Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes on the <strong>Accounts</strong> continued<br />

23. Derivative financial instruments<br />

The Group’s activities expose it to a variety of financial risks: foreign exchange risk, interest-rate risk, credit risk, liquidity risk <strong>and</strong><br />

capital risk. The Group’s overall risk management procedures focus on the unpredictability of financial markets <strong>and</strong> seek to minimise<br />

potential adverse effects on the Group’s financial performance. Risk management is carried out by the Group finance department (in<br />

close co-operation with the operating units) under policies approved by the Board of Directors.<br />

– Foreign exchange risk<br />

The Group operates internationally <strong>and</strong> is exposed to foreign exchange risk arising from various currency exposures, primarily with<br />

respect to the US Dollar, Canadian Dollar <strong>and</strong> the Euro. Foreign exchange risk arises from future commercial transactions, recognised<br />

assets <strong>and</strong> liabilities <strong>and</strong> net investments in foreign operations. As the Group has certain investments in foreign operations, these net<br />

assets are exposed to foreign currency translation risk.<br />

To manage its foreign exchange risk the Group uses foreign currency bank balances, <strong>and</strong> makes some use of foreign currency<br />

forward contracts to avoid short-term fluctuations in currencies. In addition, purchases of large items of capital in foreign currency<br />

are covered by forward contracts at the point of authorisation.<br />

At the year end the Group had forward contracts to sell Canadian Dollars into US Dollars <strong>and</strong> to sell Euros into Sterling. These<br />

contracts are valued based on year end exchange rate. An analysis of the sensitivity of the year end position relative to these forward<br />

contracts is provided below.<br />

At 31 March <strong>2012</strong>, if the Canadian Dollar had closed 10% weaker/stronger against the US Dollar (with all other variables held<br />

constant), pre-tax profit would have been unaffected because of the low value of forward contracts in place at the year end.<br />

At 31 March <strong>2012</strong>, if Sterling had closed 10% weaker/stronger against the Euro (with all other variables held constant), pre-tax profit<br />

would have been reduced/increased by £0.2m owing to the effects of forward contracts in place at the year end.<br />

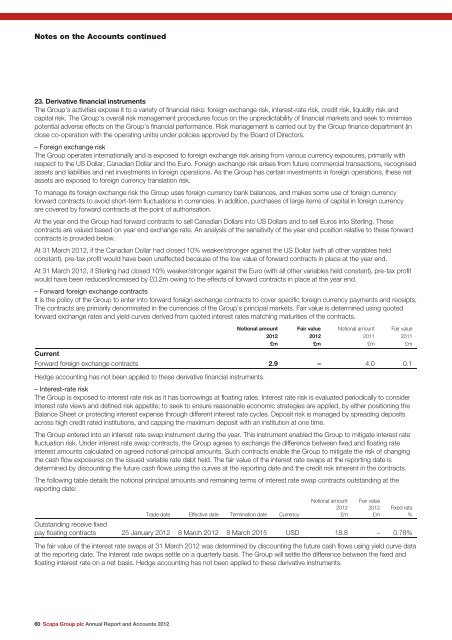

– Forward foreign exchange contracts<br />

It is the policy of the Group to enter into forward foreign exchange contracts to cover specific foreign currency payments <strong>and</strong> receipts.<br />

The contracts are primarily denominated in the currencies of the Group’s principal markets. Fair value is determined using quoted<br />

forward exchange rates <strong>and</strong> yield curves derived from quoted interest rates matching maturities of the contracts.<br />

60 <strong>Scapa</strong> Group plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong><br />

Notional amount<br />

<strong>2012</strong><br />

£m<br />

Fair value<br />

<strong>2012</strong><br />

£m<br />

Notional amount<br />

2011<br />

£m<br />

Fair value<br />

2011<br />

£m<br />

Current<br />

Forward foreign exchange contracts 2.9 – 4.0 0.1<br />

Hedge accounting has not been applied to these derivative financial instruments.<br />

– Interest-rate risk<br />

The Group is exposed to interest rate risk as it has borrowings at floating rates. Interest rate risk is evaluated periodically to consider<br />

interest rate views <strong>and</strong> defined risk appetite; to seek to ensure reasonable economic strategies are applied, by either positioning the<br />

Balance Sheet or protecting interest expense through different interest rate cycles. Deposit risk is managed by spreading deposits<br />

across high credit rated institutions, <strong>and</strong> capping the maximum deposit with an institution at one time.<br />

The Group entered into an interest rate swap instrument during the year. This instrument enabled the Group to mitigate interest rate<br />

fluctuation risk. Under interest rate swap contracts, the Group agrees to exchange the difference between fixed <strong>and</strong> floating rate<br />

interest amounts calculated on agreed notional principal amounts. Such contracts enable the Group to mitigate the risk of changing<br />

the cash flow exposures on the issued variable rate debt held. The fair value of the interest rate swaps at the reporting date is<br />

determined by discounting the future cash flows using the curves at the reporting date <strong>and</strong> the credit risk inherent in the contracts.<br />

The following table details the notional principal amounts <strong>and</strong> remaining terms of interest rate swap contracts outst<strong>and</strong>ing at the<br />

reporting date:<br />

Trade date Effective date Termination date Currency<br />

Notional amount<br />

<strong>2012</strong><br />

£m<br />

Fair value<br />

<strong>2012</strong><br />

£m<br />

Fixed rate<br />

%<br />

Outst<strong>and</strong>ing receive fixed<br />

pay floating contracts 25 January <strong>2012</strong> 8 March <strong>2012</strong> 8 March 2015 USD 18.8 – 0.78%<br />

The fair value of the interest rate swaps at 31 March <strong>2012</strong> was determined by discounting the future cash flows using yield curve data<br />

at the reporting date. The interest rate swaps settle on a quarterly basis. The Group will settle the difference between the fixed <strong>and</strong><br />

floating interest rate on a net basis. Hedge accounting has not been applied to these derivative instruments.