Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

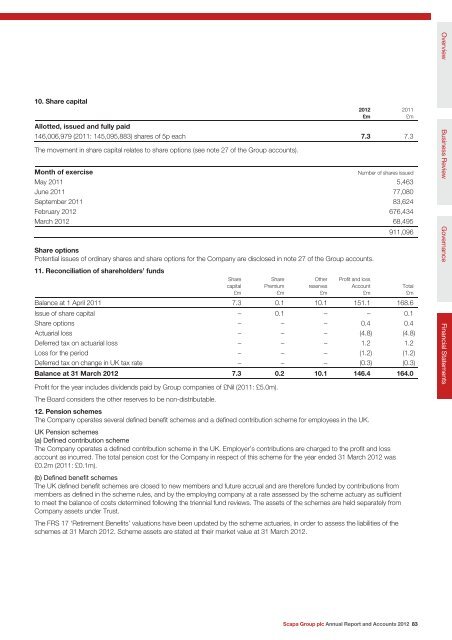

10. Share capital<br />

Allotted, issued <strong>and</strong> fully paid<br />

146,006,979 (2011: 145,095,883) shares of 5p each 7.3 7.3<br />

The movement in share capital relates to share options (see note 27 of the Group accounts).<br />

Month of exercise Number of shares issued<br />

May 2011 5,463<br />

June 2011 77,080<br />

September 2011 83,624<br />

February <strong>2012</strong> 676,434<br />

March <strong>2012</strong> 68,495<br />

Share options<br />

Potential issues of ordinary shares <strong>and</strong> share options for the Company are disclosed in note 27 of the Group accounts.<br />

11. Reconciliation of shareholders’ funds<br />

Share<br />

capital<br />

£m<br />

Share<br />

Premium<br />

£m<br />

Other<br />

reserves<br />

£m<br />

<strong>2012</strong><br />

£m<br />

Profit <strong>and</strong> loss<br />

Account<br />

£m<br />

2011<br />

£m<br />

911,096<br />

Balance at 1 April 2011 7.3 0.1 10.1 151.1 168.6<br />

Issue of share capital – 0.1 – – 0.1<br />

Share options – – – 0.4 0.4<br />

Actuarial loss – – – (4.8) (4.8)<br />

Deferred tax on actuarial loss – – – 1.2 1.2<br />

Loss for the period – – – (1.2) (1.2)<br />

Deferred tax on change in UK tax rate – – – (0.3) (0.3)<br />

Balance at 31 March <strong>2012</strong> 7.3 0.2 10.1 146.4 164.0<br />

Profit for the year includes dividends paid by Group companies of £Nil (2011: £5.0m).<br />

The Board considers the other reserves to be non-distributable.<br />

12. Pension schemes<br />

The Company operates several defined benefit schemes <strong>and</strong> a defined contribution scheme for employees in the UK.<br />

UK Pension schemes<br />

(a) Defined contribution scheme<br />

The Company operates a defined contribution scheme in the UK. Employer’s contributions are charged to the profit <strong>and</strong> loss<br />

account as incurred. The total pension cost for the Company in respect of this scheme for the year ended 31 March <strong>2012</strong> was<br />

£0.2m (2011: £0.1m).<br />

(b) Defined benefit schemes<br />

The UK defined benefit schemes are closed to new members <strong>and</strong> future accrual <strong>and</strong> are therefore funded by contributions from<br />

members as defined in the scheme rules, <strong>and</strong> by the employing company at a rate assessed by the scheme actuary as sufficient<br />

to meet the balance of costs determined following the triennial fund reviews. The assets of the schemes are held separately from<br />

Company assets under Trust.<br />

The FRS 17 ‘Retirement Benefits’ valuations have been updated by the scheme actuaries, in order to assess the liabilities of the<br />

schemes at 31 March <strong>2012</strong>. Scheme assets are stated at their market value at 31 March <strong>2012</strong>.<br />

Total<br />

£m<br />

<strong>Scapa</strong> Group plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong> 83<br />

Overview Business Review<br />

Governance<br />

Financial Statements