Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

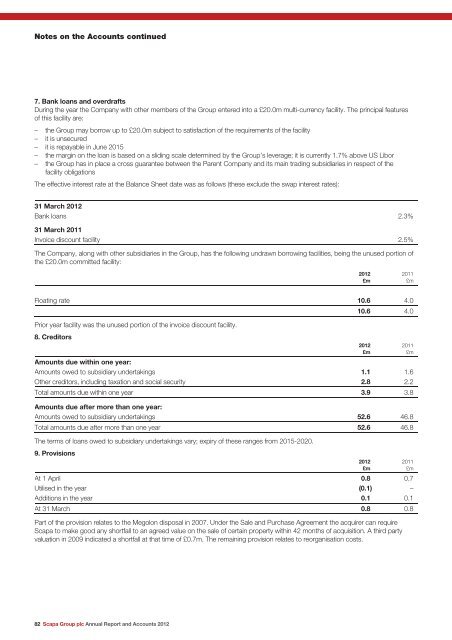

Notes on the <strong>Accounts</strong> continued<br />

7. Bank loans <strong>and</strong> overdrafts<br />

During the year the Company with other members of the Group entered into a £20.0m multi-currency facility. The principal features<br />

of this facility are:<br />

– the Group may borrow up to £20.0m subject to satisfaction of the requirements of the facility<br />

– it is unsecured<br />

– it is repayable in June 2015<br />

– the margin on the loan is based on a sliding scale determined by the Group’s leverage; it is currently 1.7% above US Libor<br />

– the Group has in place a cross guarantee between the Parent Company <strong>and</strong> its main trading subsidiaries in respect of the<br />

facility obligations<br />

The effective interest rate at the Balance Sheet date was as follows (these exclude the swap interest rates):<br />

31 March <strong>2012</strong><br />

Bank loans 2.3%<br />

31 March 2011<br />

Invoice discount facility 2.5%<br />

The Company, along with other subsidiaries in the Group, has the following undrawn borrowing facilities, being the unused portion of<br />

the £20.0m committed facility:<br />

Floating rate 10.6 4.0<br />

Prior year facility was the unused portion of the invoice discount facility.<br />

8. Creditors<br />

82 <strong>Scapa</strong> Group plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong><br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

10.6 4.0<br />

Amounts due within one year:<br />

Amounts owed to subsidiary undertakings 1.1 1.6<br />

Other creditors, including taxation <strong>and</strong> social security 2.8 2.2<br />

Total amounts due within one year 3.9 3.8<br />

Amounts due after more than one year:<br />

Amounts owed to subsidiary undertakings 52.6 46.8<br />

Total amounts due after more than one year 52.6 46.8<br />

The terms of loans owed to subsidiary undertakings vary; expiry of these ranges from 2015-2020.<br />

9. Provisions<br />

At 1 April 0.8 0.7<br />

Utilised in the year (0.1) –<br />

Additions in the year 0.1 0.1<br />

At 31 March 0.8 0.8<br />

Part of the provision relates to the Megolon disposal in 2007. Under the Sale <strong>and</strong> Purchase Agreement the acquirer can require<br />

<strong>Scapa</strong> to make good any shortfall to an agreed value on the sale of certain property within 42 months of acquisition. A third party<br />

valuation in 2009 indicated a shortfall at that time of £0.7m. The remaining provision relates to reorganisation costs.<br />

<strong>2012</strong><br />

£m<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

2011<br />

£m