ANNUAL REPORT 2010

ANNUAL REPORT 2010

ANNUAL REPORT 2010

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Business Management Report<br />

Commercial and Personal Banking<br />

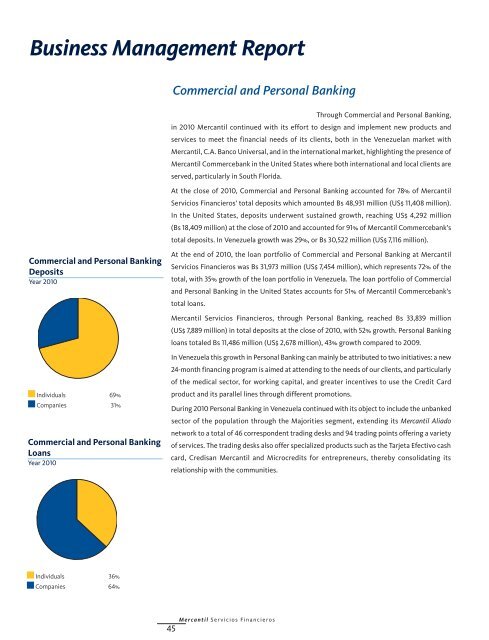

Deposits<br />

Year <strong>2010</strong><br />

Individuals 69%<br />

Companies 31%<br />

Commercial and Personal Banking<br />

Loans<br />

Year <strong>2010</strong><br />

Individuals 36%<br />

Companies 64%<br />

Commercial and Personal Banking<br />

Through Commercial and Personal Banking,<br />

in <strong>2010</strong> Mercantil continued with its effort to design and implement new products and<br />

services to meet the financial needs of its clients, both in the Venezuelan market with<br />

Mercantil, C.A. Banco Universal, and in the international market, highlighting the presence of<br />

Mercantil Commercebank in the United States where both international and local clients are<br />

served, particularly in South Florida.<br />

At the close of <strong>2010</strong>, Commercial and Personal Banking accounted for 78% of Mercantil<br />

Servicios Financieros' total deposits which amounted Bs 48,931 million (US$ 11,408 million).<br />

In the United States, deposits underwent sustained growth, reaching US$ 4,292 million<br />

(Bs 18,409 million) at the close of <strong>2010</strong> and accounted for 91% of Mercantil Commercebank’s<br />

total deposits. In Venezuela growth was 29%, or Bs 30,522 million (US$ 7,116 million).<br />

At the end of <strong>2010</strong>, the loan portfolio of Commercial and Personal Banking at Mercantil<br />

Servicios Financieros was Bs 31,973 million (US$ 7,454 million), which represents 72% of the<br />

total, with 35% growth of the loan portfolio in Venezuela. The loan portfolio of Commercial<br />

and Personal Banking in the United States accounts for 51% of Mercantil Commercebank’s<br />

total loans.<br />

Mercantil Servicios Financieros, through Personal Banking, reached Bs 33,839 million<br />

(US$ 7,889 million) in total deposits at the close of <strong>2010</strong>, with 52% growth. Personal Banking<br />

loans totaled Bs 11,486 million (US$ 2,678 million), 43% growth compared to 2009.<br />

In Venezuela this growth in Personal Banking can mainly be attributed to two initiatives: a new<br />

24-month financing program is aimed at attending to the needs of our clients, and particularly<br />

of the medical sector, for working capital, and greater incentives to use the Credit Card<br />

product and its parallel lines through different promotions.<br />

During <strong>2010</strong> Personal Banking in Venezuela continued with its object to include the unbanked<br />

sector of the population through the Majorities segment, extending its Mercantil Aliado<br />

network to a total of 46 correspondent trading desks and 94 trading points offering a variety<br />

of services. The trading desks also offer specialized products such as the Tarjeta Efectivo cash<br />

card, Credisan Mercantil and Microcredits for entrepreneurs, thereby consolidating its<br />

relationship with the communities.<br />

Mercantil Servicios Financieros<br />

45