516 and retained earnings in the<br />

amount of EEK 250,228,614. The increase of share capital was registered in the Commercial Register<br />

on 4 May 2007.<br />

ISSUE OF NEW OFFER SHARES AND DILUTION<br />

In connection with the Combined Offering the Company will issue 27,500,000 new Offer Shares.<br />

The Company reserves an option to increase the number of new Offer Shares to be offered in the<br />

Combined Offering by up to 8,000,000 Offer Shares prior to the determination of the Offer Price.<br />

The General Meeting of Shareholders is expected to approve the issue of new Offer Shares on or about<br />

14 June 2007. The Management Board will propose that the General Meeting of Shareholders waive<br />

the pre-emptive right of shareholders to subscribe for the new Offer Shares in connection with the<br />

Combined Offering in order to widen the shareholder base of the Company. The decisions of the<br />

General Meeting of Shareholders will be published through the Tallinn Stock Exchange on or about<br />

15 June 2007.<br />

The Offer Shares represent approximately 70.59 per cent of the Company’s share capital immediately<br />

prior to the Combined Offering and approximately 46.33 per cent of the Company’s share capital<br />

following the completion of the Combined Offering assuming that the Upsizing Option and the Over-<br />

Allotment Option are exercised in full.