ANNUAL REPORT 2010

ANNUAL REPORT 2010

ANNUAL REPORT 2010

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Credit Ratings<br />

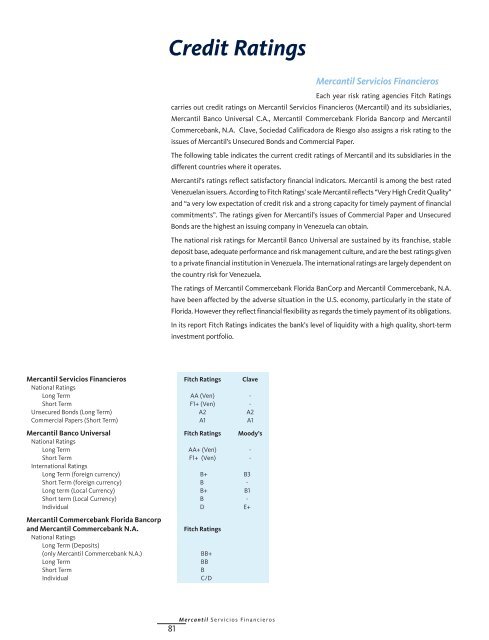

Mercantil Servicios Financieros Fitch Ratings Clave<br />

National Ratings<br />

Long Term AA (Ven) -<br />

Short Term F1+ (Ven) -<br />

Unsecured Bonds (Long Term) A2 A2<br />

Commercial Papers (Short Term) A1 A1<br />

Mercantil Banco Universal Fitch Ratings Moody’s<br />

National Ratings<br />

Long Term AA+ (Ven) -<br />

Short Term F1+ (Ven) -<br />

International Ratings<br />

Long Term (foreign currency) B+ B3<br />

Short Term (foreign currency) B -<br />

Long term (Local Currency) B+ B1<br />

Short term (Local Currency) B -<br />

Individual D E+<br />

Mercantil Commercebank Florida Bancorp<br />

and Mercantil Commercebank N.A. Fitch Ratings<br />

National Ratings<br />

Long Term (Deposits)<br />

(only Mercantil Commercebank N.A.) BB+<br />

Long Term BB<br />

Short Term B<br />

Individual C/D<br />

Mercantil Servicios Financieros<br />

81<br />

Mercantil Servicios Financieros<br />

Each year risk rating agencies Fitch Ratings<br />

carries out credit ratings on Mercantil Servicios Financieros (Mercantil) and its subsidiaries,<br />

Mercantil Banco Universal C.A., Mercantil Commercebank Florida Bancorp and Mercantil<br />

Commercebank, N.A. Clave, Sociedad Calificadora de Riesgo also assigns a risk rating to the<br />

issues of Mercantil’s Unsecured Bonds and Commercial Paper.<br />

The following table indicates the current credit ratings of Mercantil and its subsidiaries in the<br />

different countries where it operates.<br />

Mercantil’s ratings reflect satisfactory financial indicators. Mercantil is among the best rated<br />

Venezuelan issuers. According to Fitch Ratings’ scale Mercantil reflects “Very High Credit Quality”<br />

and “a very low expectation of credit risk and a strong capacity for timely payment of financial<br />

commitments”. The ratings given for Mercantil’s issues of Commercial Paper and Unsecured<br />

Bonds are the highest an issuing company in Venezuela can obtain.<br />

The national risk ratings for Mercantil Banco Universal are sustained by its franchise, stable<br />

deposit base, adequate performance and risk management culture, and are the best ratings given<br />

to a private financial institution in Venezuela. The international ratings are largely dependent on<br />

the country risk for Venezuela.<br />

The ratings of Mercantil Commercebank Florida BanCorp and Mercantil Commercebank, N.A.<br />

have been affected by the adverse situation in the U.S. economy, particularly in the state of<br />

Florida. However they reflect financial flexibility as regards the timely payment of its obligations.<br />

In its report Fitch Ratings indicates the bank’s level of liquidity with a high quality, short-term<br />

investment portfolio.