ANNUAL REPORT 2010

ANNUAL REPORT 2010

ANNUAL REPORT 2010

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

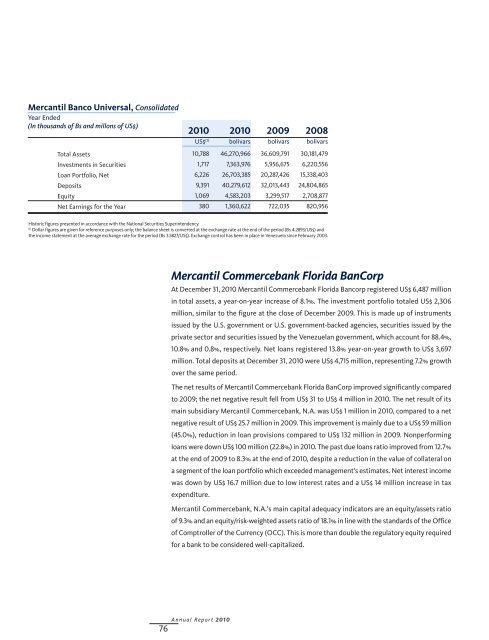

Mercantil Banco Universal, Consolidated<br />

Year Ended<br />

(In thousands of Bs and millons of US$)<br />

Total Assets<br />

Investments in Securities<br />

Loan Portfolio, Net<br />

Deposits<br />

Equity<br />

Net Earnings for the Year<br />

Historic figures presented in accordance with the National Securities Superintendency.<br />

(1) Dollar figures are given for reference purposes only; the balance sheet is converted at the exchange rate at the end of the period (Bs 4.2893/US$) and<br />

the income statement at the average exchange rate for the period (Bs 3.5827/US$). Exchange control has been in place in Venezuela since February 2003.<br />

76<br />

<strong>2010</strong><br />

US$ (1)<br />

10,788<br />

1,717<br />

6,226<br />

9,391<br />

1,069<br />

380<br />

Mercantil Commercebank Florida BanCorp<br />

At December 31, <strong>2010</strong> Mercantil Commercebank Florida Bancorp registered US$ 6,487 million<br />

in total assets, a year-on-year increase of 8.1%. The investment portfolio totaled US$ 2,306<br />

million, similar to the figure at the close of December 2009. This is made up of instruments<br />

issued by the U.S. government or U.S. government-backed agencies, securities issued by the<br />

private sector and securities issued by the Venezuelan government, which account for 88.4%,<br />

10.8% and 0.8%, respectively. Net loans registered 13.8% year-on-year growth to US$ 3,697<br />

million. Total deposits at December 31, <strong>2010</strong> were US$ 4,715 million, representing 7.2% growth<br />

over the same period.<br />

The net results of Mercantil Commercebank Florida BanCorp improved significantly compared<br />

to 2009; the net negative result fell from US$ 31 to US$ 4 million in <strong>2010</strong>. The net result of its<br />

main subsidiary Mercantil Commercebank, N.A. was US$ 1 million in <strong>2010</strong>, compared to a net<br />

negative result of US$ 25.7 million in 2009. This improvement is mainly due to a US$ 59 million<br />

(45.0%), reduction in loan provisions compared to US$ 132 million in 2009. Nonperforming<br />

loans were down US$ 100 million (22.8%) in <strong>2010</strong>. The past due loans ratio improved from 12.7%<br />

at the end of 2009 to 8.3% at the end of <strong>2010</strong>, despite a reduction in the value of collateral on<br />

a segment of the loan portfolio which exceeded management’s estimates. Net interest income<br />

was down by US$ 16.7 million due to low interest rates and a US$ 14 million increase in tax<br />

expenditure.<br />

Mercantil Commercebank, N.A.’s main capital adequacy indicators are an equity/assets ratio<br />

of 9.3% and an equity/risk-weighted assets ratio of 18.1% in line with the standards of the Office<br />

of Comptroller of the Currency (OCC). This is more than double the regulatory equity required<br />

for a bank to be considered well-capitalized.<br />

Annual Report <strong>2010</strong><br />

<strong>2010</strong><br />

bolivars<br />

46,270,966<br />

7,363,976<br />

26,703,385<br />

40,279,612<br />

4,583,203<br />

1,360,622<br />

2009<br />

bolivars<br />

36,609,791<br />

5,956,675<br />

20,287,426<br />

32,013,443<br />

3,299,517<br />

722,035<br />

2008<br />

bolivars<br />

30,181,479<br />

6,220,556<br />

15,338,403<br />

24,804,865<br />

2,708,877<br />

820,956