Brand value increases across categories

Brand value increases across categories

Brand value increases across categories

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Part 2 | The Top 100<br />

Regions<br />

ASIA UP, LATAM DOWN,<br />

OTHER REGIONS MODERATE<br />

ALMOST HALF of the brands in the<br />

<strong>Brand</strong>Z Top 100 ranking are based<br />

in North America. They account for<br />

two-thirds of the Top 100’s $2.6 trillion<br />

in brand <strong>value</strong>. <strong>Brand</strong> <strong>value</strong> growth in<br />

North America was flat, however.<br />

Growth rates fluctuated by region: Asia,<br />

Continental Europe, Latin America,<br />

North America and the UK. The BRIC<br />

markets drove the greatest swings, with<br />

the Top 10 brands from Asia up 13<br />

percent in brand <strong>value</strong>, while the Latam<br />

Top 10 declined 13 percent. The key<br />

reasons for the contrast in growths rates<br />

<strong>across</strong> regions were:<br />

Strong individual brand performances<br />

in China, despite a slower national<br />

economic growth rate, and brand<br />

growth in Korea, Japan and Australia;<br />

The slowdown of the Brazilian economy<br />

and the impact of government<br />

policy on strategic <strong>categories</strong>,<br />

including energy and banking; and<br />

Modest growth in the <strong>value</strong> of leading<br />

technology brands based in North<br />

America, relative to prior years<br />

In addition, the resilience of luxury and<br />

apparel brands based in Continental<br />

Europe balanced the overall impact of<br />

the region’s troubled economies. And a<br />

couple of global banks based in the UK<br />

improved sharply in brand <strong>value</strong>.<br />

Asia appreciates in brand <strong>value</strong><br />

Many of China’s leading brands<br />

continued to appreciate in brand <strong>value</strong>,<br />

despite the slowdown in the rate of<br />

economic growth. The country’s most<br />

valuable brand, China Mobile increased<br />

18 percent in brand <strong>value</strong>. China Mobile<br />

won more 3G subscribers than its rivals<br />

with its aggressive marketing. It is also<br />

expanding its 4G network.<br />

36 <strong>Brand</strong>Z Top 100 Most Valuable Global <strong>Brand</strong>s 2013<br />

Tencent, with a 52 percent rise in brand<br />

<strong>value</strong>, continued to draw more users to<br />

its instant messaging service and other<br />

offerings. The success of its Galaxy<br />

smartphones drove the improved 51<br />

percent in Samsung’s brand <strong>value</strong> and<br />

burnished the Korean brand <strong>across</strong> its<br />

wide range of home appliances and<br />

digital devices.<br />

Toyota reclaimed the number one position<br />

in the <strong>Brand</strong>Z car category ranking,<br />

suggesting that the Japanese brand has<br />

recovered from the product recall crisis<br />

of 2009. The presence of two Australian<br />

banks, Commonwealth and ANZ, reflects<br />

the country’s economic strength relative<br />

to other developed markets.<br />

Latam declines in brand <strong>value</strong><br />

The brand <strong>value</strong> decline by the Top 10<br />

Latam brands resulted from the impact<br />

of the troubled Brazilian economy and<br />

the government’s response with policies<br />

aimed at expanding the middle class and<br />

controlling inflation.<br />

These factors negatively impacted<br />

Petrobras, the government-controlled oil<br />

and gas company, and major Brazilian<br />

bank brands, including Bradesco and<br />

Itaù. At the same time, government<br />

policies to stimulate spending helped<br />

consumer products. The Brazilian beer<br />

Skol increased 39 percent in brand <strong>value</strong>.<br />

Corona, the Mexican beer, improved 29<br />

percent in brand <strong>value</strong>. In addition, two<br />

Colombian brands entered the <strong>Brand</strong>Z<br />

category rankings for the first time, the<br />

beer brand Aquila and Ecopetrol, an oil<br />

and gas brand.<br />

Continental Europe and the UK<br />

experience modest growth<br />

Despite economic problems <strong>across</strong> the<br />

continent, the Top 10 brands based in<br />

Europe increased 5 percent in brand<br />

<strong>value</strong>, in part on the strength of apparel.<br />

Fast fashion apparel brand Zara<br />

improved 60 percent.<br />

In a year when the technology category<br />

improved only modestly in overall<br />

brand <strong>value</strong>, Germany-based SAP<br />

appreciated 34 percent as the businessto-business<br />

sector recovered and SAP<br />

introduced solutions for using big data<br />

for enterprise transformation.<br />

The 4 percent brand <strong>value</strong> rise in by Top<br />

10 UK-based brands resulted primarily<br />

from the financial rebound of banking.<br />

Barclays, with a 34 percent rise in brand<br />

<strong>value</strong>, worked to restore trust. Improving<br />

24 percent in brand <strong>value</strong>, HSBC<br />

refocused on developing its profitable<br />

international trade business.<br />

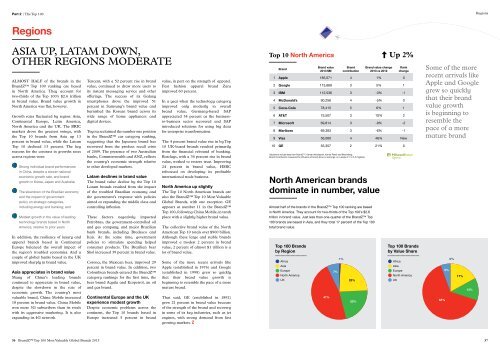

North America up slightly<br />

The Top 10 North American brands are<br />

also the <strong>Brand</strong>Z Top 10 Most Valuable<br />

Global <strong>Brand</strong>s, with one exception. GE<br />

appears at number 11 in the <strong>Brand</strong>Z<br />

Top 100, following China Mobile, in tenth<br />

place with a slightly higher brand <strong>value</strong>.<br />

The collective brand <strong>value</strong> of the North<br />

American Top 10 totals over $900 billion.<br />

Although these large and stable brands<br />

improved a modest 2 percent in brand<br />

<strong>value</strong>, 2 percent of almost $1 trillion is a<br />

lot of brand <strong>value</strong>.<br />

Some of the more recent arrivals like<br />

Apple (established in 1976) and Google<br />

(established in 1998) grew so quickly<br />

that their brand <strong>value</strong> growth is<br />

beginning to resemble the pace of a more<br />

mature brand.<br />

That said, GE (established in 1892)<br />

grew 21 percent in brand <strong>value</strong> because<br />

of the strength of the brand and recovery<br />

in some of its key industries, such as jet<br />

engines, with strong demand from fast<br />

growing markets.<br />

Top 10 North America<br />

<strong>Brand</strong><br />

North American brands<br />

dominate in number, <strong>value</strong><br />

Almost half of the brands in the <strong>Brand</strong>Z Top 100 ranking are based<br />

in North America. They account for two-thirds of the Top 100’s $2.6<br />

trillion in brand <strong>value</strong>. Just less than one-quarter of the <strong>Brand</strong>Z Top<br />

100 brands are based in Asia, and they total 17 percent of the Top 100<br />

total brand <strong>value</strong>.<br />

Top 100 <strong>Brand</strong>s<br />

by Region<br />

Africa<br />

Asia<br />

Europe<br />

North America<br />

UK<br />

<strong>Brand</strong> <strong>value</strong><br />

2013 $M<br />

47%<br />

7%<br />

1%<br />

<strong>Brand</strong><br />

contribution<br />

23%<br />

22%<br />

<strong>Brand</strong> <strong>value</strong> change<br />

2013 vs 2012<br />

Rank<br />

change<br />

1 Apple 185,071 4 1% 0<br />

2 Google 113,669 3 5% 1<br />

3 IBM 112,536 3 -3% -1<br />

4 McDonald’s 90,256 4 -5% 0<br />

5 Coca-Cola 78,415 5 6% 1<br />

6 AT&T 75,507 3 10% 2<br />

7 Microsoft 69,814 3 -9% -2<br />

8 Marlboro 69,383 3 -6% -1<br />

9 Visa 56,060 4 46% New<br />

10 GE 55,357 2 21% 0<br />

Valuations include data from <strong>Brand</strong>Z, Kantar Worldpanel, Kantar Retail and Bloomberg.<br />

<strong>Brand</strong> Contribution measures the influence of brand alone on earnings, on a scale of 1 to 5 (5 highest).<br />

Up 2%<br />

Top 100 <strong>Brand</strong>s<br />

by Value Share<br />

Africa<br />

Asia<br />

Europe<br />

North America<br />

UK<br />

Some of the more<br />

recent arrivals like<br />

Apple and Google<br />

grew so quickly<br />

that their brand<br />

<strong>value</strong> growth<br />

is beginning to<br />

resemble the<br />

pace of a more<br />

mature brand<br />

65%<br />

5%<br />

0%<br />

17%<br />

13%<br />

Regions<br />

37