Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

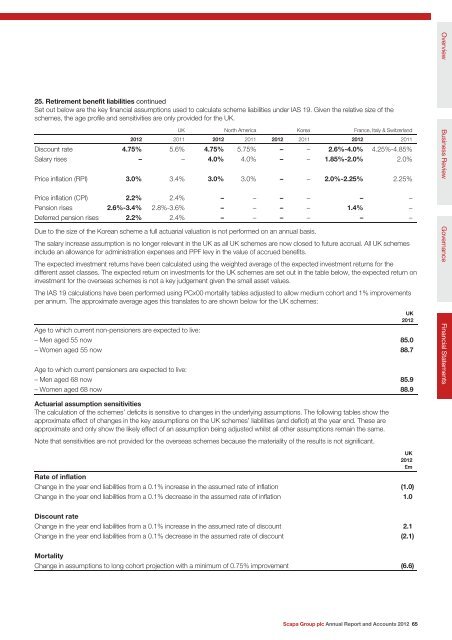

25. Retirement benefit liabilities continued<br />

Set out below are the key financial assumptions used to calculate scheme liabilities under IAS 19. Given the relative size of the<br />

schemes, the age profile <strong>and</strong> sensitivities are only provided for the UK.<br />

UK North America Korea France, Italy & Switzerl<strong>and</strong><br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Discount rate 4.75% 5.6% 4.75% 5.75% – – 2.6%-4.0% 4.25%-4.85%<br />

Salary rises – – 4.0% 4.0% – – 1.85%-2.0% 2.0%<br />

Price inflation (RPI) 3.0% 3.4% 3.0% 3.0% – – 2.0%-2.25% 2.25%<br />

Price inflation (CPI) 2.2% 2.4% – – – – – –<br />

Pension rises 2.6%-3.4% 2.8%-3.6% – – – – 1.4% –<br />

Deferred pension rises 2.2% 2.4% – – – – – –<br />

Due to the size of the Korean scheme a full actuarial valuation is not performed on an annual basis.<br />

The salary increase assumption is no longer relevant in the UK as all UK schemes are now closed to future accrual. All UK schemes<br />

include an allowance for administration expenses <strong>and</strong> PPF levy in the value of accrued benefits.<br />

The expected investment returns have been calculated using the weighted average of the expected investment returns for the<br />

different asset classes. The expected return on investments for the UK schemes are set out in the table below, the expected return on<br />

investment for the overseas schemes is not a key judgement given the small asset values.<br />

The IAS 19 calculations have been performed using PCx00 mortality tables adjusted to allow medium cohort <strong>and</strong> 1% improvements<br />

per annum. The approximate average ages this translates to are shown below for the UK schemes:<br />

UK<br />

<strong>2012</strong><br />

Age to which current non-pensioners are expected to live:<br />

– Men aged 55 now 85.0<br />

– Women aged 55 now 88.7<br />

Age to which current pensioners are expected to live:<br />

– Men aged 68 now 85.9<br />

– Women aged 68 now 88.9<br />

Actuarial assumption sensitivities<br />

The calculation of the schemes’ deficits is sensitive to changes in the underlying assumptions. The following tables show the<br />

approximate effect of changes in the key assumptions on the UK schemes’ liabilities (<strong>and</strong> deficit) at the year end. These are<br />

approximate <strong>and</strong> only show the likely effect of an assumption being adjusted whilst all other assumptions remain the same.<br />

Note that sensitivities are not provided for the overseas schemes because the materiality of the results is not significant.<br />

UK<br />

<strong>2012</strong><br />

£m<br />

Rate of inflation<br />

Change in the year end liabilities from a 0.1% increase in the assumed rate of inflation (1.0)<br />

Change in the year end liabilities from a 0.1% decrease in the assumed rate of inflation 1.0<br />

Discount rate<br />

Change in the year end liabilities from a 0.1% increase in the assumed rate of discount 2.1<br />

Change in the year end liabilities from a 0.1% decrease in the assumed rate of discount (2.1)<br />

Mortality<br />

Change in assumptions to long cohort projection with a minimum of 0.75% improvement (6.6)<br />

<strong>Scapa</strong> Group plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong> 65<br />

Overview Business Review<br />

Governance<br />

Financial Statements