ANNUAL REPORT 2010

ANNUAL REPORT 2010

ANNUAL REPORT 2010

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

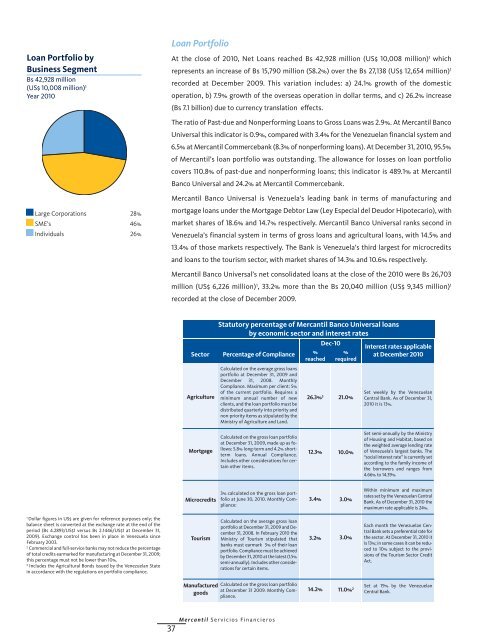

Loan Portfolio by<br />

Business Segment<br />

Bs 42,928 million<br />

(US$ 10,008 million) 1<br />

Year <strong>2010</strong><br />

Large Corporations 28%<br />

SME’s 46%<br />

Individuals 26%<br />

1 Dollar figures in US$ are given for reference purposes only; the<br />

balance sheet is converted at the exchange rate at the end of the<br />

period (Bs 4.2893/US$1 versus Bs 2.1446/US$1 at December 31,<br />

2009). Exchange control has been in place in Venezuela since<br />

February 2003.<br />

2 Commercial and full-service banks may not reduce the percentage<br />

of total credits earmarked for manufacturing at December 31, 2009;<br />

this percentage must not be lower than 10%.<br />

3 Includes the Agricultural Bonds issued by the Venezuelan State<br />

in accordance with the regulations on portfolio compliance.<br />

Loan Portfolio<br />

At the close of <strong>2010</strong>, Net Loans reached Bs 42,928 million (US$ 10,008 million) 1 which<br />

represents an increase of Bs 15,790 million (58.2%) over the Bs 27,138 (US$ 12,654 million) 1<br />

recorded at December 2009. This variation includes: a) 24.1% growth of the domestic<br />

operation, b) 7.9% growth of the overseas operation in dollar terms, and c) 26.2% increase<br />

(Bs 7.1 billion) due to currency translation effects.<br />

The ratio of Past-due and Nonperforming Loans to Gross Loans was 2.9%. At Mercantil Banco<br />

Universal this indicator is 0.9%, compared with 3.4% for the Venezuelan financial system and<br />

6.5% at Mercantil Commercebank (8.3% of nonperforming loans). At December 31, <strong>2010</strong>, 95.5%<br />

of Mercantil’s loan portfolio was outstanding. The allowance for losses on loan portfolio<br />

covers 110.8% of past-due and nonperforming loans; this indicator is 489.1% at Mercantil<br />

Banco Universal and 24.2% at Mercantil Commercebank.<br />

Mercantil Banco Universal is Venezuela's leading bank in terms of manufacturing and<br />

mortgage loans under the Mortgage Debtor Law (Ley Especial del Deudor Hipotecario), with<br />

market shares of 18.6% and 14.7% respectively. Mercantil Banco Universal ranks second in<br />

Venezuela’s financial system in terms of gross loans and agricultural loans, with 14.5% and<br />

13.4% of those markets respectively. The Bank is Venezuela’s third largest for microcredits<br />

and loans to the tourism sector, with market shares of 14.3% and 10.6% respectively.<br />

Mercantil Banco Universal’s net consolidated loans at the close of the <strong>2010</strong> were Bs 26,703<br />

million (US$ 6,226 million) 1 , 33.2% more than the Bs 20,040 million (US$ 9,345 million) 1<br />

recorded at the close of December 2009.<br />

Statutory percentage of Mercantil Banco Universal loans<br />

by economic sector and interest rates<br />

Dec-10<br />

Interest rates applicable<br />

Sector Percentage of Compliance %<br />

% at December <strong>2010</strong><br />

reached required<br />

Agriculture<br />

Mortgage<br />

Microcredits<br />

Tourism<br />

Manufactured<br />

goods<br />

Calculated on the average gross loans<br />

portfolio at December 31, 2009 and<br />

December 31, 2008. Monthly<br />

Compliance. Maximum per client: 5%<br />

of the current portfolio. Requires a<br />

minimum annual number of new<br />

clients, and the loan portfolio must be<br />

distributed quarterly into priority and<br />

non-priority items as stipulated by the<br />

Ministry of Agriculture and Land.<br />

Calculated on the gross loan portfolio<br />

at December 31, 2009, made up as follows:<br />

5.8% long-term and 4.2% shortterm<br />

loans. Annual Compliance.<br />

Includes other considerations for certain<br />

other items.<br />

3% calculated on the gross loan portfolio<br />

at June 30, <strong>2010</strong>. Monthly Compliance:<br />

Calculated on the average gross loan<br />

portfolio at December 31, 2009 and December<br />

31, 2008. In February <strong>2010</strong> the<br />

Ministry of Tourism stipulated that<br />

banks must earmark 3% of their loan<br />

portfolio. Compliance must be achieved<br />

by December 31, <strong>2010</strong> at the latest (1.5%<br />

semi-annually). Includes other considerations<br />

for certain items.<br />

Calculated on the gross loan portfolio<br />

at December 31 2009. Monthly Compliance.<br />

Mercantil Servicios Financieros<br />

37<br />

26.3% 3<br />

12.3%<br />

3.4%<br />

3.2%<br />

14.2%<br />

21.0%<br />

10.0%<br />

3.0%<br />

3.0%<br />

11.0% 2<br />

Set weekly by the Venezuelan<br />

Central Bank. As of December 31,<br />

<strong>2010</strong> it is 13%.<br />

Set semi-annually by the Ministry<br />

of Housing and Habitat, based on<br />

the weighted average lending rate<br />

of Venezuela’s largest banks. The<br />

“social interest rate” is currently set<br />

according to the family income of<br />

the borrowers and ranges from<br />

4.66% to 14.39%<br />

Within minimum and maximum<br />

rates set by the Venezuelan Central<br />

Bank. As of December 31, <strong>2010</strong> the<br />

maximum rate applicable is 24%.<br />

Each month the Venezuelan Central<br />

Bank sets a preferential rate for<br />

the sector. At December 31, <strong>2010</strong> it<br />

is 13%; in some cases it can be reduced<br />

to 10% subject to the provisions<br />

of the Tourism Sector Credit<br />

Act.<br />

Set at 19% by the Venezuelan<br />

Central Bank.