Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

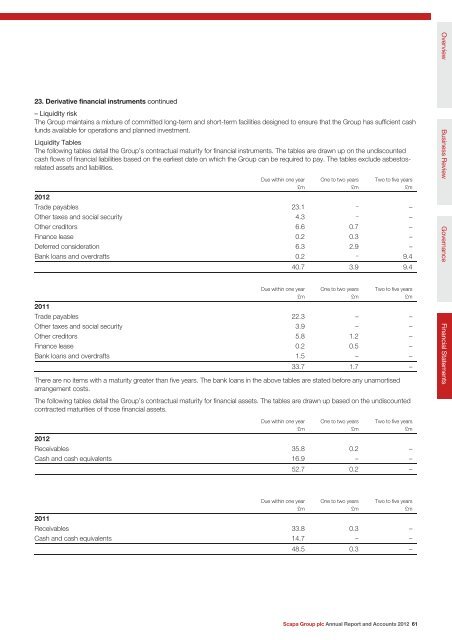

23. Derivative financial instruments continued<br />

– Liquidity risk<br />

The Group maintains a mixture of committed long-term <strong>and</strong> short-term facilities designed to ensure that the Group has sufficient cash<br />

funds available for operations <strong>and</strong> planned investment.<br />

Liquidity Tables<br />

The following tables detail the Group’s contractual maturity for financial instruments. The tables are drawn up on the undiscounted<br />

cash flows of financial liabilities based on the earliest date on which the Group can be required to pay. The tables exclude asbestosrelated<br />

assets <strong>and</strong> liabilities.<br />

Due within one year<br />

£m<br />

One to two years<br />

£m<br />

Two to five years<br />

£m<br />

<strong>2012</strong><br />

Trade payables 23.1 – –<br />

Other taxes <strong>and</strong> social security 4.3 – –<br />

Other creditors 6.6 0.7 –<br />

Finance lease 0.2 0.3 –<br />

Deferred consideration 6.3 2.9 –<br />

Bank loans <strong>and</strong> overdrafts 0.2 – 9.4<br />

Due within one year<br />

£m<br />

40.7 3.9 9.4<br />

One to two years<br />

£m<br />

Two to five years<br />

£m<br />

2011<br />

Trade payables 22.3 – –<br />

Other taxes <strong>and</strong> social security 3.9 – –<br />

Other creditors 5.8 1.2 –<br />

Finance lease 0.2 0.5 –<br />

Bank loans <strong>and</strong> overdrafts 1.5 – –<br />

33.7 1.7 –<br />

There are no items with a maturity greater than five years. The bank loans in the above tables are stated before any unamortised<br />

arrangement costs.<br />

The following tables detail the Group’s contractual maturity for financial assets. The tables are drawn up based on the undiscounted<br />

contracted maturities of those financial assets.<br />

Due within one year<br />

£m<br />

One to two years<br />

£m<br />

Two to five years<br />

£m<br />

<strong>2012</strong><br />

Receivables 35.8 0.2 –<br />

Cash <strong>and</strong> cash equivalents 16.9 – –<br />

Due within one year<br />

£m<br />

52.7 0.2 –<br />

One to two years<br />

£m<br />

Two to five years<br />

£m<br />

2011<br />

Receivables 33.8 0.3 –<br />

Cash <strong>and</strong> cash equivalents 14.7 – –<br />

48.5 0.3 –<br />

<strong>Scapa</strong> Group plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong> 61<br />

Overview Business Review<br />

Governance<br />

Financial Statements