Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

Annual Report and Accounts 2012 - Scapa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes on the <strong>Accounts</strong> continued<br />

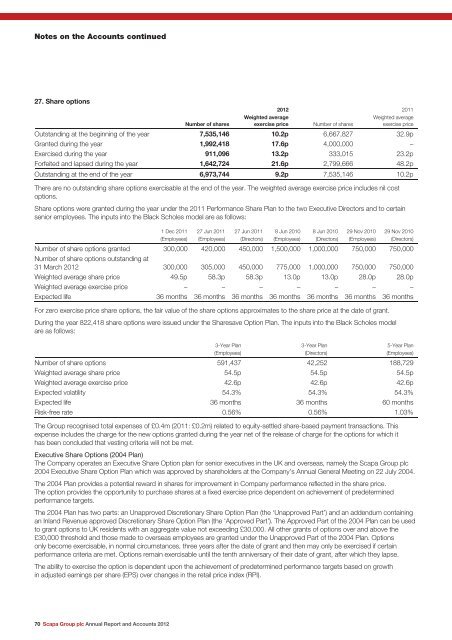

27. Share options<br />

70 <strong>Scapa</strong> Group plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong><br />

Number of shares<br />

<strong>2012</strong><br />

Weighted average<br />

exercise price Number of shares<br />

2011<br />

Weighted average<br />

exercise price<br />

Outst<strong>and</strong>ing at the beginning of the year 7,535,146 10.2p 6,667,827 32.9p<br />

Granted during the year 1,992,418 17.6p 4,000,000 –<br />

Exercised during the year 911,096 13.2p 333,015 23.2p<br />

Forfeited <strong>and</strong> lapsed during the year 1,642,724 21.6p 2,799,666 48.2p<br />

Outst<strong>and</strong>ing at the end of the year 6,973,744 9.2p 7,535,146 10.2p<br />

There are no outst<strong>and</strong>ing share options exercisable at the end of the year. The weighted average exercise price includes nil cost<br />

options.<br />

Share options were granted during the year under the 2011 Performance Share Plan to the two Executive Directors <strong>and</strong> to certain<br />

senior employees. The inputs into the Black Scholes model are as follows:<br />

1 Dec 2011<br />

(Employees)<br />

27 Jun 2011<br />

(Employees)<br />

27 Jun 2011<br />

(Directors)<br />

8 Jun 2010<br />

(Employees)<br />

8 Jun 2010<br />

(Directors)<br />

29 Nov 2010<br />

(Employees)<br />

29 Nov 2010<br />

(Directors)<br />

Number of share options granted 300,000 420,000 450,000 1,500,000 1,000,000 750,000 750,000<br />

Number of share options outst<strong>and</strong>ing at<br />

31 March <strong>2012</strong> 300,000 305,000 450,000 775,000 1,000,000 750,000 750,000<br />

Weighted average share price 49.5p 58.3p 58.3p 13.0p 13.0p 28.0p 28.0p<br />

Weighted average exercise price – – – – – – –<br />

Expected life 36 months 36 months 36 months 36 months 36 months 36 months 36 months<br />

For zero exercise price share options, the fair value of the share options approximates to the share price at the date of grant.<br />

During the year 822,418 share options were issued under the Sharesave Option Plan. The inputs into the Black Scholes model<br />

are as follows:<br />

3-Year Plan<br />

(Employees)<br />

3-Year Plan<br />

(Directors)<br />

5-Year Plan<br />

(Employees)<br />

Number of share options 591,437 42,252 188,729<br />

Weighted average share price 54.5p 54.5p 54.5p<br />

Weighted average exercise price 42.6p 42.6p 42.6p<br />

Expected volatility 54.3% 54.3% 54.3%<br />

Expected life 36 months 36 months 60 months<br />

Risk-free rate 0.56% 0.56% 1.03%<br />

The Group recognised total expenses of £0.4m (2011: £0.2m) related to equity-settled share-based payment transactions. This<br />

expense includes the charge for the new options granted during the year net of the release of charge for the options for which it<br />

has been concluded that vesting criteria will not be met.<br />

Executive Share Options (2004 Plan)<br />

The Company operates an Executive Share Option plan for senior executives in the UK <strong>and</strong> overseas, namely the <strong>Scapa</strong> Group plc<br />

2004 Executive Share Option Plan which was approved by shareholders at the Company’s <strong>Annual</strong> General Meeting on 22 July 2004.<br />

The 2004 Plan provides a potential reward in shares for improvement in Company performance reflected in the share price.<br />

The option provides the opportunity to purchase shares at a fixed exercise price dependent on achievement of predetermined<br />

performance targets.<br />

The 2004 Plan has two parts: an Unapproved Discretionary Share Option Plan (the ‘Unapproved Part’) <strong>and</strong> an addendum containing<br />

an Inl<strong>and</strong> Revenue approved Discretionary Share Option Plan (the ‘Approved Part’). The Approved Part of the 2004 Plan can be used<br />

to grant options to UK residents with an aggregate value not exceeding £30,000. All other grants of options over <strong>and</strong> above the<br />

£30,000 threshold <strong>and</strong> those made to overseas employees are granted under the Unapproved Part of the 2004 Plan. Options<br />

only become exercisable, in normal circumstances, three years after the date of grant <strong>and</strong> then may only be exercised if certain<br />

performance criteria are met. Options remain exercisable until the tenth anniversary of their date of grant, after which they lapse.<br />

The ability to exercise the option is dependent upon the achievement of predetermined performance targets based on growth<br />

in adjusted earnings per share (EPS) over changes in the retail price index (RPI).