Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6. Key management compensation <strong>and</strong> Directors’ remuneration continued<br />

Key management is defined as the Leadership Team, two new members of which joined part way through the year <strong>and</strong> two left<br />

during the year.<br />

The short-term employment benefits include wages <strong>and</strong> salaries, bonuses, social security contributions <strong>and</strong> non-monetary benefits.<br />

7. Related Party Transactions<br />

In addition to compensation listed under note 6, as part of the WEBTEC acquisition the Group has provided for deferred consideration<br />

payments of US$10.0m <strong>and</strong> US$5.0m due on the achievement of certain performance targets over the next two years. R<strong>and</strong>y<br />

Holmes (Director of Global Development) is part owner of the company that will be paid these contingent amounts.<br />

The Group has incurred £0.1m of property lease costs during the year, payable to HPB Investments, a company owned in part by<br />

R<strong>and</strong>y Holmes. The lease expires in August 2019 <strong>and</strong> the annual lease cost is £0.2m.<br />

The pension schemes are related parties to the Group. There were no contributions outst<strong>and</strong>ing at the year end <strong>and</strong> full details of<br />

transactions within the pension schemes are detailed in note 25.<br />

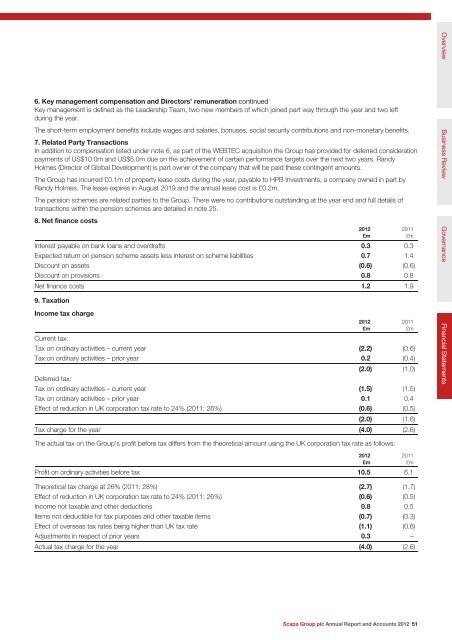

8. Net finance costs<br />

Interest payable on bank loans <strong>and</strong> overdrafts 0.3 0.3<br />

Expected return on pension scheme assets less interest on scheme liabilities 0.7 1.4<br />

Discount on assets (0.6) (0.6)<br />

Discount on provisions 0.8 0.8<br />

Net finance costs 1.2 1.9<br />

9. Taxation<br />

Income tax charge<br />

Current tax:<br />

Tax on ordinary activities – current year (2.2) (0.6)<br />

Tax on ordinary activities – prior year 0.2 (0.4)<br />

(2.0) (1.0)<br />

Deferred tax:<br />

Tax on ordinary activities – current year (1.5) (1.5)<br />

Tax on ordinary activities – prior year 0.1 0.4<br />

Effect of reduction in UK corporation tax rate to 24% (2011: 26%) (0.6) (0.5)<br />

<strong>2012</strong><br />

£m<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

2011<br />

£m<br />

(2.0) (1.6)<br />

Tax charge for the year (4.0) (2.6)<br />

The actual tax on the Group’s profit before tax differs from the theoretical amount using the UK corporation tax rate as follows:<br />

Profit on ordinary activities before tax 10.5 6.1<br />

Theoretical tax charge at 26% (2011: 28%) (2.7) (1.7)<br />

Effect of reduction in UK corporation tax rate to 24% (2011: 26%) (0.6) (0.5)<br />

Income not taxable <strong>and</strong> other deductions 0.8 0.5<br />

Items not deductible for tax purposes <strong>and</strong> other taxable items (0.7) (0.3)<br />

Effect of overseas tax rates being higher than UK tax rate (1.1) (0.6)<br />

Adjustments in respect of prior years 0.3 –<br />

Actual tax charge for the year (4.0) (2.6)<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

<strong>Scapa</strong> Group plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong> 51<br />

Overview Business Review<br />

Governance<br />

Financial Statements